Get the free Tax Appeal Determination

Show details

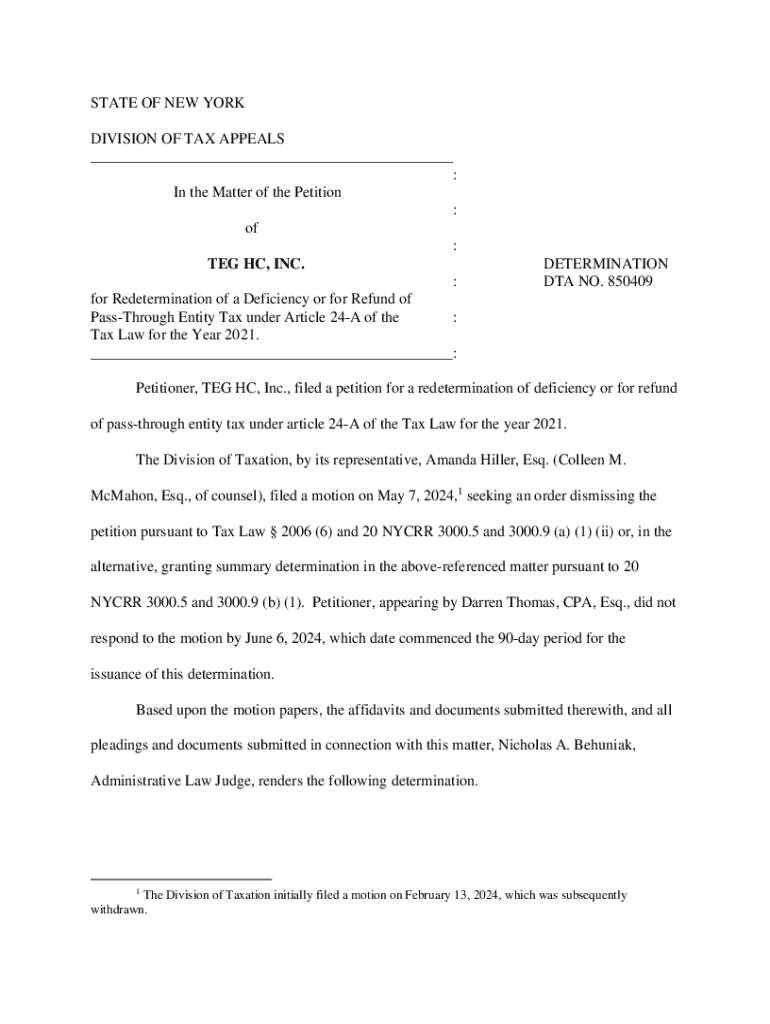

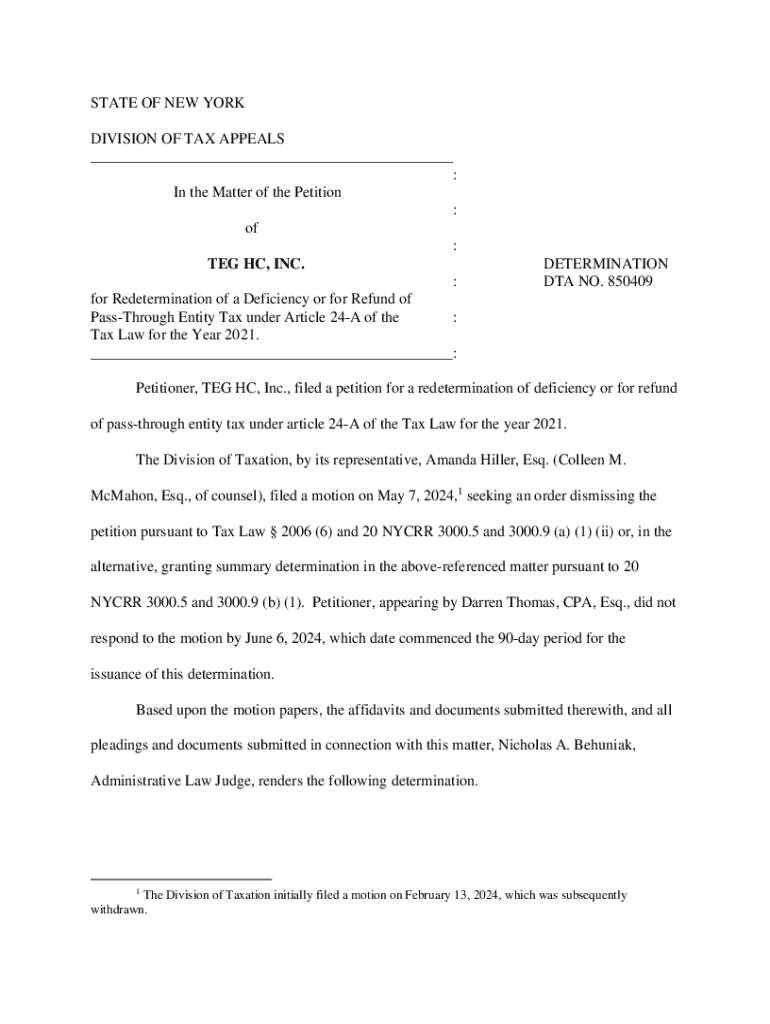

This document outlines the determination of a petition filed by TEG HC, Inc. for redetermination of a deficiency or for refund of pass-through entity tax under Article 24-A of the New York Tax Law for the year 2021. It includes findings of fact, legal conclusions, and the dismissal of the petition due to lack of subject matter jurisdiction.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign tax appeal determination

Edit your tax appeal determination form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your tax appeal determination form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing tax appeal determination online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit tax appeal determination. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

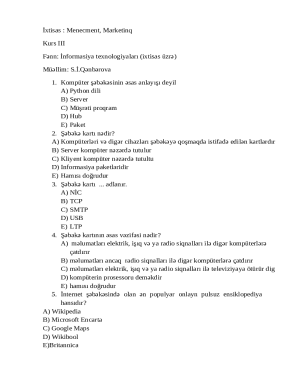

How to fill out tax appeal determination

How to fill out tax appeal determination

01

Gather your property tax statement and any relevant documentation.

02

Determine the assessed value of your property and gather evidence to support your claim.

03

Fill out the tax appeal form, ensuring that all sections are completed correctly.

04

Clearly state the reason for your appeal in the designated area of the form.

05

Attach any supporting documents, such as comparables or photographs, to validate your appeal.

06

Review the completed form for accuracy and completeness.

07

Submit the appeal form by the required deadline, ensuring you keep a copy for your records.

Who needs tax appeal determination?

01

Property owners who believe their property has been overassessed.

02

Businesses disputing their property tax assessment.

03

Individuals seeking a fair property tax rate based on current market value.

04

Anyone who has received a notice of property tax increase.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I sign the tax appeal determination electronically in Chrome?

Yes. You can use pdfFiller to sign documents and use all of the features of the PDF editor in one place if you add this solution to Chrome. In order to use the extension, you can draw or write an electronic signature. You can also upload a picture of your handwritten signature. There is no need to worry about how long it takes to sign your tax appeal determination.

Can I create an eSignature for the tax appeal determination in Gmail?

Use pdfFiller's Gmail add-on to upload, type, or draw a signature. Your tax appeal determination and other papers may be signed using pdfFiller. Register for a free account to preserve signed papers and signatures.

How do I edit tax appeal determination on an iOS device?

Use the pdfFiller app for iOS to make, edit, and share tax appeal determination from your phone. Apple's store will have it up and running in no time. It's possible to get a free trial and choose a subscription plan that fits your needs.

What is tax appeal determination?

Tax appeal determination is the process by which a taxpayer formally challenges the assessed value of their property for tax purposes, seeking a reassessment that may reduce their tax obligation.

Who is required to file tax appeal determination?

Any property owner who disagrees with the assessed value of their property as determined by local tax authorities is required to file a tax appeal determination.

How to fill out tax appeal determination?

To fill out a tax appeal determination, one must complete the required form provided by the local tax authority, providing details such as the property description, the assessed value, and the basis for the appeal.

What is the purpose of tax appeal determination?

The purpose of tax appeal determination is to allow property owners to contest potentially excessive assessments, ensuring that they are taxed fairly based on the accurate value of their property.

What information must be reported on tax appeal determination?

Information that must be reported includes the property address, current assessed value, appealing party information, reasons for the appeal, and any supporting documentation.

Fill out your tax appeal determination online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Tax Appeal Determination is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.