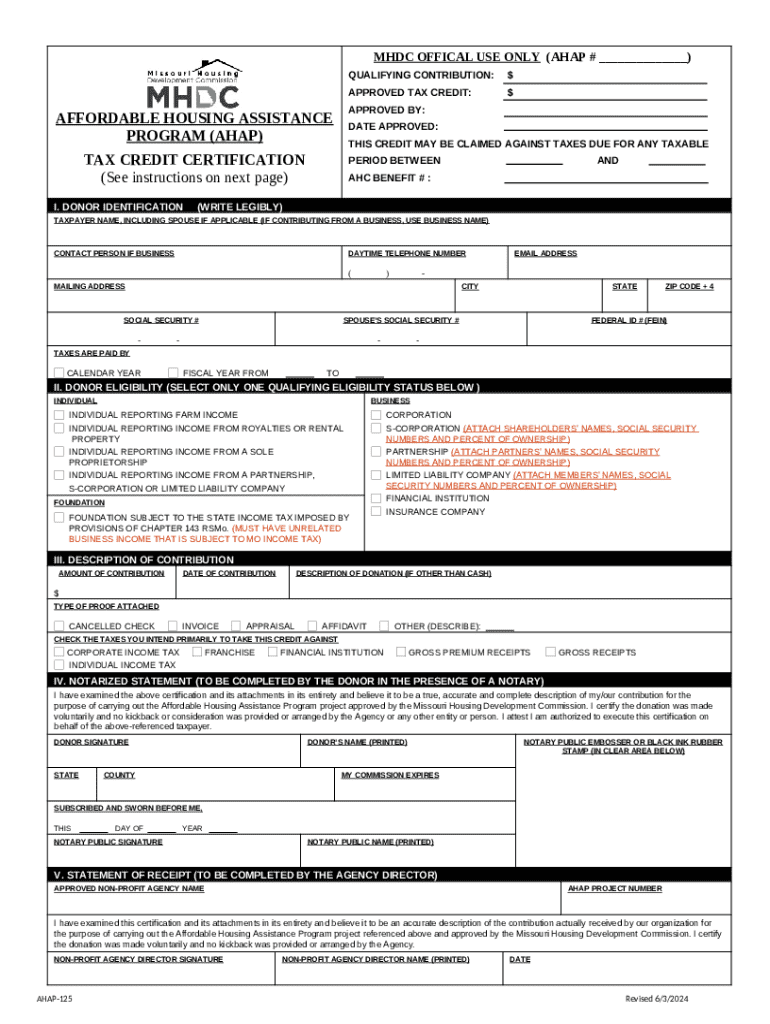

What is AHAP Tax Credits Form?

The AHAP Tax Credits is a document that has to be filled-out and signed for certain purposes. In that case, it is provided to the exact addressee in order to provide certain info of certain kinds. The completion and signing is possible manually in hard copy or via an appropriate solution like PDFfiller. These services help to send in any PDF or Word file online. While doing that, you can edit its appearance depending on your requirements and put a legal electronic signature. Upon finishing, the user ought to send the AHAP Tax Credits to the respective recipient or several recipients by mail and even fax. PDFfiller has a feature and options that make your template printable. It has various options for printing out. It does no matter how you deliver a form after filling it out - in hard copy or by email - it will always look neat and organized. In order not to create a new writable document from the beginning all the time, turn the original document as a template. After that, you will have a rewritable sample.

Template AHAP Tax Credits instructions

Before filling out AHAP Tax Credits Word template, remember to prepared enough of necessary information. It's a very important part, as far as some errors can bring unpleasant consequences from re-submission of the full word template and finishing with deadlines missed and you might be charged a penalty fee. You need to be careful enough when working with digits. At a glimpse, this task seems to be not challenging thing. Nonetheless, you can easily make a mistake. Some use some sort of a lifehack keeping all data in a separate file or a record book and then add it into documents' temlates. Nevertheless, come up with all efforts and provide valid and solid information with your AHAP Tax Credits word form, and doublecheck it while filling out all the fields. If it appears that some mistakes still persist, you can easily make corrections while using PDFfiller editing tool and avoid missing deadlines.

Frequently asked questions about the form AHAP Tax Credits

1. Is it legal to file forms digitally?

As per ESIGN Act 2000, forms completed and approved with an electronic signature are considered to be legally binding, similarly to their hard analogs. In other words, you are free to rightfully complete and submit AHAP Tax Credits word form to the establishment needed using digital signature solution that meets all requirements according to certain terms, like PDFfiller.

2. Is it risk-free to fill out sensitive information online?

Yes, it is completely risk-free thanks to features offered by the product you use for your work flow. As an example, PDFfiller provides the benefits like:

- All personal data is stored in the cloud that is facilitated with multi-layer file encryption, and it's also prohibited from disclosure. It's only you the one who controls to whom and how this document can be shown.

- Every file signed has its own unique ID, so it can’t be faked.

- User can set extra protection like user authentication by picture or password. There is an option to protect entire directory with encryption. Just place your AHAP Tax Credits .doc form and set your password.

3. Can I export my data to the form?

Yes, but you need a specific feature to do that. In PDFfiller, it is called Fill in Bulk. With the help of this one, you are able to export data from the Excel worksheet and place it into your word file.