Get the free Call Report Tax Worksheet

Show details

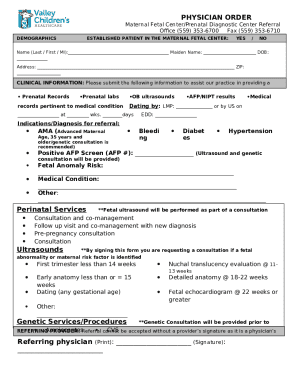

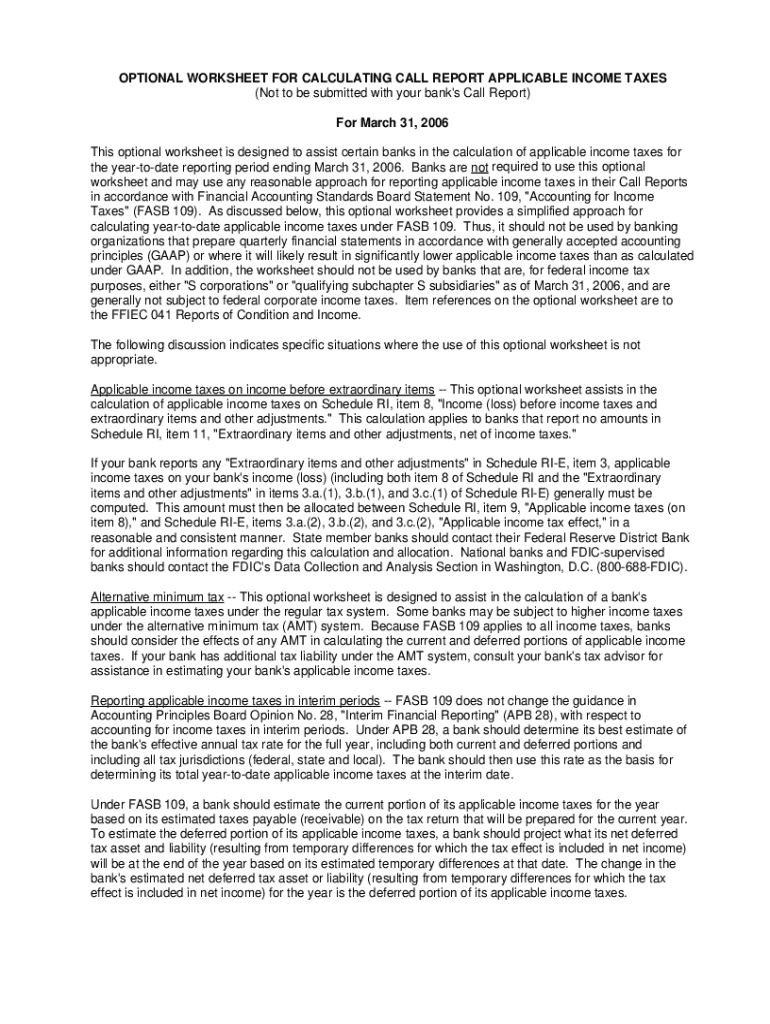

This document is an optional worksheet designed to assist banks in calculating applicable income taxes for the reporting period ending March 31, 2006, in accordance with FASB 109. It provides a simplified approach for determining income tax amounts, including calculations for current and deferred income taxes, while also outlining situations where the worksheet may not be appropriate for certain banking organizations.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign call report tax worksheet

Edit your call report tax worksheet form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your call report tax worksheet form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit call report tax worksheet online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit call report tax worksheet. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out call report tax worksheet

How to fill out call report tax worksheet

01

Gather necessary financial documents and data.

02

Identify the reporting period for the call report.

03

Open the call report tax worksheet template.

04

Fill in the institution's information including name and address.

05

Input total assets and liabilities from your balance sheet.

06

Populate income statements data such as interest income, non-interest income, and expenses.

07

Check and calculate ratios as required in the report.

08

Review the completed worksheet for accuracy and completeness.

09

Submit the worksheet to the relevant regulatory body by the deadline.

Who needs call report tax worksheet?

01

Banks and financial institutions that are required to report their financial condition.

02

Regulatory agencies that use the report to assess the financial health of institutions.

03

Auditors and accountants who may need the information for audits.

04

Stakeholders interested in the institution's financial performance.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send call report tax worksheet to be eSigned by others?

Once your call report tax worksheet is complete, you can securely share it with recipients and gather eSignatures with pdfFiller in just a few clicks. You may transmit a PDF by email, text message, fax, USPS mail, or online notarization directly from your account. Make an account right now and give it a go.

How do I edit call report tax worksheet on an iOS device?

No, you can't. With the pdfFiller app for iOS, you can edit, share, and sign call report tax worksheet right away. At the Apple Store, you can buy and install it in a matter of seconds. The app is free, but you will need to set up an account if you want to buy a subscription or start a free trial.

How do I fill out call report tax worksheet on an Android device?

Complete call report tax worksheet and other documents on your Android device with the pdfFiller app. The software allows you to modify information, eSign, annotate, and share files. You may view your papers from anywhere with an internet connection.

What is call report tax worksheet?

The call report tax worksheet is a financial document that banks and financial institutions use to report their financial condition and regulatory compliance to federal and state regulatory agencies.

Who is required to file call report tax worksheet?

All banks and savings institutions that are federally insured and those that are state-chartered or regulated are required to file the call report tax worksheet.

How to fill out call report tax worksheet?

To fill out the call report tax worksheet, institutions must gather their financial data, complete relevant sections on assets, liabilities, and equity, ensure all calculations are accurate, and submit it electronically to the required regulatory authority.

What is the purpose of call report tax worksheet?

The purpose of the call report tax worksheet is to provide a comprehensive overview of a bank's financial health, operational performance, and compliance with banking regulations to help regulators monitor the institution's safety and soundness.

What information must be reported on call report tax worksheet?

The call report tax worksheet must include information such as the institution's balance sheet items, income statement details, regulatory capital ratios, and other financial metrics that reflect its financial status.

Fill out your call report tax worksheet online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Call Report Tax Worksheet is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.