Get the free Real Property Tax Relief and... - County of Kaua'i

Show details

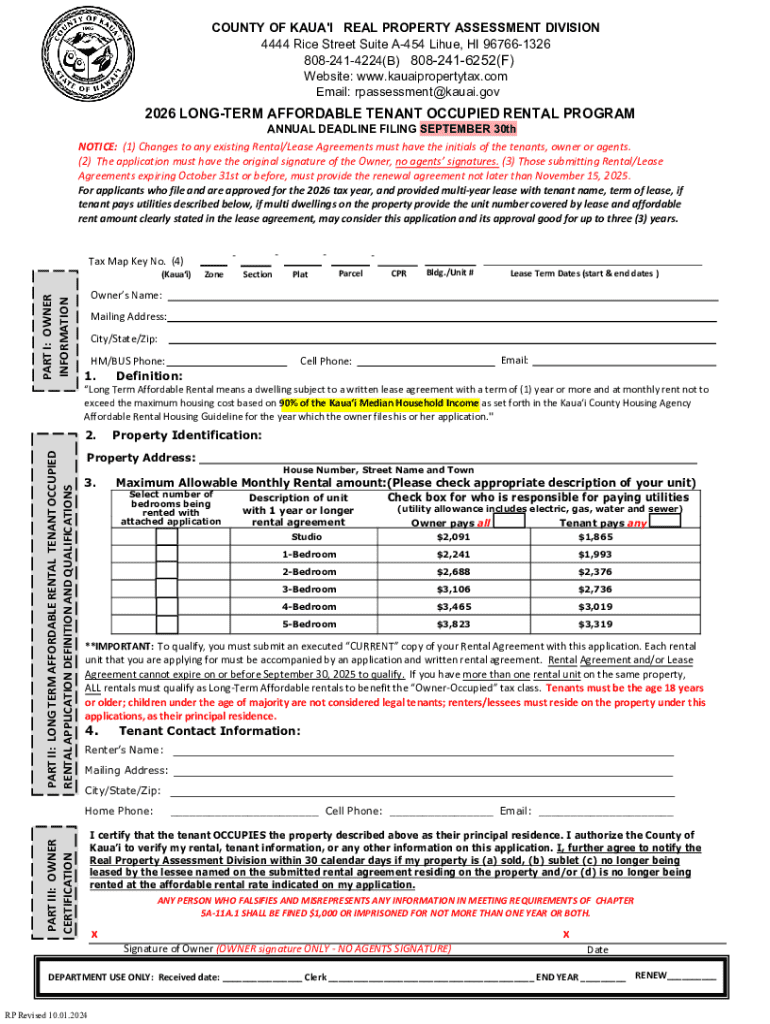

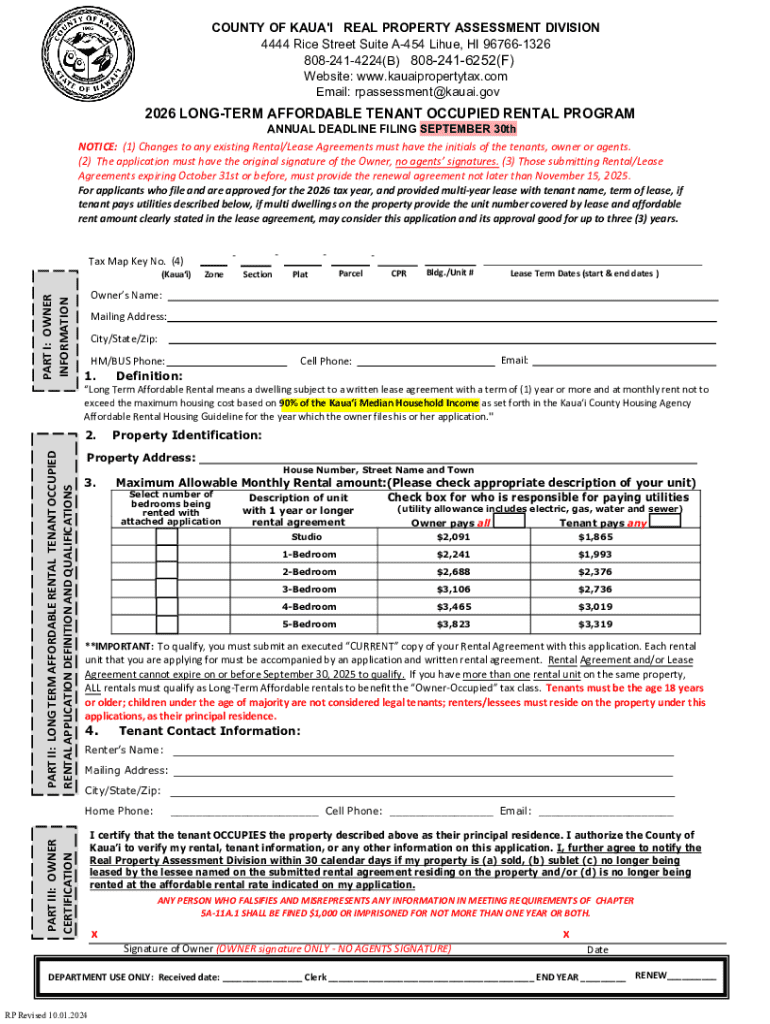

COUNTY OF KAUA\'I REAL PROPERTY ASSESSMENT DIVISION 4444 Rice Street Suite A454 Lihue, HI 967661326 8082414224(B) 8082416252(F) Website: www.kauaipropertytax.com Email: rpassessment@kauai.govPRINTRESET2026

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign real property tax relief

Edit your real property tax relief form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your real property tax relief form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit real property tax relief online

To use the services of a skilled PDF editor, follow these steps below:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit real property tax relief. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out real property tax relief

How to fill out real property tax relief

01

Gather necessary documents such as property tax bill, income statements, and proof of residency.

02

Visit your local tax assessor's office or their website to obtain the real property tax relief application form.

03

Complete the application form accurately, providing all required personal and property information.

04

Attach the required documents to the application form as specified by your local office.

05

Submit the application form and documents by the deadline set by your local tax authority.

06

Keep a copy of the submitted application for your records.

Who needs real property tax relief?

01

Homeowners facing financial hardship due to low income or unemployment.

02

Senior citizens often eligible for tax reductions or exemptions.

03

Disabled individuals who may qualify for property tax relief.

04

Veterans who have service-related disabilities that impact their finances.

05

Families with dependent children who encounter economic difficulties.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send real property tax relief to be eSigned by others?

To distribute your real property tax relief, simply send it to others and receive the eSigned document back instantly. Post or email a PDF that you've notarized online. Doing so requires never leaving your account.

Can I sign the real property tax relief electronically in Chrome?

Yes. By adding the solution to your Chrome browser, you may use pdfFiller to eSign documents while also enjoying all of the PDF editor's capabilities in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a photo of your handwritten signature using the extension. Whatever option you select, you'll be able to eSign your real property tax relief in seconds.

How do I complete real property tax relief on an iOS device?

In order to fill out documents on your iOS device, install the pdfFiller app. Create an account or log in to an existing one if you have a subscription to the service. Once the registration process is complete, upload your real property tax relief. You now can take advantage of pdfFiller's advanced functionalities: adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

What is real property tax relief?

Real property tax relief refers to various programs and mechanisms that provide financial assistance or incentives to reduce the amount of property taxes owed by homeowners or property owners.

Who is required to file real property tax relief?

Typically, property owners who qualify for specific tax relief programs, such as senior citizens, disabled individuals, or those with low income, are required to file for real property tax relief.

How to fill out real property tax relief?

To fill out real property tax relief, applicants should obtain the designated form from their local tax authority, provide required personal and property information, and submit any necessary documentation to prove eligibility.

What is the purpose of real property tax relief?

The purpose of real property tax relief is to alleviate the financial burden of property taxes on eligible homeowners, promote homeownership, and support low-income residents.

What information must be reported on real property tax relief?

Information typically reported includes the property owner's name, address, property assessment details, income level, and any documentation proving eligibility for relief programs.

Fill out your real property tax relief online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Real Property Tax Relief is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.