Get the free Finra Membership / Sec Rule 15b9-1 Affirmation

Show details

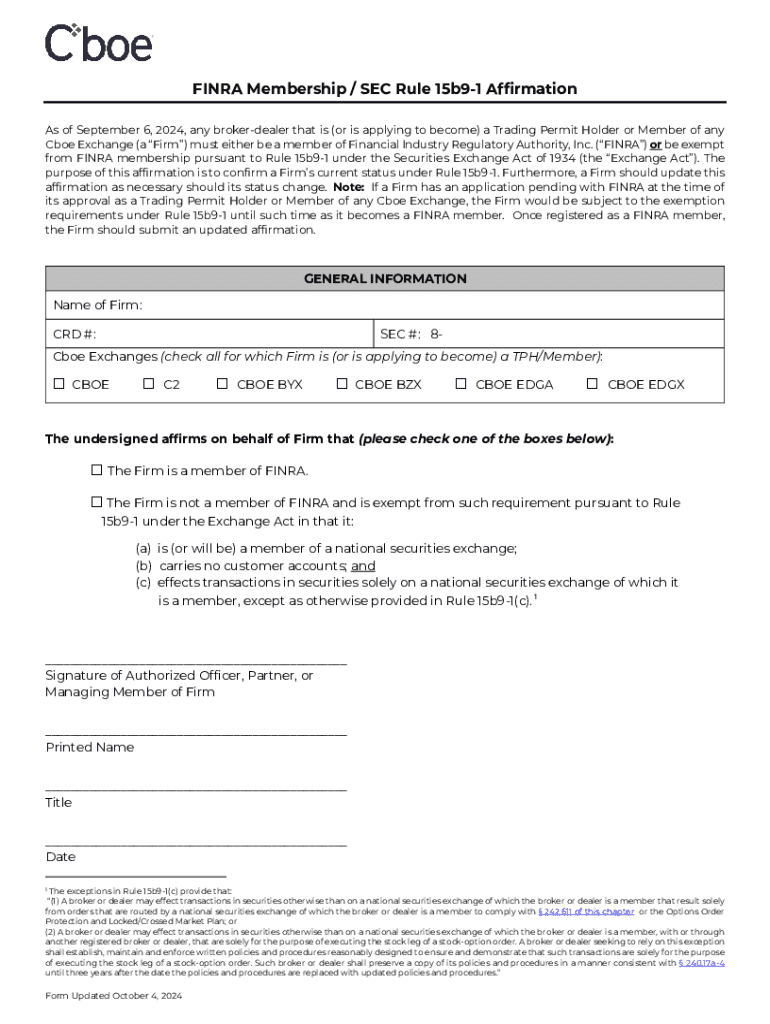

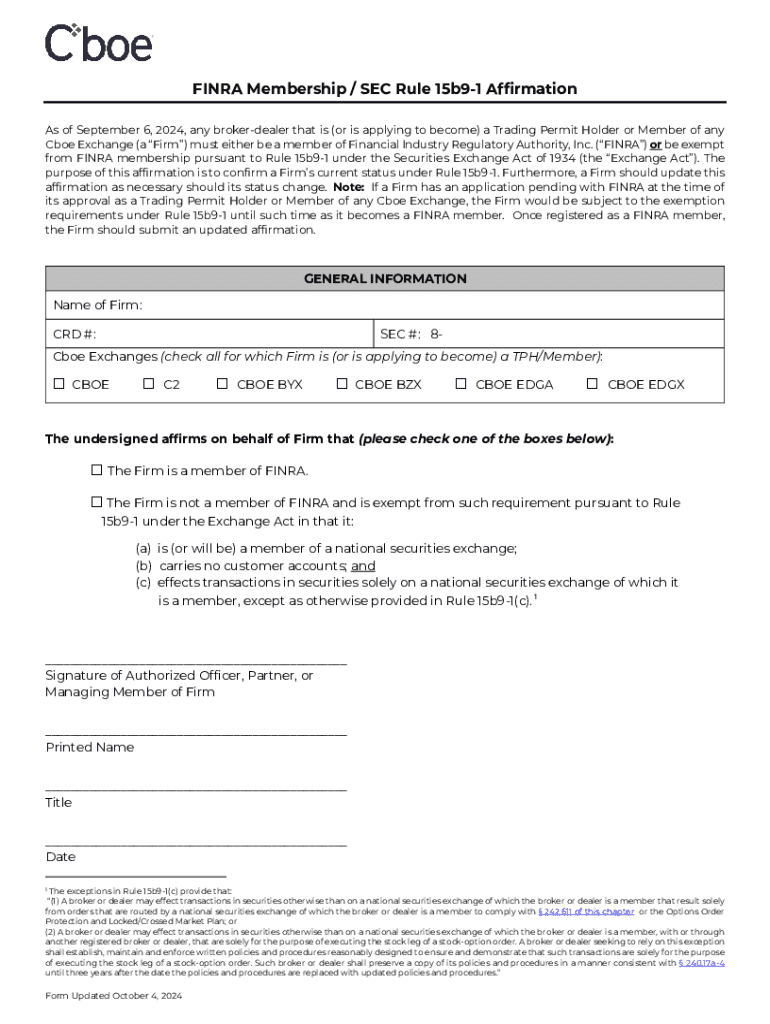

This document serves to confirm a broker-dealer firm\'s current status regarding FINRA membership or its exemption under SEC Rule 15b9-1, as required for trading permit holders or members of Cboe Exchanges. Firms must update this affirmation as necessary, and it outlines the conditions under which exemptions may apply.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign finra membership sec rule

Edit your finra membership sec rule form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your finra membership sec rule form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit finra membership sec rule online

Follow the steps down below to benefit from a competent PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit finra membership sec rule. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out finra membership sec rule

How to fill out finra membership sec rule

01

Review the SEC Rule related to FINRA membership carefully.

02

Gather all necessary documentation, including financial statements and business plans.

03

Complete the FINRA membership application form accurately.

04

Prepare a Business Continuity Plan as per FINRA requirements.

05

Ensure compliance with all operational and financial standards set by FINRA.

06

Submit the application along with all required documents to FINRA.

07

Respond promptly to any inquiries or requests for additional information from FINRA.

08

Attend a FINRA interview if requested to discuss your application.

Who needs finra membership sec rule?

01

Newly established broker-dealers in the financial services industry.

02

Firms seeking to offer investment services or products to the public.

03

Any organization that engages in securities transactions on behalf of clients.

04

Individuals or entities that wish to facilitate trading in securities.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get finra membership sec rule?

The premium pdfFiller subscription gives you access to over 25M fillable templates that you can download, fill out, print, and sign. The library has state-specific finra membership sec rule and other forms. Find the template you need and change it using powerful tools.

How do I make changes in finra membership sec rule?

pdfFiller not only allows you to edit the content of your files but fully rearrange them by changing the number and sequence of pages. Upload your finra membership sec rule to the editor and make any required adjustments in a couple of clicks. The editor enables you to blackout, type, and erase text in PDFs, add images, sticky notes and text boxes, and much more.

How do I fill out finra membership sec rule using my mobile device?

The pdfFiller mobile app makes it simple to design and fill out legal paperwork. Complete and sign finra membership sec rule and other papers using the app. Visit pdfFiller's website to learn more about the PDF editor's features.

What is finra membership sec rule?

The FINRA Membership SEC Rule outlines the requirements and procedures for firms seeking membership in the Financial Industry Regulatory Authority (FINRA), detailing the application process for new brokerage firms.

Who is required to file finra membership sec rule?

Any firm that seeks to become a member of FINRA must file the FINRA Membership SEC Rule, including new broker-dealers and existing firms that are seeking to change their membership status.

How to fill out finra membership sec rule?

To fill out the FINRA Membership SEC Rule, applicants must complete an application form that includes information about the firm's business model, ownership, financial status, and compliance protocols, and submit it to FINRA for review.

What is the purpose of finra membership sec rule?

The purpose of the FINRA Membership SEC Rule is to ensure that firms meet regulatory standards for operational integrity, compliance, and financial stability before being allowed to trade securities in the market.

What information must be reported on finra membership sec rule?

Firms must report information such as business structure, ownership, financial statements, proposed business plans, and details about key personnel when filing the FINRA Membership SEC Rule.

Fill out your finra membership sec rule online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Finra Membership Sec Rule is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.