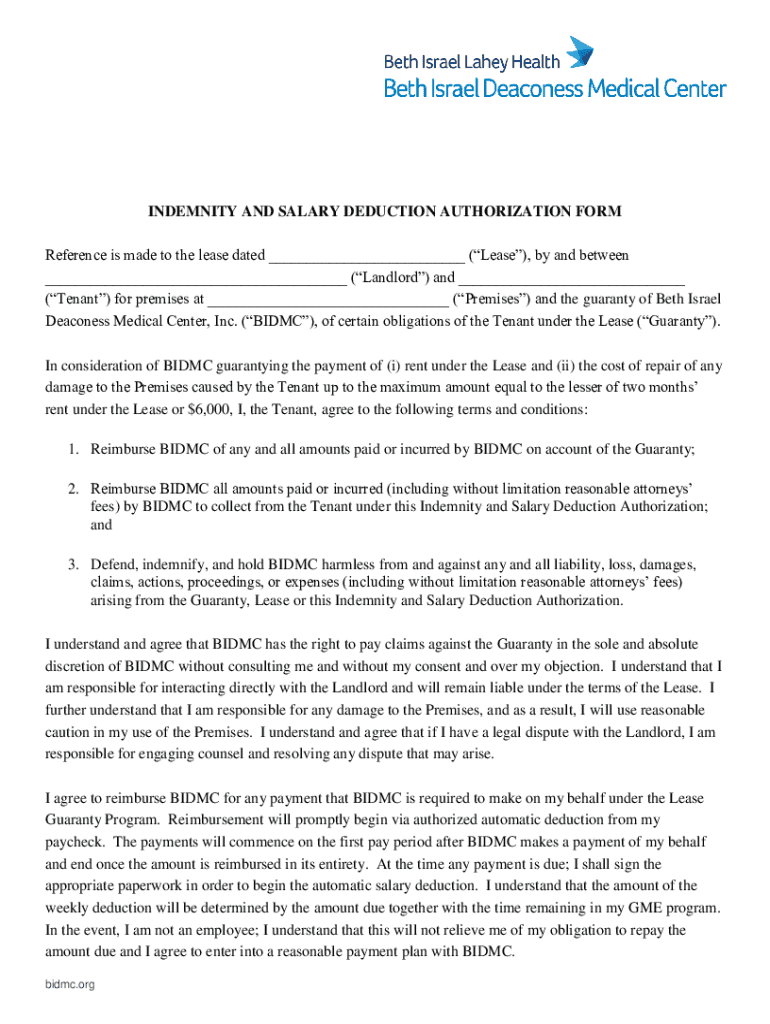

Get the free Indemnity and Salary Deduction Authorization Form

Show details

This form is used to authorize reimbursement to Beth Israel Deaconess Medical Center, Inc. (BIDMC) for any payments made on behalf of a Tenant under a lease agreement, including rent and damage costs, through automatic salary deductions. It outlines the responsibilities of both the Tenant and BIDMC in regards to the Guaranty and Lease, and establishes terms for reimbursement and indemnification.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign indemnity and salary deduction

Edit your indemnity and salary deduction form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your indemnity and salary deduction form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing indemnity and salary deduction online

To use the professional PDF editor, follow these steps below:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit indemnity and salary deduction. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

Dealing with documents is simple using pdfFiller. Now is the time to try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

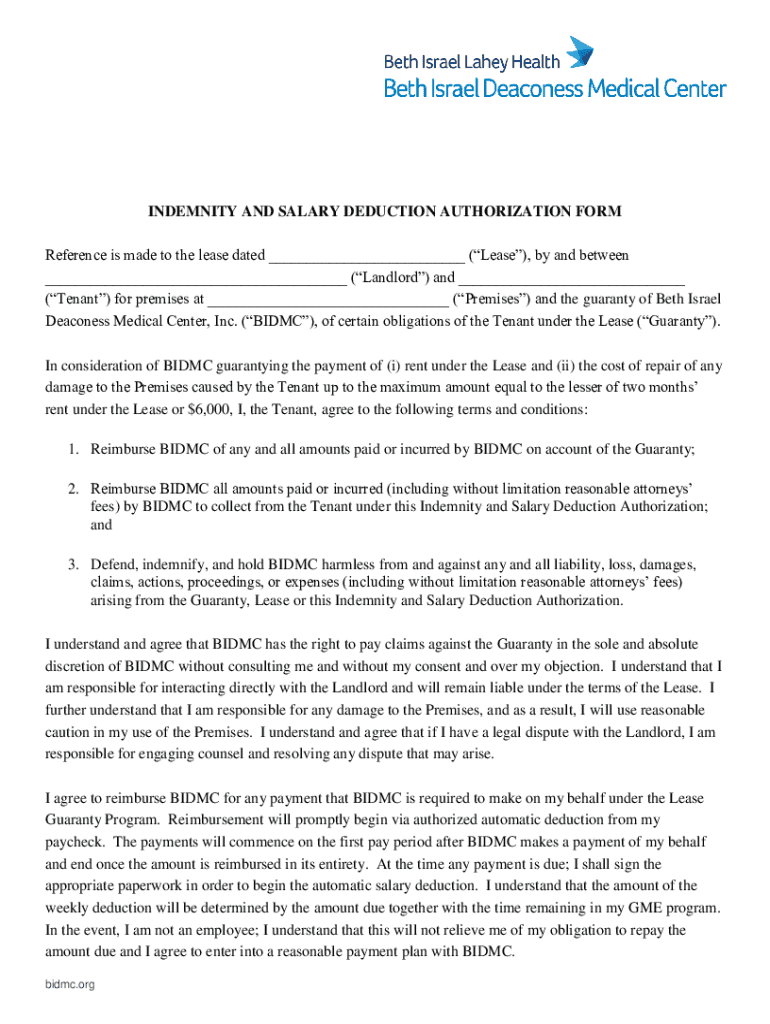

How to fill out indemnity and salary deduction

How to fill out indemnity and salary deduction

01

Gather all necessary documents, such as employment records and pay stubs.

02

Review the specific indemnity form and instructions provided by your employer.

03

Fill out personal information including your name, employee ID, and contact details.

04

Indicate the reason for the indemnity claim clearly and concisely.

05

Attach any supporting documents required, such as medical reports or accident details.

06

Provide details about salary deduction, including the amount and reason for the deduction.

07

Sign and date the form to confirm the information is accurate.

08

Submit the filled-out form to the appropriate department or HR representative.

Who needs indemnity and salary deduction?

01

Employees who have suffered a workplace injury or illness.

02

Employees facing salary deductions for reasons such as overpayment or disciplinary actions.

03

Employers who need to document indemnity claims and salary deductions for accounting and compliance.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my indemnity and salary deduction directly from Gmail?

indemnity and salary deduction and other documents can be changed, filled out, and signed right in your Gmail inbox. You can use pdfFiller's add-on to do this, as well as other things. When you go to Google Workspace, you can find pdfFiller for Gmail. You should use the time you spend dealing with your documents and eSignatures for more important things, like going to the gym or going to the dentist.

Where do I find indemnity and salary deduction?

The premium pdfFiller subscription gives you access to over 25M fillable templates that you can download, fill out, print, and sign. The library has state-specific indemnity and salary deduction and other forms. Find the template you need and change it using powerful tools.

Can I create an electronic signature for the indemnity and salary deduction in Chrome?

Yes. By adding the solution to your Chrome browser, you may use pdfFiller to eSign documents while also enjoying all of the PDF editor's capabilities in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a photo of your handwritten signature using the extension. Whatever option you select, you'll be able to eSign your indemnity and salary deduction in seconds.

What is indemnity and salary deduction?

Indemnity refers to compensation for loss or damage, often provided by insurance, while salary deduction involves withholding a portion of an employee's wages for reasons such as taxes, benefits, or other agreed-upon payments.

Who is required to file indemnity and salary deduction?

Employers are required to file indemnity and salary deduction forms to report withheld amounts from employees' salaries, as well as any indemnity claims made.

How to fill out indemnity and salary deduction?

To fill out indemnity and salary deduction forms, you need to provide employee information, the amount deducted, reason for the deduction, and any relevant claim details for indemnity.

What is the purpose of indemnity and salary deduction?

The purpose of these filings is to ensure compliance with tax laws, to report employer contributions to benefits or insurance, and to track any indemnity claims made by employees.

What information must be reported on indemnity and salary deduction?

The information required includes employee name and identification, amounts deducted, reasons for deductions, and any relevant claim details regarding indemnity.

Fill out your indemnity and salary deduction online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Indemnity And Salary Deduction is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.