Get the free Sba 7(a) Borrower Information Form

Show details

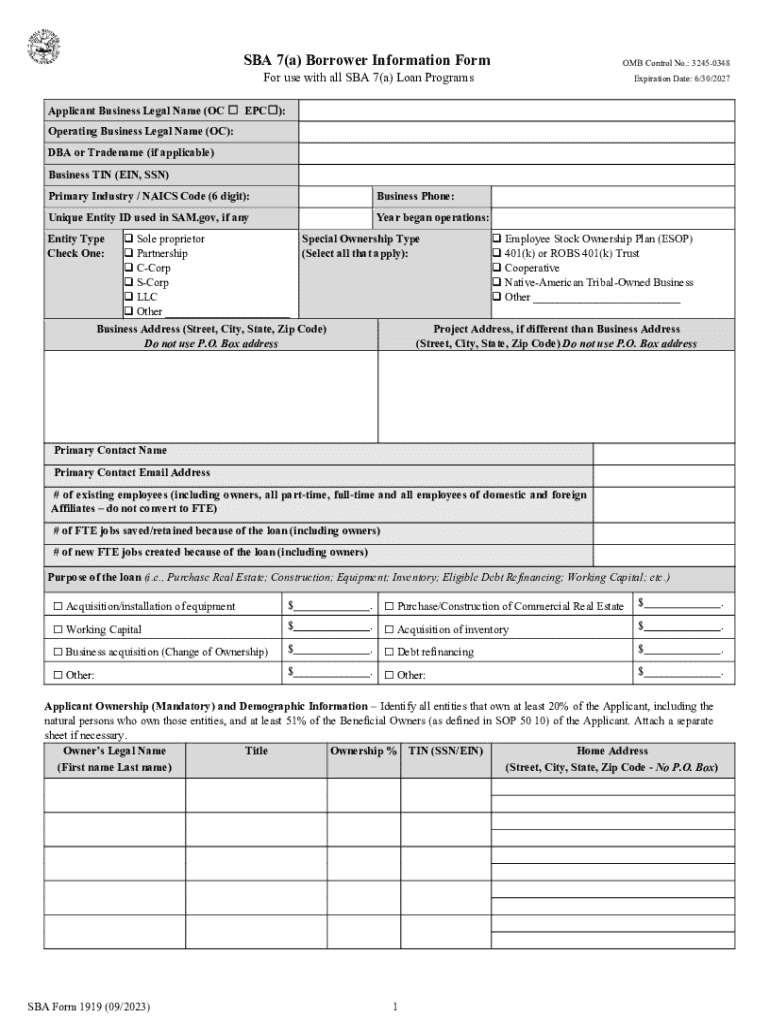

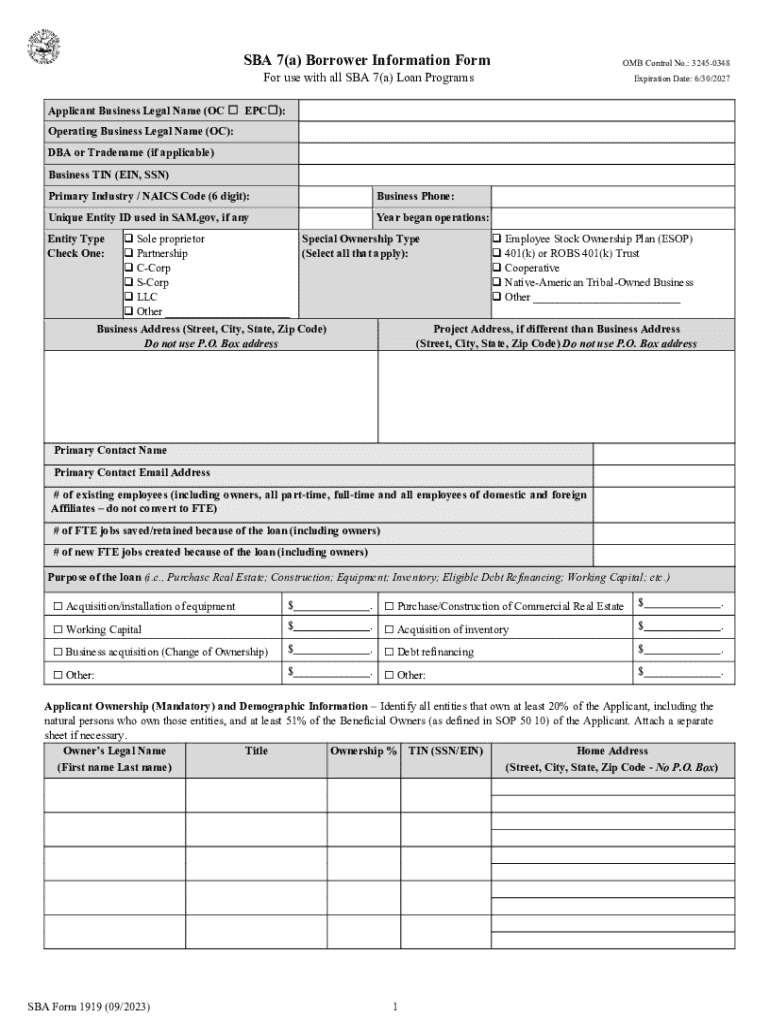

This form is designed for collecting essential information about small business applicants seeking loans under the SBA 7(a) Loan Programs, including details about the business, ownership, loan purpose, and demographic data of the owners. It includes various sections for reporting business structure, ownership demographics, financial information, and purposes of the loan to assess eligibility.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign sba 7a borrower information

Edit your sba 7a borrower information form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your sba 7a borrower information form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing sba 7a borrower information online

To use the services of a skilled PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit sba 7a borrower information. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out sba 7a borrower information

How to fill out sba 7a borrower information

01

Start by obtaining the SBA Form 1919, which is the Borrower Information Form for SBA 7(a) loans.

02

Fill in the applicant's legal name as it appears on official documents.

03

Provide the business's doing business as (DBA) name if it differs from the legal name.

04

Enter the business address, including street, city, state, and zip code.

05

Select the type of business entity (e.g., corporation, LLC, sole proprietorship).

06

Provide the business tax ID number (EIN or SSN).

07

Indicate the date the business was established.

08

Complete information about the ownership structure, identifying all owners with 20% or more stake in the business.

09

Include personal information for each owner, including name, title, ownership percentage, and social security number.

10

Fill in details about the business operations and purpose of the loan.

11

Review for accuracy and completeness before submission.

Who needs sba 7a borrower information?

01

Small business owners seeking financing through the SBA 7(a) loan program.

02

Businesses planning to expand, purchase equipment, or cover operational costs.

03

Lenders processing SBA loan applications require this information for approval.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send sba 7a borrower information for eSignature?

When you're ready to share your sba 7a borrower information, you can send it to other people and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail. You can also notarize your PDF on the web. You don't have to leave your account to do this.

Can I create an electronic signature for the sba 7a borrower information in Chrome?

Yes, you can. With pdfFiller, you not only get a feature-rich PDF editor and fillable form builder but a powerful e-signature solution that you can add directly to your Chrome browser. Using our extension, you can create your legally-binding eSignature by typing, drawing, or capturing a photo of your signature using your webcam. Choose whichever method you prefer and eSign your sba 7a borrower information in minutes.

How can I fill out sba 7a borrower information on an iOS device?

Install the pdfFiller iOS app. Log in or create an account to access the solution's editing features. Open your sba 7a borrower information by uploading it from your device or online storage. After filling in all relevant fields and eSigning if required, you may save or distribute the document.

What is sba 7a borrower information?

SBA 7a borrower information refers to the data and details submitted by small business borrowers to the Small Business Administration (SBA) when applying for an SBA 7(a) loan. This information includes personal and business financial details necessary to assess the borrower's creditworthiness and the viability of the loan.

Who is required to file sba 7a borrower information?

Any small business applying for an SBA 7(a) loan is required to file SBA 7a borrower information. This typically includes business owners, partners, and any individuals with significant ownership stakes.

How to fill out sba 7a borrower information?

To fill out SBA 7a borrower information, borrowers should gather relevant financial documents, personal identification, business plans, and other requested information. They then complete the application forms, ensuring that all data is accurate and comprehensive, and submit them to their lender or the SBA.

What is the purpose of sba 7a borrower information?

The purpose of SBA 7a borrower information is to provide the SBA and lenders with necessary data to evaluate the financial health of the borrower, the feasibility of the business venture, and the risk associated with granting the loan.

What information must be reported on sba 7a borrower information?

The SBA 7a borrower information must report personal financial statements, business financial statements, tax returns, business credit history, and any other documents that support the borrower's ability to repay the loan.

Fill out your sba 7a borrower information online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Sba 7a Borrower Information is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.