Get the free Personal Financial Statement - FivePoint Credit Union - fivepointcu

Show details

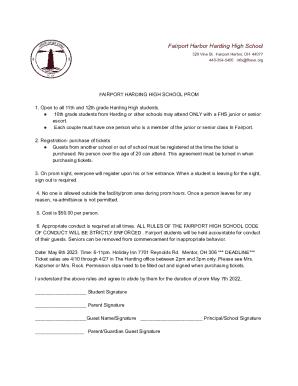

Statement Date Personal Financial Statement Name: Residence Address: City, State, & Zip Code: Date of Birth: Social Security Number: Driver's License Number: Mother's Maiden Name: Do You have a Will?

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign personal financial statement

Edit your personal financial statement form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your personal financial statement form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing personal financial statement online

In order to make advantage of the professional PDF editor, follow these steps:

1

Log into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit personal financial statement. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to deal with documents. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out personal financial statement

How to fill out a personal financial statement:

01

Gather all necessary documents: Collect statements for all bank accounts, credit cards, loans, mortgages, investments, and retirement accounts. Also, gather documentation for any other assets you own, such as real estate, vehicles, or valuable possessions. Additionally, collect any statements or documents related to your income and expenses.

02

Identify your assets: List all your assets, including cash, investments, real estate, vehicles, and any other valuable possessions you own. Include the current market value and any outstanding loans or mortgages associated with these assets.

03

Calculate your liabilities: List all your liabilities, which are your debts and financial obligations. This includes credit card balances, student loans, mortgage payments, auto loans, personal loans, and any other outstanding debts.

04

Determine your net worth: Subtract your total liabilities from your total assets to calculate your net worth. This will give you a comprehensive snapshot of your financial standing.

05

Analyze your income and expenses: List all your sources of income, such as salary, rental income, investment income, and any other sources of revenue. Then, tally up all your monthly expenses, including but not limited to rent or mortgage payments, utility bills, groceries, transportation costs, insurance premiums, and entertainment expenses. This analysis will help you understand your cash flow and manage your finances effectively.

06

Projections and future planning: Use your personal financial statement to set financial goals and make projections for the future. This may include saving for retirement, paying off debts, or planning for major expenses like education or purchasing a home.

07

Review and update regularly: Keep your personal financial statement up to date by reviewing and updating it regularly. This will ensure that you have an accurate overview of your financial situation and can make informed decisions regarding your financial goals and plans.

Who needs a personal financial statement?

01

Individuals planning for retirement: A personal financial statement is crucial for individuals who are planning for their retirement. It helps to assess their current financial situation, determine how much they need to save for retirement, and make informed decisions about investment strategies.

02

Small business owners: Small business owners often need to provide a personal financial statement when applying for business loans or seeking investors. It helps lenders and investors assess the owner's financial stability and their ability to manage business finances effectively.

03

Individuals applying for loans or mortgages: Banks and lending institutions often require applicants to submit a personal financial statement when applying for loans or mortgages. It helps lenders evaluate the applicant's creditworthiness and determine their ability to repay the loan.

04

Individuals seeking financial advice or planning: Creating a personal financial statement can be beneficial for anyone seeking financial advice or planning for their financial future. It provides an overview of their financial situation, identifies areas for improvement, and acts as a foundation for financial planning and decision-making.

Remember, a personal financial statement is a crucial tool that helps individuals assess their financial standing, set goals, and make informed financial decisions. Regularly updating and reviewing it can contribute to long-term financial stability and success.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is personal financial statement?

A personal financial statement is a document that outlines an individual's financial position at a given point in time.

Who is required to file personal financial statement?

Certain individuals such as government officials, candidates for public office, and employees in certain positions may be required to file a personal financial statement.

How to fill out personal financial statement?

To fill out a personal financial statement, individuals typically need to provide information on their assets, liabilities, income, and expenses.

What is the purpose of personal financial statement?

The purpose of a personal financial statement is to provide an overview of an individual's financial situation and to disclose any potential conflicts of interest.

What information must be reported on personal financial statement?

Information such as assets, liabilities, sources of income, and business interests must be reported on a personal financial statement.

How can I modify personal financial statement without leaving Google Drive?

You can quickly improve your document management and form preparation by integrating pdfFiller with Google Docs so that you can create, edit and sign documents directly from your Google Drive. The add-on enables you to transform your personal financial statement into a dynamic fillable form that you can manage and eSign from any internet-connected device.

Can I create an electronic signature for the personal financial statement in Chrome?

Yes. By adding the solution to your Chrome browser, you can use pdfFiller to eSign documents and enjoy all of the features of the PDF editor in one place. Use the extension to create a legally-binding eSignature by drawing it, typing it, or uploading a picture of your handwritten signature. Whatever you choose, you will be able to eSign your personal financial statement in seconds.

How do I complete personal financial statement on an Android device?

Use the pdfFiller app for Android to finish your personal financial statement. The application lets you do all the things you need to do with documents, like add, edit, and remove text, sign, annotate, and more. There is nothing else you need except your smartphone and an internet connection to do this.

Fill out your personal financial statement online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Personal Financial Statement is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.