Get the free Long Term Care Insurance Medical History Form

Show details

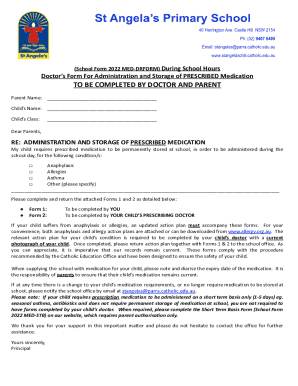

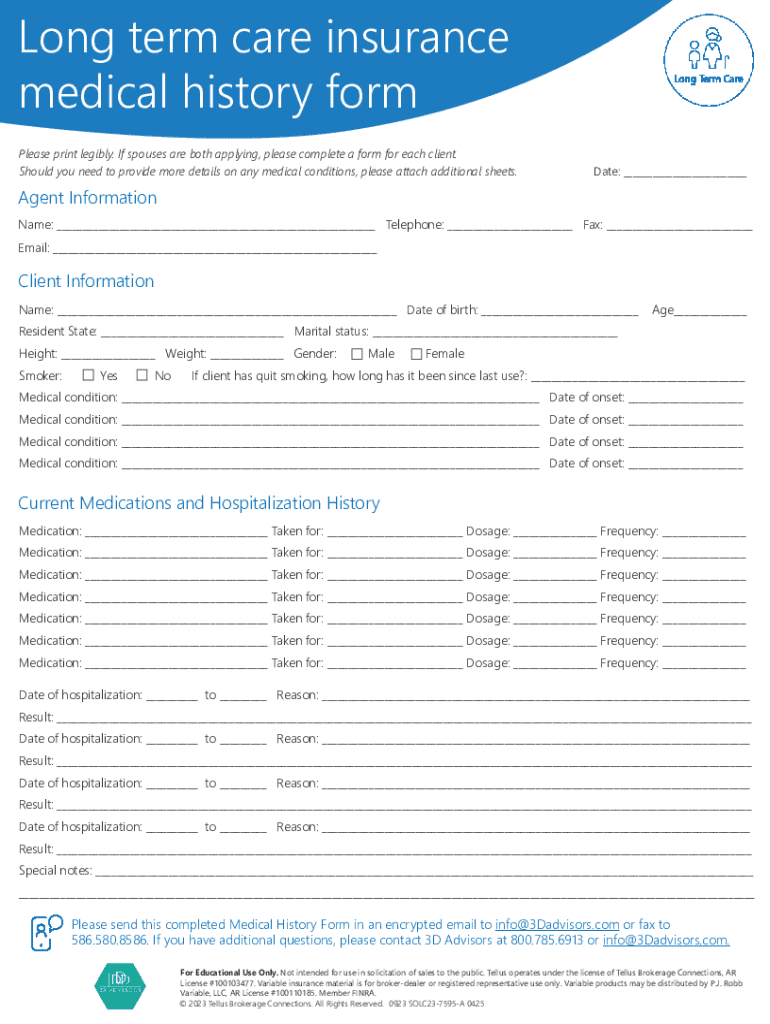

This form is used to gather the medical history of clients applying for long term care insurance. It requires personal information, medical conditions, medications, and hospitalization history. Clients must fill out separate forms if both spouses are applying.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign long term care insurance

Edit your long term care insurance form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your long term care insurance form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit long term care insurance online

To use our professional PDF editor, follow these steps:

1

Log in to your account. Click Start Free Trial and sign up a profile if you don't have one.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit long term care insurance. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, it's always easy to deal with documents. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out long term care insurance

How to fill out long term care insurance

01

Gather Personal Information: Collect details such as your name, address, and contact information.

02

Review Policy Options: Research different policy options available for long term care insurance.

03

Understand Coverage: Familiarize yourself with what services and care are covered by the policy.

04

Assess Your Needs: Consider your potential long term care needs based on health, age, and family history.

05

Fill Out Application: Complete the application form with accurate information regarding your health history and lifestyle.

06

Consider Premiums: Review the cost of premiums and determine what you can afford concerning coverage.

07

Check for Waiting Periods: Be aware of any waiting periods before the coverage begins.

08

Submit Application: Send the completed application to the insurance company for processing.

09

Review and Sign Policy: Once approved, read through the policy documents carefully before signing.

10

Keep Records: Store all documents related to your long term care insurance in a safe place.

Who needs long term care insurance?

01

Older Adults: Individuals over the age of 65 who are more likely to require long term care.

02

Individuals with Chronic Illnesses: Those who have conditions that make them need assistance with daily activities.

03

People with Disabilities: Individuals who have physical or cognitive disabilities that limit their independence.

04

Family Caregivers: Families who want to ensure that their loved ones receive professional care.

05

Anyone with a Family History: Individuals with a history of health issues in their family may want to secure coverage.

06

Those Planning for the Future: Anyone who wants to plan ahead to avoid financial burden later in life.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find long term care insurance?

The premium version of pdfFiller gives you access to a huge library of fillable forms (more than 25 million fillable templates). You can download, fill out, print, and sign them all. State-specific long term care insurance and other forms will be easy to find in the library. Find the template you need and use advanced editing tools to make it your own.

How do I complete long term care insurance online?

Filling out and eSigning long term care insurance is now simple. The solution allows you to change and reorganize PDF text, add fillable fields, and eSign the document. Start a free trial of pdfFiller, the best document editing solution.

Can I sign the long term care insurance electronically in Chrome?

As a PDF editor and form builder, pdfFiller has a lot of features. It also has a powerful e-signature tool that you can add to your Chrome browser. With our extension, you can type, draw, or take a picture of your signature with your webcam to make your legally-binding eSignature. Choose how you want to sign your long term care insurance and you'll be done in minutes.

What is long term care insurance?

Long term care insurance is a type of insurance designed to cover the costs of long-term care services, which are not typically covered by health insurance or Medicare. This includes assistance with daily activities such as bathing, dressing, and meal preparation, often provided in settings like nursing homes or through home health aides.

Who is required to file long term care insurance?

Generally, individuals who purchase long term care insurance policies may need to file them with their state insurance departments to comply with state regulations. Additionally, policyholders may need to file claims with their insurance providers when seeking benefits.

How to fill out long term care insurance?

To fill out a long term care insurance application, you’ll need to provide personal information, health history, and details about the type and amount of coverage you desire. Review the application carefully, provide accurate information, and submit any required documentation like medical records.

What is the purpose of long term care insurance?

The purpose of long term care insurance is to provide financial support for individuals who may need assistance with daily living activities due to chronic illness, disability, or age-related issues. It helps cover the cost of services that can help maintain quality of life and independence.

What information must be reported on long term care insurance?

The information typically reported on long term care insurance includes personal identification details, medical history, the severity of health conditions, lifestyle choices, previous long term care services used, and information on current health coverage.

Fill out your long term care insurance online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Long Term Care Insurance is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.