Get the free Schedule Itc

Show details

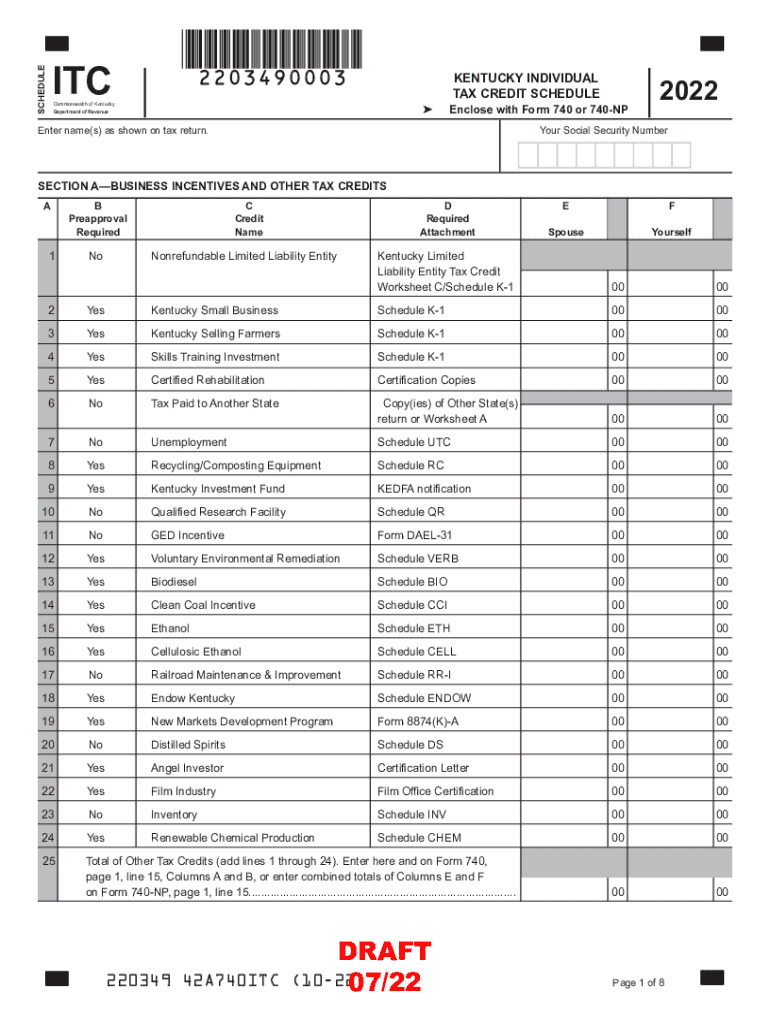

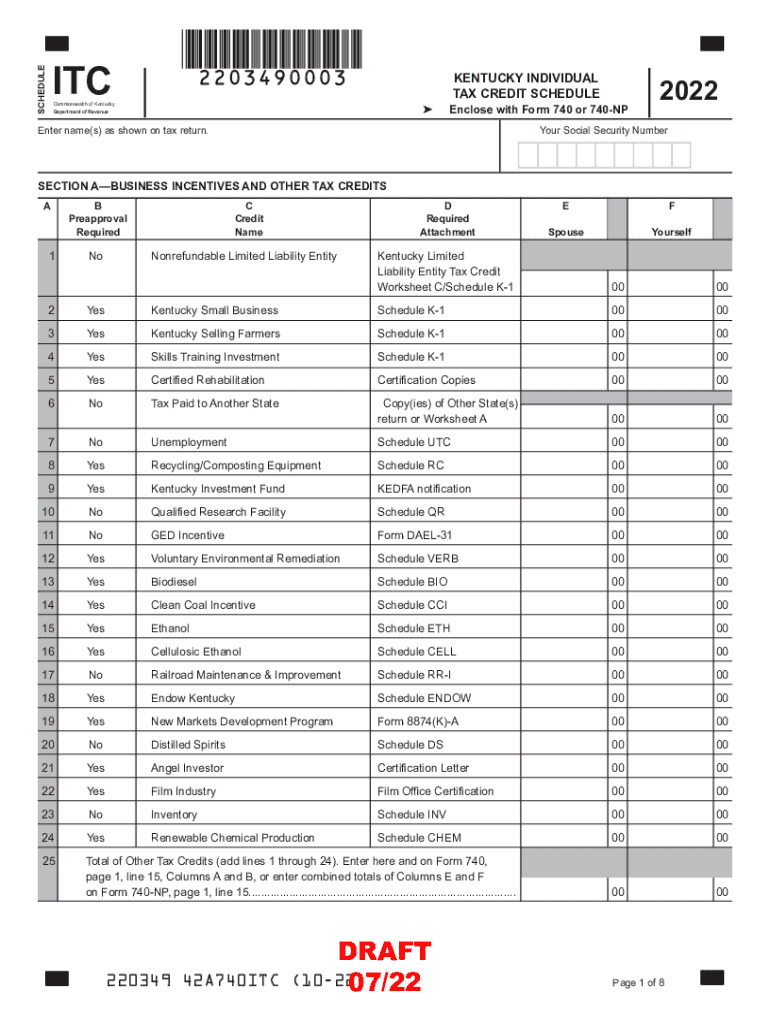

This schedule is used by individuals in Kentucky to report and claim various tax credits related to business incentives, personal tax credits, and family size tax credits for the tax year 2022. It includes details about nonrefundable credits for limited liability entity tax, small businesses, selling farmers, skills training investment, clean coal incentives, and more, along with specific requirements and documentation needed to claim those credits.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign schedule itc

Edit your schedule itc form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your schedule itc form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing schedule itc online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit schedule itc. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out schedule itc

How to fill out schedule itc

01

Gather all necessary information regarding the tasks and deadlines.

02

Open the Schedule ITC template or application.

03

Start by entering the title of the project at the top of the schedule.

04

List all tasks or activities in the first column.

05

In the adjacent columns, enter start dates and end dates for each task.

06

Assign resources or team members responsible for each task.

07

Indicate the priority level or status of each task (e.g., not started, in progress, completed).

08

Review the schedule for accuracy and completeness.

09

Save or export the schedule as needed for sharing.

Who needs schedule itc?

01

Project managers who oversee project timelines.

02

Team members needing clarity on their assigned tasks.

03

Stakeholders wanting to track progress and deadlines.

04

Operational managers responsible for resource allocation.

05

Any organization creating structured project schedules.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send schedule itc for eSignature?

To distribute your schedule itc, simply send it to others and receive the eSigned document back instantly. Post or email a PDF that you've notarized online. Doing so requires never leaving your account.

How do I edit schedule itc online?

The editing procedure is simple with pdfFiller. Open your schedule itc in the editor. You may also add photos, draw arrows and lines, insert sticky notes and text boxes, and more.

Can I create an electronic signature for the schedule itc in Chrome?

You can. With pdfFiller, you get a strong e-signature solution built right into your Chrome browser. Using our addon, you may produce a legally enforceable eSignature by typing, sketching, or photographing it. Choose your preferred method and eSign in minutes.

What is schedule itc?

Schedule ITC (Input Tax Credit) is a form used by taxpayers to claim credit for the input tax paid on goods and services used in the course of business.

Who is required to file schedule itc?

Businesses registered under Goods and Services Tax (GST) that wish to claim input tax credit are required to file Schedule ITC.

How to fill out schedule itc?

To fill out Schedule ITC, taxpayers must provide details of input tax credit claimed, including invoice details, supplier information, and the amount of tax paid.

What is the purpose of schedule itc?

The purpose of Schedule ITC is to accurately track and claim input tax credits on eligible purchases, ensuring that businesses can reduce their tax liabilities.

What information must be reported on schedule itc?

Information that must be reported includes GSTIN of the supplier, invoice number, date of invoice, description of goods/services, and the amount of input tax claimed.

Fill out your schedule itc online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Schedule Itc is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.