IRS 943 2024-2025 free printable template

Show details

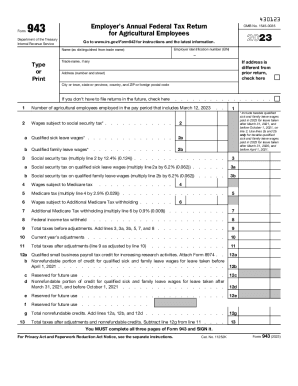

Don t use Form 943-V to make federal tax deposits. Use Form 943-V when making any payment with Form 943. Don t send cash. Don t staple Form 943-V or your payment to Form 943 or to each other. Detach Form 943-V and send it with your payment and Form 943 to the address provided in the Instructions for Note You must also complete the entity information above line 1 on Form 943. Check if self-employed PTIN Firm s EIN Phone no. Cat. No. 11252K 943 2024 430621 This page intentionally left blank Form...943-V Payment Voucher Purpose of Form Specific Instructions Complete Form 943-V if you re making a payment with Form 943. All filers If line 13 is less than 2 500 don t complete line 17 or Form 943-A. Semiweekly schedule depositors Complete Form 943-A and check here. 943-V 1 Enter your employer identification number EIN. Don t staple this voucher or your payment to Form 943. See Deposit Penalties in section 11 of Pub. 15. Detach Here and Mail With Your Payment and Form 943. However if you pay an...amount with CAUTION Form 943 that should ve been deposited you may be subject to a penalty. Box 2 Amount paid. Enter the amount paid with Box 3 Name and address. Enter your name and address as shown on Form 943. Form 430124 Employer s Annual Federal Tax Return for Agricultural Employees Department of the Treasury Internal Revenue Service OMB No* 1545-0029 Go to www*irs*gov/Form943 for instructions and the latest information* Employer identification number EIN Name as distinguished from trade...name Trade name if any Type or Print If address is different from prior return check here. Address number and street City or town state or province country and ZIP or foreign postal code If you don t have to file returns in the future check here. Monthly schedule depositors Complete line 17 and check here. Send a refund. Monthly Summary of Federal Tax Liability. Don t complete if you were a semiweekly schedule depositor. Tax liability for month A B C D E Number of agricultural employees employed...in the pay period that includes March 12 2024. Wages subject to social security tax. Social security tax multiply line 2 by 12. 4 0. 124. Medicare tax multiply line 4 by 2. 9 0. 029. Additional Medicare Tax withholding multiply line 6 by 0. 9 0. 009. Federal income tax withheld Total taxes before adjustments. Add lines 3 5 7 and 8. Current year s adjustments. Total taxes after adjustments line 9 as adjusted by line 10. Balance due. If line 13 is more than line 14 enter the difference and see the...instructions. Overpayment. If line 14 is more than line 13 enter the difference Check one Apply to next return* January February March April. May. ThirdParty Designee Sign Here F G H I J June. July. August. September October. K November. L December. M Total liability for year add lines A through L. Do you want to allow another person to discuss this return with the IRS See the separate instructions. name Yes. Complete the following. No* Personal identification number PIN Phone no. Under...penalties of perjury I declare that I have examined this return including accompanying schedules and statements and to the best of my knowledge and belief it is true correct and complete.

pdfFiller is not affiliated with IRS

Instructions and Help about IRS 943

How to edit IRS 943

How to fill out IRS 943

Instructions and Help about IRS 943

How to edit IRS 943

Edit IRS 943 form using pdfFiller, which allows you to modify the content easily. You can add or remove information, ensuring that all entries are accurate. Make sure to review the form after editing to confirm that no errors are present before submission.

How to fill out IRS 943

Filling out the IRS 943 form involves several key steps. Start by gathering the necessary information about your agricultural employees and their wages. Follow these steps:

01

Obtain the latest version of IRS 943 from the IRS website or use a tax preparation service.

02

Enter your identification information in the designated sections of the form.

03

Report the total number of agricultural employees and their wages in the appropriate fields.

04

Complete the tax liability calculations as outlined on the form.

05

Sign and date the form before submitting it to the IRS.

Latest updates to IRS 943

Latest updates to IRS 943

The IRS occasionally updates the 943 form to reflect changes in tax law or policy. Keep informed about these updates by regularly checking the IRS official website. Form versions typically remain available for access throughout the tax year, ensuring that filers can use the most current information.

All You Need to Know About IRS 943

What is IRS 943?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

All You Need to Know About IRS 943

What is IRS 943?

IRS 943 is a tax form used by agricultural employers to report wages paid to employees and the associated tax liabilities. It is specifically designed for farms and agricultural businesses that pay qualifying employees in a calendar year.

What is the purpose of this form?

The purpose of IRS 943 is to document employment taxes related to farm workers. It helps the IRS track the payment of social security and Medicare taxes, ensuring compliance with federal tax laws.

Who needs the form?

Employers of agricultural workers who pay $1,000 or more in wages during any calendar quarter must file IRS 943. This includes farmers, ranchers, and farm-related businesses that hire seasonal or payroll employees.

When am I exempt from filling out this form?

You may be exempt from filing IRS 943 if you do not pay agricultural labor wages exceeding $1,000 in any quarter during the year. Additionally, if all your agricultural labor is performed by immediate family members, you might not need to file.

Components of the form

IRS 943 includes various sections, such as taxpayer identification details, wage information, tax calculations for social security and Medicare, and a summary of any taxes withheld. Each part is crucial for accurate reporting and tax liability assessment.

What are the penalties for not issuing the form?

Failing to file IRS 943 can result in hefty penalties for agricultural employers, including the possibility of fines and interest on unpaid taxes. Remaining compliant by submitting this form on time is essential for avoiding these consequences.

What information do you need when you file the form?

To file IRS 943, you'll need your Employer Identification Number (EIN), detailed records of employee wages, tax withholding amounts, and any previous year’s tax liabilities. Accurate data is essential for correct and efficient filing.

Is the form accompanied by other forms?

IRS 943 may need to be filed alongside other employment tax forms, such as Forms 941 or 945, depending on the specifics of your employment situation. Verify your requirements to ensure compliance with all IRS regulations.

Where do I send the form?

Send IRS 943 to the appropriate address indicated in the instruction booklet for the form. This address may vary based on whether you are submitting payment with the form or filing without payment. Always verify the correct mailing address on the IRS website or in the form instructions.

See what our users say