Get the free PA EDUCATIONAL TAX CREDITS FOR INDIVIDUALS

Show details

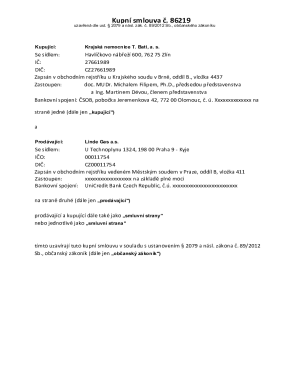

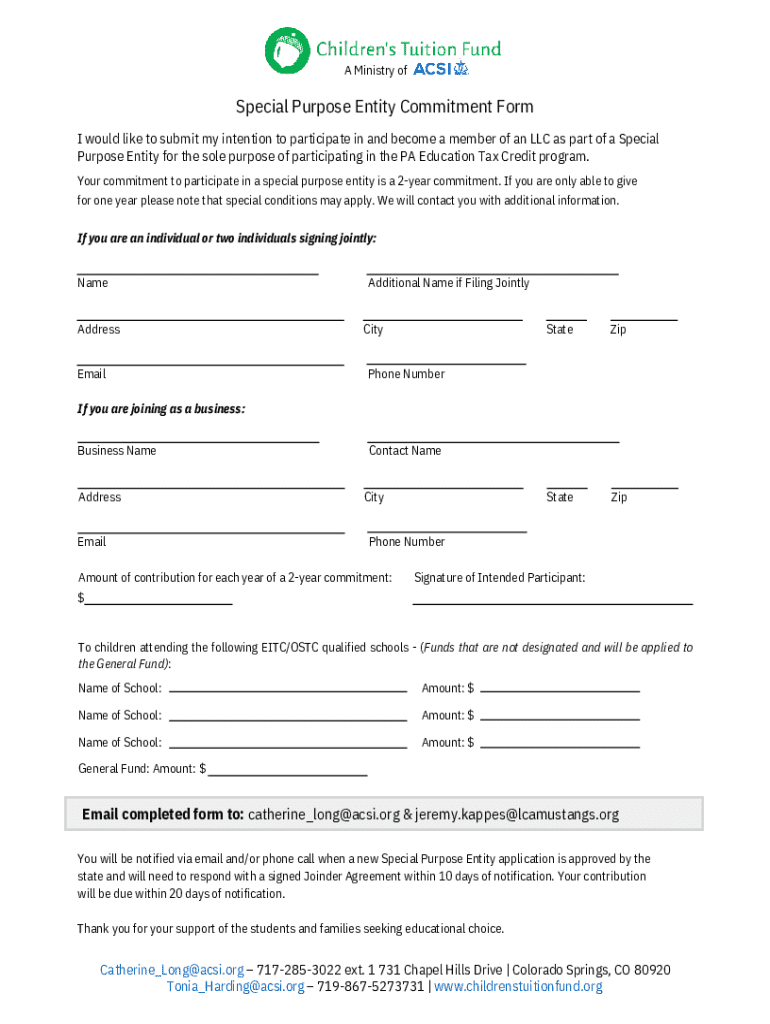

A Ministry ofSpecial Purpose Entity Commitment Form I would like to submit my intention to participate in and become a member of an LLC as part of a Special Purpose Entity for the sole purpose of

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign pa educational tax credits

Edit your pa educational tax credits form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your pa educational tax credits form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit pa educational tax credits online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit pa educational tax credits. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out pa educational tax credits

How to fill out pa educational tax credits

01

Gather all relevant documents, including your tax filings and education-related expenses.

02

Determine your eligibility based on your income and the educational institution attended.

03

Complete the Pennsylvania tax credit form specifically designed for educational credits.

04

Fill in your educational expenses accurately, including tuition, fees, and other qualified costs.

05

Check the limits and caps on the credits to ensure compliance.

06

Submit the completed form along with your tax return by the deadline.

Who needs pa educational tax credits?

01

Students enrolled in eligible educational institutions in Pennsylvania.

02

Parents or guardians of dependent students who incur education-related expenses.

03

Individuals seeking to reduce their state tax liability through educational credits.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send pa educational tax credits for eSignature?

To distribute your pa educational tax credits, simply send it to others and receive the eSigned document back instantly. Post or email a PDF that you've notarized online. Doing so requires never leaving your account.

How do I complete pa educational tax credits online?

pdfFiller has made it simple to fill out and eSign pa educational tax credits. The application has capabilities that allow you to modify and rearrange PDF content, add fillable fields, and eSign the document. Begin a free trial to discover all of the features of pdfFiller, the best document editing solution.

Can I create an electronic signature for the pa educational tax credits in Chrome?

Yes. By adding the solution to your Chrome browser, you may use pdfFiller to eSign documents while also enjoying all of the PDF editor's capabilities in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a photo of your handwritten signature using the extension. Whatever option you select, you'll be able to eSign your pa educational tax credits in seconds.

What is pa educational tax credits?

PA Educational Tax Credits are state tax incentives provided to businesses and individuals who contribute to scholarship organizations, educational improvement organizations, or pre-K scholarship organizations in Pennsylvania.

Who is required to file pa educational tax credits?

Businesses and individuals who made contributions to approved organizations and wish to claim tax credits on their Pennsylvania tax returns are required to file for PA Educational Tax Credits.

How to fill out pa educational tax credits?

To fill out PA Educational Tax Credits, you need to complete the appropriate forms provided by the Pennsylvania Department of Community and Economic Development and report your contributions accurately on your PA tax return.

What is the purpose of pa educational tax credits?

The purpose of PA Educational Tax Credits is to encourage donations to educational institutions and programs, providing opportunities for students in need while offering tax relief to contributors.

What information must be reported on pa educational tax credits?

You must report the amount contributed, the name of the organization, and the date of the contribution when filing for PA Educational Tax Credits.

Fill out your pa educational tax credits online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Pa Educational Tax Credits is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.