Get the free Streamlined Sales Tax Governing Board Approves SSUTA ...

Show details

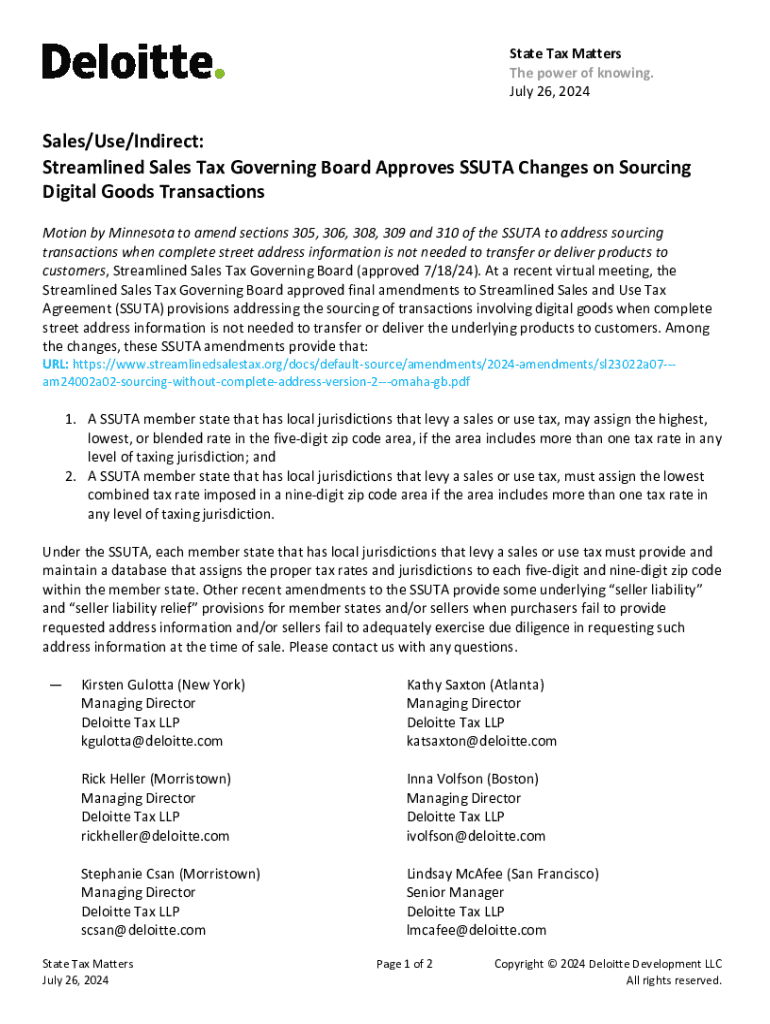

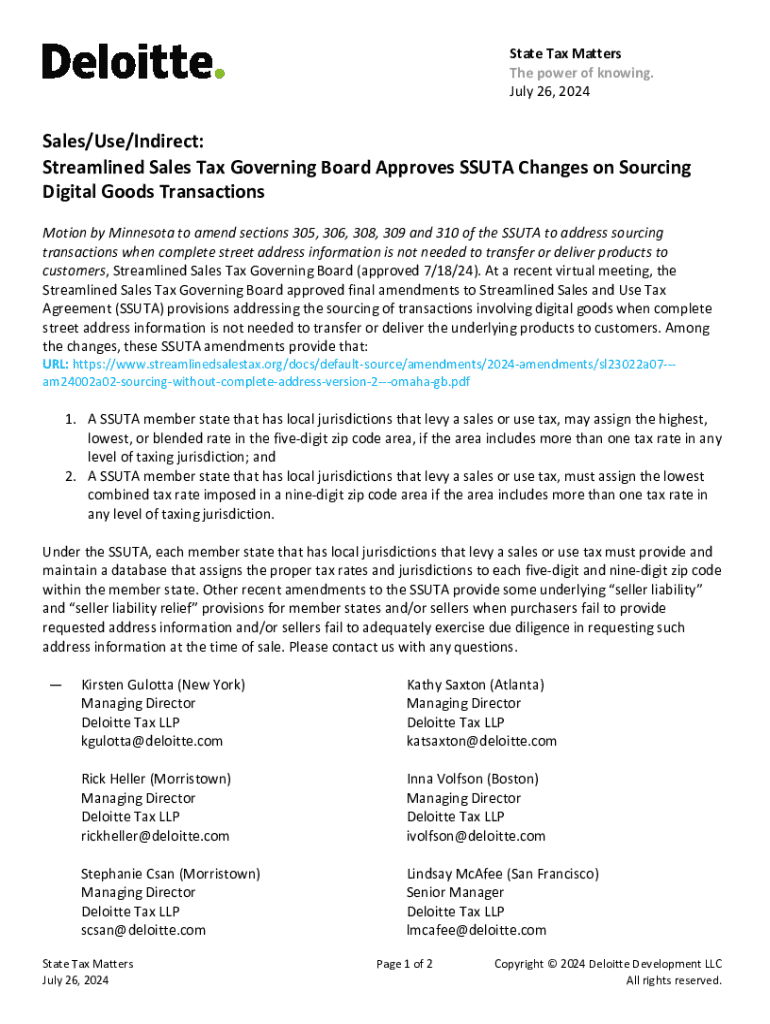

State Tax Matters The power of knowing. July 26, 2024Sales/Use/Indirect: Streamlined Sales Tax Governing Board Approves SSUTA Changes on Sourcing Digital Goods Transactions Motion by Minnesota to

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign streamlined sales tax governing

Edit your streamlined sales tax governing form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your streamlined sales tax governing form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit streamlined sales tax governing online

Follow the guidelines below to benefit from a competent PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit streamlined sales tax governing. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out streamlined sales tax governing

How to fill out streamlined sales tax governing

01

Gather required information about your business, including your sales data and product details.

02

Visit the Streamlined Sales Tax Governing Board website to access the necessary forms.

03

Fill out the registration form, including business information such as name, address, and types of products sold.

04

Determine your nexus status in each participating state where you make sales.

05

Review your sales tax rate and rules for each state you will be registering in.

06

Submit your registration form electronically through the website or by mail to the appropriate state tax authority.

07

Await confirmation of your registration and keep a record of all submitted documents.

Who needs streamlined sales tax governing?

01

Businesses that sell products or services across state lines.

02

E-commerce retailers operating in multiple states.

03

Companies that need to comply with varying sales tax regulations in different jurisdictions.

04

Any entity seeking to ensure compliance with streamlined sales tax laws.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send streamlined sales tax governing for eSignature?

Once your streamlined sales tax governing is complete, you can securely share it with recipients and gather eSignatures with pdfFiller in just a few clicks. You may transmit a PDF by email, text message, fax, USPS mail, or online notarization directly from your account. Make an account right now and give it a go.

Where do I find streamlined sales tax governing?

It's simple using pdfFiller, an online document management tool. Use our huge online form collection (over 25M fillable forms) to quickly discover the streamlined sales tax governing. Open it immediately and start altering it with sophisticated capabilities.

How do I edit streamlined sales tax governing online?

pdfFiller allows you to edit not only the content of your files, but also the quantity and sequence of the pages. Upload your streamlined sales tax governing to the editor and make adjustments in a matter of seconds. Text in PDFs may be blacked out, typed in, and erased using the editor. You may also include photos, sticky notes, and text boxes, among other things.

What is streamlined sales tax governing?

Streamlined sales tax governing refers to the framework and regulations developed to simplify and standardize sales tax collection and administration across participating states, aimed at reducing compliance burdens for sellers.

Who is required to file streamlined sales tax governing?

Businesses making taxable sales in participating states are required to file streamlined sales tax returns, including remote sellers who have economic nexus in those states.

How to fill out streamlined sales tax governing?

To fill out streamlined sales tax governing, businesses must complete the required forms provided by the state, report total sales, exempt sales, and calculate the sales tax due using the standardized rates and rules.

What is the purpose of streamlined sales tax governing?

The purpose of streamlined sales tax governing is to simplify the sales tax process for businesses, making it easier to comply with sales tax laws and ensuring that states receive the tax revenue they are owed.

What information must be reported on streamlined sales tax governing?

Businesses must report total sales, the amount of taxable sales, exempt sales, estimated sales tax due, and any relevant business identification details.

Fill out your streamlined sales tax governing online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Streamlined Sales Tax Governing is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.