Get the free 11 accounting sheet

Show details

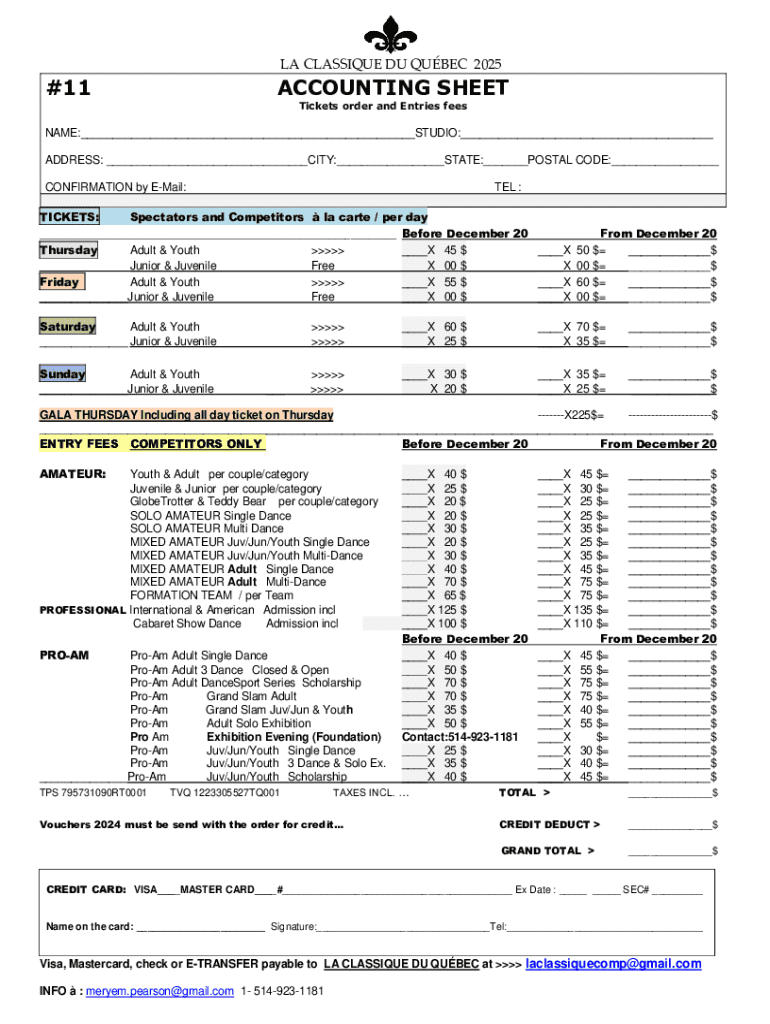

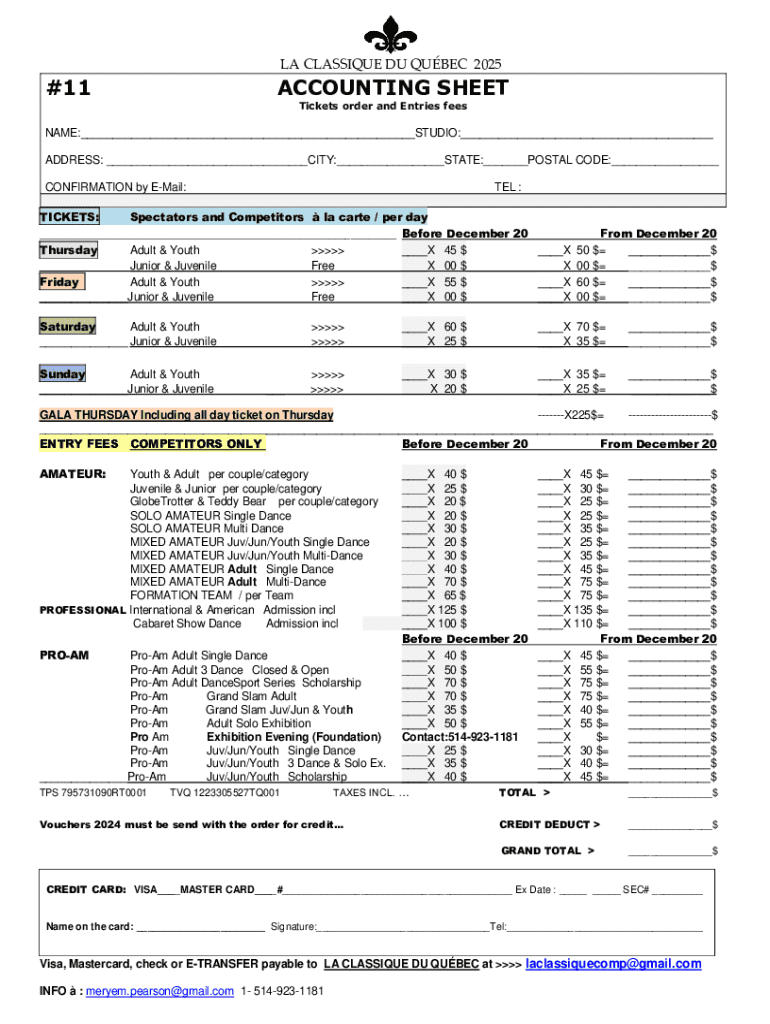

LA CLASSIQUE DU QUBEC 2025#11ACCOUNTING SHEET Tickets order and Entries feesNAME:___STUDIO:___ ADDRESS: ___CITY:___STATE:___POSTAL CODE:___ CONFIRMATION by EMail:TEL :TICKETS: Spectators and Competitors

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 11 accounting sheet

Edit your 11 accounting sheet form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 11 accounting sheet form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit 11 accounting sheet online

To use the services of a skilled PDF editor, follow these steps below:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit 11 accounting sheet. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 11 accounting sheet

How to fill out 11 accounting sheet

01

Gather all relevant financial data including income, expenses, assets, and liabilities.

02

Open the 11 accounting sheet and locate the appropriate sections.

03

Start with the income section and record all sources of income for the period.

04

Move to the expenses section and detail all incurred expenses categorized appropriately.

05

Fill in the assets section with current values of assets such as cash, property, and investments.

06

List all liabilities in the liabilities section, including loans and outstanding debts.

07

Ensure all entries are accurate and reflect the correct time period.

08

Review the sheet to detect any discrepancies and make corrections as needed.

09

Calculate totals for income, expenses, assets, and liabilities.

10

Prepare a summary or analysis if needed based on the filled-out data.

11

Save and store the accounting sheet in a secure location for future reference.

Who needs 11 accounting sheet?

01

Accountants who need to maintain accurate financial records.

02

Business owners for tracking financial performance.

03

Financial analysts investigating company health.

04

Tax professionals preparing tax returns.

05

Auditors conducting audits for compliance.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send 11 accounting sheet to be eSigned by others?

When you're ready to share your 11 accounting sheet, you can swiftly email it to others and receive the eSigned document back. You may send your PDF through email, fax, text message, or USPS mail, or you can notarize it online. All of this may be done without ever leaving your account.

How do I fill out the 11 accounting sheet form on my smartphone?

You can quickly make and fill out legal forms with the help of the pdfFiller app on your phone. Complete and sign 11 accounting sheet and other documents on your mobile device using the application. If you want to learn more about how the PDF editor works, go to pdfFiller.com.

How do I fill out 11 accounting sheet on an Android device?

Use the pdfFiller mobile app to complete your 11 accounting sheet on an Android device. The application makes it possible to perform all needed document management manipulations, like adding, editing, and removing text, signing, annotating, and more. All you need is your smartphone and an internet connection.

What is 11 accounting sheet?

The 11 accounting sheet is a financial document used for tax reporting, specifically detailing income, deductions, and credits for businesses and individuals.

Who is required to file 11 accounting sheet?

Individuals and businesses that meet certain income thresholds or have specific types of deductions are required to file the 11 accounting sheet.

How to fill out 11 accounting sheet?

To fill out the 11 accounting sheet, gather all relevant financial documents, follow the instructions outlined in the provided guidelines, and accurately input the required information regarding income, expenses, and other financial data.

What is the purpose of 11 accounting sheet?

The purpose of the 11 accounting sheet is to provide a comprehensive overview of a taxpayer's financial situation, which helps in calculating taxes owed or refunds due.

What information must be reported on 11 accounting sheet?

The information required on the 11 accounting sheet includes total income, deductible expenses, tax credits, and any other relevant financial details that impact tax liabilities.

Fill out your 11 accounting sheet online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

11 Accounting Sheet is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.