Get the free New Mortgage Loan Origination Rule Changes

Show details

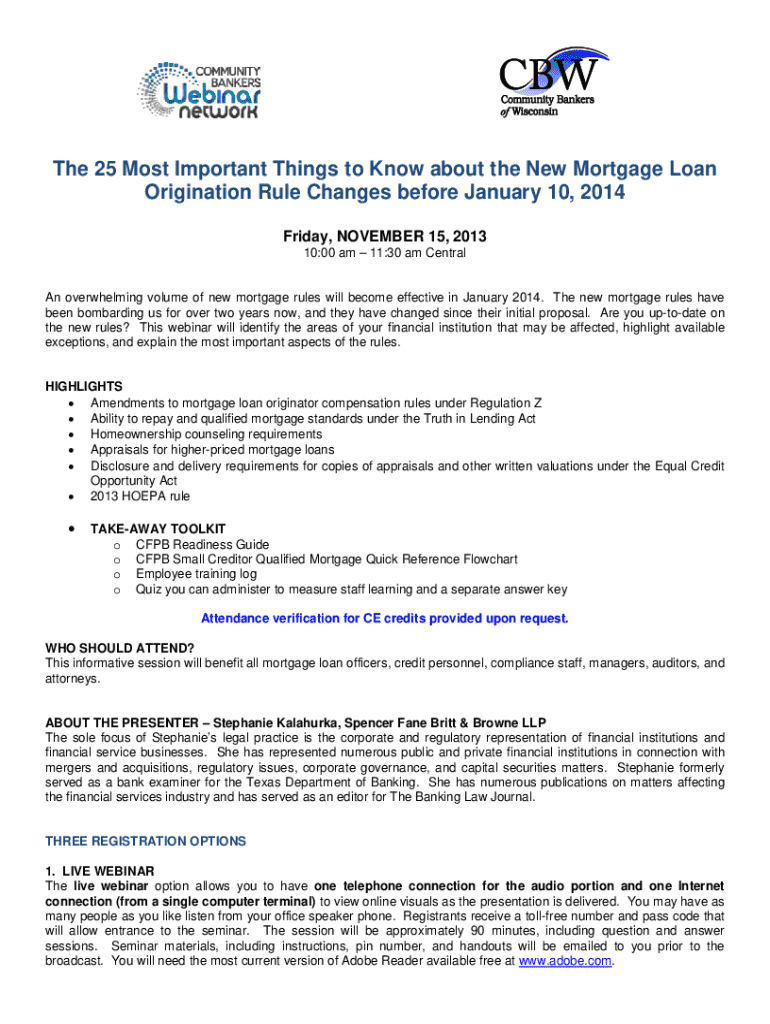

This document outlines critical updates to mortgage loan origination rules set to take effect in January 2014, addressing changes in regulation, compensation rules, requirements for repayment capabilities, appraisal processes, and more, as well as offering valuable resources for compliance and training.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign new mortgage loan origination

Edit your new mortgage loan origination form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your new mortgage loan origination form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit new mortgage loan origination online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit new mortgage loan origination. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

Dealing with documents is always simple with pdfFiller. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out new mortgage loan origination

How to fill out new mortgage loan origination

01

Gather your financial documents, including income statements, credit reports, and asset information.

02

Research different mortgage lenders to find the best rates and terms.

03

Fill out the loan application form with accurate details on your financial situation.

04

Provide necessary documentation to support your application, like tax returns and bank statements.

05

Review and sign the loan estimate form provided by the lender.

06

Schedule a home appraisal if required by the lender.

07

Respond to any follow-up requests from the lender promptly.

08

Review the final loan terms before closing.

Who needs new mortgage loan origination?

01

First-time homebuyers looking to purchase a home.

02

Homeowners wanting to refinance their existing mortgage.

03

Real estate investors seeking financing for new property acquisitions.

04

Individuals needing funds for home improvements.

05

Anyone looking to leverage equity from their current home.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my new mortgage loan origination directly from Gmail?

new mortgage loan origination and other documents can be changed, filled out, and signed right in your Gmail inbox. You can use pdfFiller's add-on to do this, as well as other things. When you go to Google Workspace, you can find pdfFiller for Gmail. You should use the time you spend dealing with your documents and eSignatures for more important things, like going to the gym or going to the dentist.

How do I execute new mortgage loan origination online?

pdfFiller has made it easy to fill out and sign new mortgage loan origination. You can use the solution to change and move PDF content, add fields that can be filled in, and sign the document electronically. Start a free trial of pdfFiller, the best tool for editing and filling in documents.

How do I make edits in new mortgage loan origination without leaving Chrome?

new mortgage loan origination can be edited, filled out, and signed with the pdfFiller Google Chrome Extension. You can open the editor right from a Google search page with just one click. Fillable documents can be done on any web-connected device without leaving Chrome.

What is new mortgage loan origination?

New mortgage loan origination refers to the process of creating a new mortgage loan for a borrower, which involves evaluating the borrower's financial situation, determining the amount they can borrow, and officially issuing the loan.

Who is required to file new mortgage loan origination?

Lenders or financial institutions that issue mortgage loans are required to file new mortgage loan origination.

How to fill out new mortgage loan origination?

To fill out a new mortgage loan origination, borrowers need to provide personal and financial information, including income, credit history, employment details, property information, and other relevant documentation to the lender.

What is the purpose of new mortgage loan origination?

The purpose of new mortgage loan origination is to facilitate the transfer of funds for the purchase of property, enabling individuals or businesses to obtain financing for home buying or investment purposes.

What information must be reported on new mortgage loan origination?

Information that must be reported includes the borrower's personal details, loan amount, interest rate, terms of the loan, property address, and other relevant financial information.

Fill out your new mortgage loan origination online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

New Mortgage Loan Origination is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.