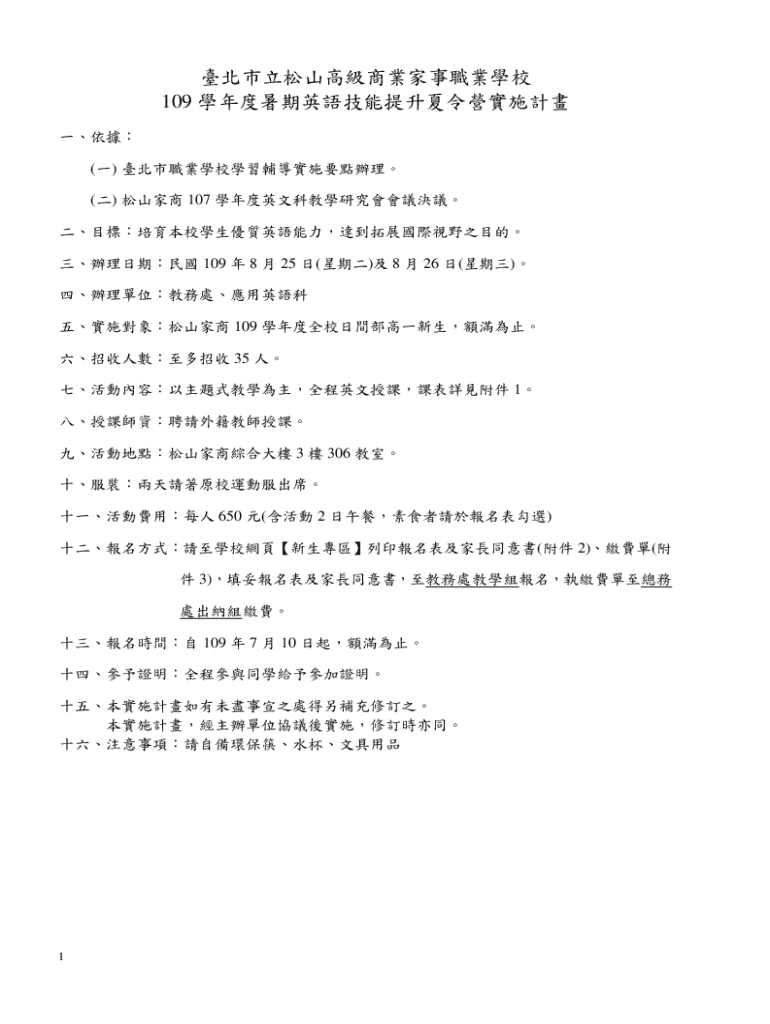

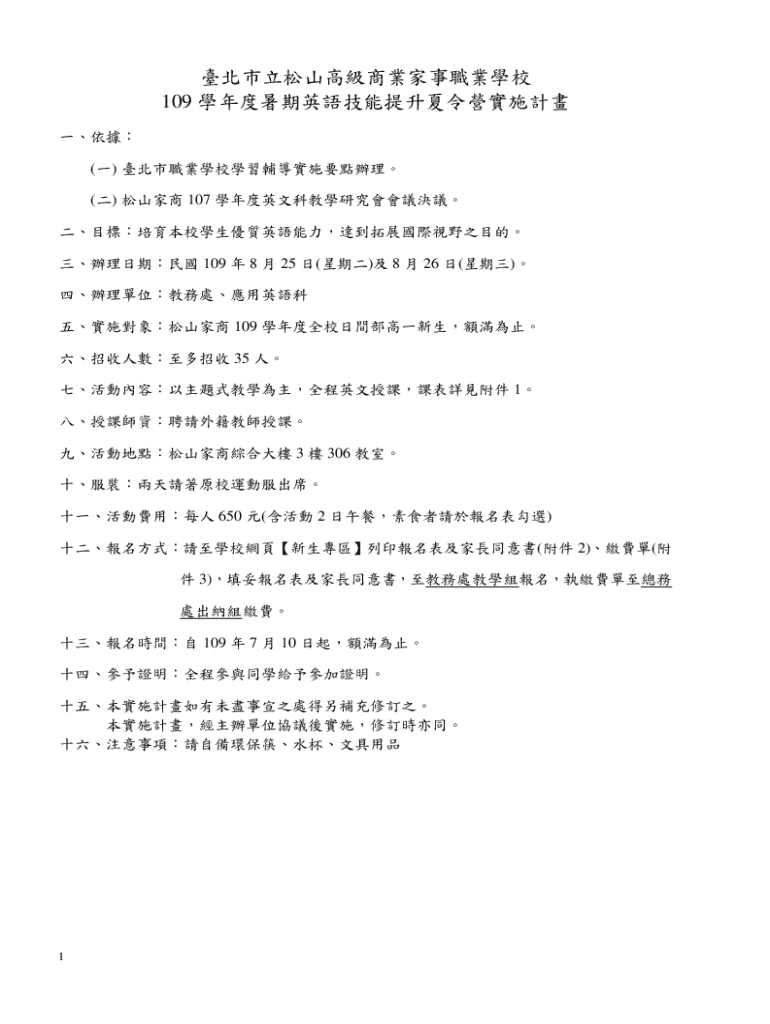

Get the free 109學年度暑期英語技能提升夏令營實施計畫

Show details

本計畫旨在提升松山高商學生的英語能力,拓展他們的國際視野,透過為期兩天的主題式教學活動,鼓勵全校高一新生參與,並提供全程英文授課,由外籍教師授課,活動將包含各種互動和實用課程。

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 109

Edit your 109 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 109 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing 109 online

Use the instructions below to start using our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit 109. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

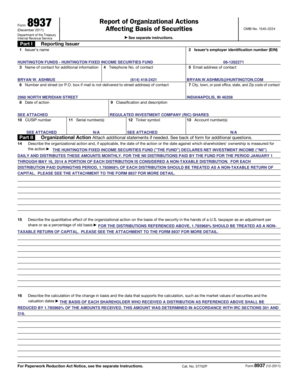

How to fill out 109

How to fill out 109

01

Gather all necessary documentation, including income statements and deductions.

02

Obtain a Form 109 from the IRS website or through your tax preparation software.

03

Start with the personal information section: fill in your name, address, and Social Security number.

04

Next, enter the income amounts in the appropriate boxes based on the type of income you're reporting.

05

If applicable, complete any additional schedules or attachments required for your specific situation.

06

Double-check all entries for accuracy and completeness.

07

Sign and date the form before submission.

08

If filing electronically, follow the prompts from your tax software to submit the form electronically.

Who needs 109?

01

Individuals who have received income that needs to be reported to the IRS.

02

Self-employed individuals reporting their business income and expenses.

03

Freelancers or contract workers who receive 1099 forms from clients.

04

Taxpayers eligible for certain tax credits or deductions that require additional reporting.

05

Anyone who has made significant capital gains or losses during the tax year.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send 109 to be eSigned by others?

Once your 109 is complete, you can securely share it with recipients and gather eSignatures with pdfFiller in just a few clicks. You may transmit a PDF by email, text message, fax, USPS mail, or online notarization directly from your account. Make an account right now and give it a go.

How can I fill out 109 on an iOS device?

In order to fill out documents on your iOS device, install the pdfFiller app. Create an account or log in to an existing one if you have a subscription to the service. Once the registration process is complete, upload your 109. You now can take advantage of pdfFiller's advanced functionalities: adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

How do I edit 109 on an Android device?

Yes, you can. With the pdfFiller mobile app for Android, you can edit, sign, and share 109 on your mobile device from any location; only an internet connection is needed. Get the app and start to streamline your document workflow from anywhere.

What is 109?

Form 109 is an IRS tax form used to report certain types of income received during the tax year, primarily related to non-employee compensation, dividends, and interest.

Who is required to file 109?

Employers and businesses who have paid $600 or more in a year to an individual, partnership, corporation, or other entities for services or other specified payments must file Form 109.

How to fill out 109?

To fill out Form 109, you need to provide the payee's taxpayer identification number (TIN), the total amount paid to the payee, and your business's information including name, address, and EIN.

What is the purpose of 109?

The purpose of Form 109 is to report income that is taxable to the IRS, ensuring that individuals and entities report their earnings accurately and pay the appropriate taxes.

What information must be reported on 109?

Form 109 must report the payee's name and TIN, the payer's name and TIN, the total amount paid, and the type of payment made.

Fill out your 109 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

109 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.