Get the free Tax Accounting Risk Advisory Services - Senior - Multiple ...

Show details

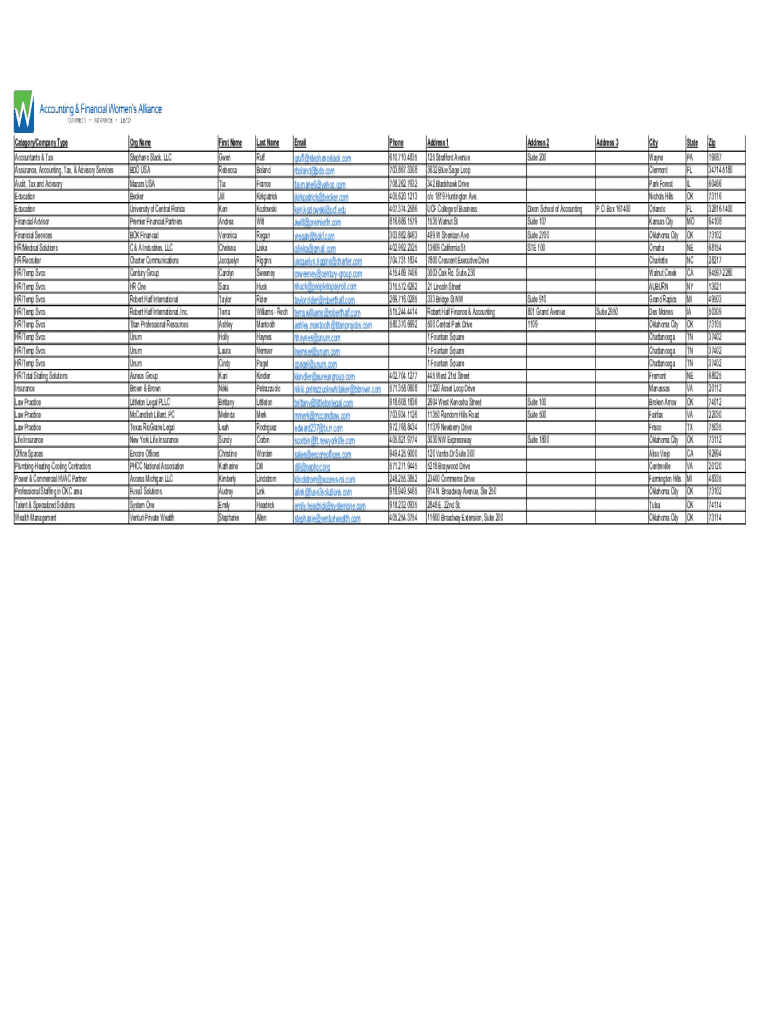

Category/Company TypeOrg NameFirst NameLast NameEmailPhoneAddress 1Address 2Accountants & Tax Assurance, Accounting, Tax, & Advisory Services Audit, Tax and Advisory Education Education Financial

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign tax accounting risk advisory

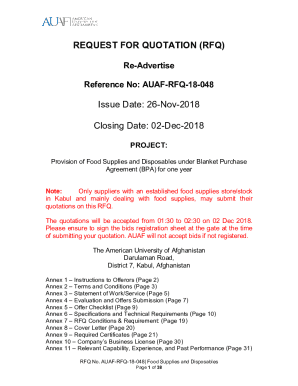

Edit your tax accounting risk advisory form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your tax accounting risk advisory form via URL. You can also download, print, or export forms to your preferred cloud storage service.

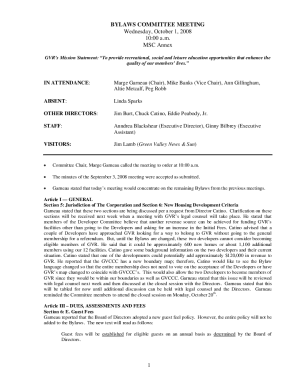

Editing tax accounting risk advisory online

Follow the guidelines below to benefit from a competent PDF editor:

1

Sign into your account. It's time to start your free trial.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit tax accounting risk advisory. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out tax accounting risk advisory

How to fill out tax accounting risk advisory

01

Gather necessary financial documents such as income statements, expense records, and previous tax returns.

02

Identify potential risk areas in tax accounting, including compliance issues, deduction inaccuracies, and reporting errors.

03

Consult relevant tax laws and regulations to ensure understanding of current requirements.

04

Assess the internal controls over financial reporting to identify weaknesses.

05

Analyze the data collected for any inconsistencies that may pose a risk.

06

Develop a risk management plan that outlines strategies to mitigate identified risks.

07

Document all findings and strategies in a concise report.

08

Schedule regular reviews and updates of tax accounting practices.

Who needs tax accounting risk advisory?

01

Individuals who have complex financial situations requiring accurate tax reporting.

02

Small business owners seeking to optimize their tax liability.

03

Accountants and financial advisors looking for specialized guidance on tax-related risks.

04

Corporations with significant assets, subsidiaries, or international operations.

05

Non-profit organizations needing to ensure compliance with tax-exempt regulations.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

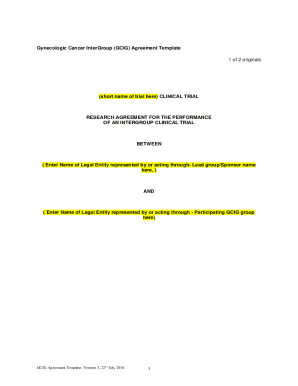

Can I create an electronic signature for signing my tax accounting risk advisory in Gmail?

Use pdfFiller's Gmail add-on to upload, type, or draw a signature. Your tax accounting risk advisory and other papers may be signed using pdfFiller. Register for a free account to preserve signed papers and signatures.

How do I fill out tax accounting risk advisory using my mobile device?

Use the pdfFiller mobile app to fill out and sign tax accounting risk advisory on your phone or tablet. Visit our website to learn more about our mobile apps, how they work, and how to get started.

How do I complete tax accounting risk advisory on an iOS device?

Get and install the pdfFiller application for iOS. Next, open the app and log in or create an account to get access to all of the solution’s editing features. To open your tax accounting risk advisory, upload it from your device or cloud storage, or enter the document URL. After you complete all of the required fields within the document and eSign it (if that is needed), you can save it or share it with others.

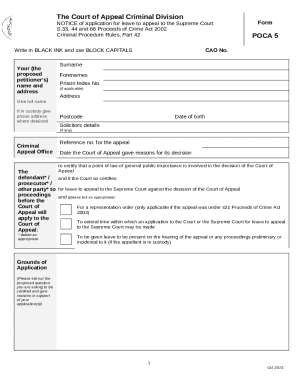

What is tax accounting risk advisory?

Tax accounting risk advisory involves consulting services that help organizations identify, assess, and mitigate risks related to tax compliance and reporting.

Who is required to file tax accounting risk advisory?

Businesses and organizations that operate in jurisdictions with complex tax regulations or those undergoing audits may be required to file tax accounting risk advisory.

How to fill out tax accounting risk advisory?

Filling out tax accounting risk advisory typically involves providing details about tax positions, risk assessments, and compliance measures in a structured format as specified by regulatory authorities.

What is the purpose of tax accounting risk advisory?

The purpose of tax accounting risk advisory is to ensure that organizations are aware of their tax obligations and to provide strategies for minimizing tax risks.

What information must be reported on tax accounting risk advisory?

Required information usually includes financial data, tax positions, risk evaluations, compliance history, and any pertinent documentation related to tax matters.

Fill out your tax accounting risk advisory online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Tax Accounting Risk Advisory is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.