Get the free Before fiscal yearend - mveca

Show details

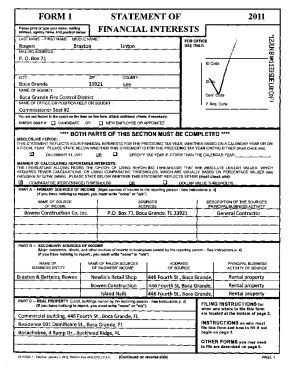

2011 MV ECA USPS FISCAL YEAR END NOTE: You cannot start a July payroll until the following steps are completed!!!!! Before fiscal yearend: 1. When entering large sums, for example severance pay. If

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign before fiscal yearend

Edit your before fiscal yearend form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your before fiscal yearend form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit before fiscal yearend online

To use the professional PDF editor, follow these steps below:

1

Log in to your account. Click Start Free Trial and sign up a profile if you don't have one.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit before fiscal yearend. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out before fiscal yearend

How to fill out before fiscal yearend:

01

Gather all financial transactions and records: Before the fiscal yearend, it is crucial to collect and organize all financial transactions and records. This includes invoices, receipts, bank statements, and any other relevant documents.

02

Reconcile accounts: It is important to review all accounts and ensure that they are reconciled, meaning that the recorded transactions match with the actual bank and cash balances. Reconciliation helps identify any discrepancies or errors that need to be resolved before the fiscal yearend.

03

Review and adjust financial statements: Take the time to review the financial statements, including the income statement, balance sheet, and cash flow statement. Look for any inaccuracies or discrepancies and make any necessary adjustments to ensure the statements are accurate and reflect the true financial position of the business.

04

Prepare necessary reports and disclosures: Depending on your jurisdiction and the regulatory requirements, you may need to prepare and submit various reports and disclosures before the fiscal yearend. This may include tax filings, audit reports, or any other required financial reports.

05

Seek professional advice if needed: If you are unsure about certain accounting procedures or have complex financial situations, it is always recommended to seek professional advice from a qualified accountant or financial advisor. They can guide you through the process, ensure compliance with laws and regulations, and provide valuable insights.

Who needs before fiscal yearend:

01

Businesses: All types of businesses, regardless of their size or industry, need to fill out before the fiscal yearend. This ensures that their financial records are accurate, compliant with regulations, and reflect the true financial position of the business.

02

Accountants and bookkeepers: Professionals in the accounting and bookkeeping field are responsible for helping businesses fill out before the fiscal yearend. They play a crucial role in organizing and analyzing financial data, reconciling accounts, and preparing necessary reports and disclosures.

03

Government agencies and regulatory bodies: Government agencies and regulatory bodies often require businesses to submit financial reports and disclosures before the fiscal yearend. These organizations use the information to monitor compliance, enforce regulations, and assess the financial health of businesses.

04

Investors and stakeholders: Investors and stakeholders, such as shareholders, lenders, and potential buyers, may also be interested in reviewing financial statements and reports before the fiscal yearend. This information helps them make informed decisions about investing in or engaging with the business.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is before fiscal yearend?

Before fiscal yearend refers to the period before the end of a company's fiscal year, typically used for financial planning and reporting purposes.

Who is required to file before fiscal yearend?

All companies and organizations with a fiscal year-end date are required to file before fiscal yearend.

How to fill out before fiscal yearend?

Before fiscal yearend forms and reports are typically filled out by accountants or financial professionals using the company's financial data for the year.

What is the purpose of before fiscal yearend?

The purpose of before fiscal yearend is to ensure that all financial reports and filings are completed prior to the end of the fiscal year for accurate financial reporting and planning.

What information must be reported on before fiscal yearend?

Before fiscal yearend reports typically include financial statements, income statements, balance sheets, and cash flow statements.

How can I manage my before fiscal yearend directly from Gmail?

You can use pdfFiller’s add-on for Gmail in order to modify, fill out, and eSign your before fiscal yearend along with other documents right in your inbox. Find pdfFiller for Gmail in Google Workspace Marketplace. Use time you spend on handling your documents and eSignatures for more important things.

How can I edit before fiscal yearend from Google Drive?

Using pdfFiller with Google Docs allows you to create, amend, and sign documents straight from your Google Drive. The add-on turns your before fiscal yearend into a dynamic fillable form that you can manage and eSign from anywhere.

How do I fill out before fiscal yearend on an Android device?

On an Android device, use the pdfFiller mobile app to finish your before fiscal yearend. The program allows you to execute all necessary document management operations, such as adding, editing, and removing text, signing, annotating, and more. You only need a smartphone and an internet connection.

Fill out your before fiscal yearend online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Before Fiscal Yearend is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.