Get the free Commercial Loan App - Blue Note Assets

Show details

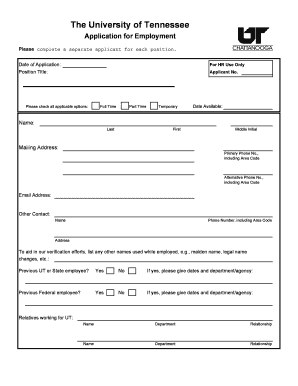

Commercial Real Estate Loan Application BUSINESS INFORMATION Business Applicant s Name (exact legal name) Street Address City State ZIP Code Mailing Address (if different from above) City State ZIP

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign commercial loan app

Edit your commercial loan app form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your commercial loan app form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit commercial loan app online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Check your account. It's time to start your free trial.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit commercial loan app. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out commercial loan app

How to fill out a commercial loan application:

01

Gather the necessary documents: Before starting the application process, prepare documents such as financial statements, tax returns, business plans, and any other documentation required by the lender.

02

Provide accurate and complete information: Fill out all sections of the application form with accurate and up-to-date information. Make sure to double-check the information for errors or omissions.

03

Include a detailed business plan: A well-prepared business plan showcases your understanding of your business and its potential for success. Include information about your industry, target market, competition, marketing strategies, and financial projections.

04

Provide financial documents: Lenders will require financial statements, such as balance sheets, income statements, and cash flow statements. Make sure these documents reflect the financial health of your business.

05

Demonstrate collateral and guarantees: If the loan requires collateral or guarantees, specify the assets you are willing to offer as collateral or the individuals who are willing to provide personal guarantees.

06

Explain the purpose of the loan: Clearly state why you need the loan and how you plan to use the funds. Provide a breakdown of the loan amount requested and explain how it will be utilized to benefit your business.

07

Answer personal background questions: The application might ask for personal information about the business owners or key executives. Be prepared to provide details regarding your educational background, work experience, and any previous business ownership.

08

Review and proofread: Before submitting the application, thoroughly review all the information provided. Check for any errors, inconsistencies, or missing sections. It's always a good idea to have someone else review the application as well to catch any mistakes you may have missed.

Who needs a commercial loan application?

01

Business owners seeking capital: Entrepreneurs who wish to start a new business or expand an existing one often require funding through commercial loans. These loans can help with purchasing equipment, investing in marketing campaigns, hiring additional staff, or expanding operations.

02

Small business owners: Small businesses face unique financial challenges, and a commercial loan can provide the necessary capital to cover unexpected expenses, manage cash flow fluctuations, or invest in growth opportunities.

03

Commercial real estate investors: Individuals or companies involved in commercial real estate, such as purchasing or developing properties, often require commercial loans to finance their projects.

04

Established businesses: Even successful businesses may seek commercial loans to finance major initiatives like mergers and acquisitions, research and development, or purchase of new equipment.

05

Businesses with poor credit: Some businesses with less than ideal credit scores may seek commercial loans to improve their financial situation or cover urgent expenses. However, they may need to provide additional collateral or demonstrate a solid business plan to secure the loan.

Remember, it's important to consult with a financial advisor or a loan officer to ensure you understand all the requirements and options available in the commercial loan application process.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is commercial loan app?

Commercial loan app is an application for a loan intended for business purposes.

Who is required to file commercial loan app?

Any business or individual seeking a commercial loan is required to file a commercial loan app.

How to fill out commercial loan app?

To fill out a commercial loan app, you will need to provide information about your business, financial statements, and the purpose of the loan.

What is the purpose of commercial loan app?

The purpose of a commercial loan app is to apply for a loan to finance business activities or investments.

What information must be reported on commercial loan app?

The information reported on a commercial loan app typically includes the borrower's personal and business details, financial statements, and the loan amount requested.

How do I complete commercial loan app online?

pdfFiller makes it easy to finish and sign commercial loan app online. It lets you make changes to original PDF content, highlight, black out, erase, and write text anywhere on a page, legally eSign your form, and more, all from one place. Create a free account and use the web to keep track of professional documents.

How do I edit commercial loan app online?

With pdfFiller, you may not only alter the content but also rearrange the pages. Upload your commercial loan app and modify it with a few clicks. The editor lets you add photos, sticky notes, text boxes, and more to PDFs.

Can I create an electronic signature for signing my commercial loan app in Gmail?

You can easily create your eSignature with pdfFiller and then eSign your commercial loan app directly from your inbox with the help of pdfFiller’s add-on for Gmail. Please note that you must register for an account in order to save your signatures and signed documents.

Fill out your commercial loan app online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Commercial Loan App is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.