Get the free No GST Penalty for Unused Ineligible Input Tax Credit. ...

Show details

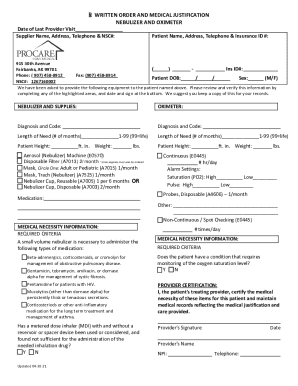

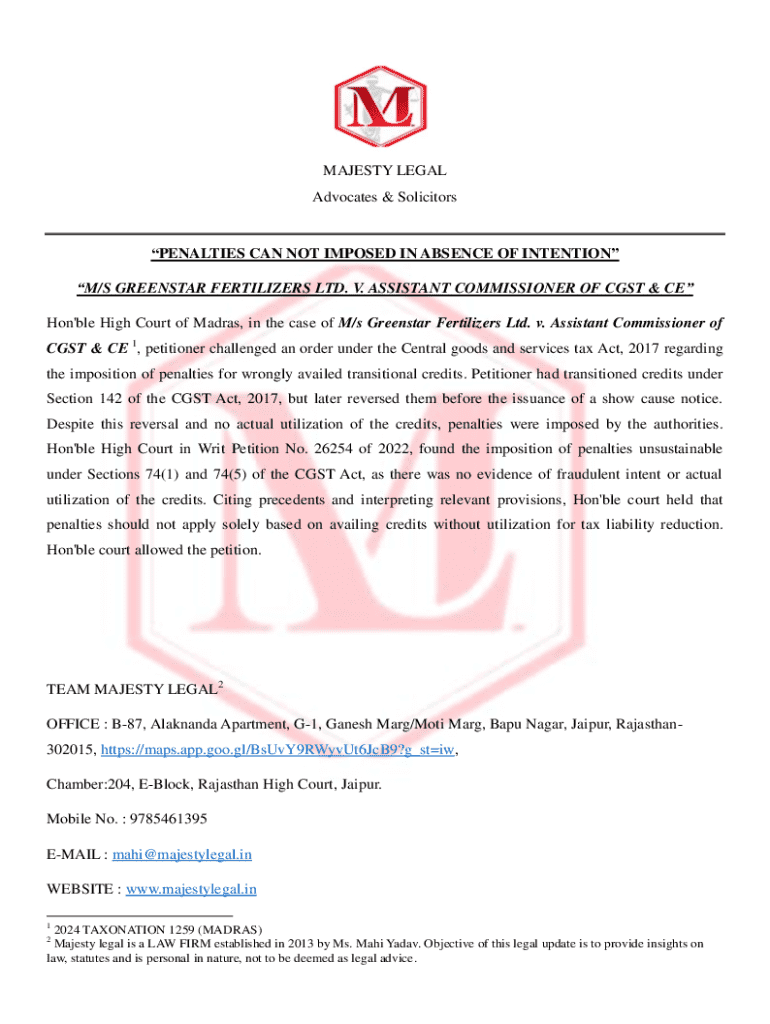

MAJESTY LEGAL Advocates & SolicitorsPENALTIES CAN NOT IMPOSED IN ABSENCE OF INTENTION M/S GREENSTAR FERTILIZERS LTD. V. ASSISTANT COMMISSIONER OF CGST & CE Hon\'ble High Court of Madras, in the case

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign no gst penalty for

Edit your no gst penalty for form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your no gst penalty for form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing no gst penalty for online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit no gst penalty for. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out no gst penalty for

How to fill out no gst penalty for

01

Gather all necessary documentation related to your GST filings.

02

Check the eligibility criteria for claiming a no GST penalty.

03

Fill out the required forms accurately.

04

Provide a clear explanation for the reason you are applying for the no GST penalty.

05

Attach any supporting documents that validate your request.

06

Submit the completed application to the appropriate tax authority.

Who needs no gst penalty for?

01

Businesses and individuals who have made a genuine mistake in their GST filings.

02

Those who have faced extraordinary circumstances that prevented timely filing.

03

Taxpayers looking to appeal against unfair penalties imposed for minor errors.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify no gst penalty for without leaving Google Drive?

Using pdfFiller with Google Docs allows you to create, amend, and sign documents straight from your Google Drive. The add-on turns your no gst penalty for into a dynamic fillable form that you can manage and eSign from anywhere.

How can I send no gst penalty for to be eSigned by others?

Once your no gst penalty for is complete, you can securely share it with recipients and gather eSignatures with pdfFiller in just a few clicks. You may transmit a PDF by email, text message, fax, USPS mail, or online notarization directly from your account. Make an account right now and give it a go.

How do I edit no gst penalty for online?

With pdfFiller, the editing process is straightforward. Open your no gst penalty for in the editor, which is highly intuitive and easy to use. There, you’ll be able to blackout, redact, type, and erase text, add images, draw arrows and lines, place sticky notes and text boxes, and much more.

What is no gst penalty for?

No GST penalty is for taxpayers who have not collected or submitted Goods and Services Tax (GST) due to a lack of taxable sales or transactions.

Who is required to file no gst penalty for?

Businesses or individuals who are registered for GST but did not have any taxable supplies during the reporting period are required to file for no GST penalty.

How to fill out no gst penalty for?

To fill out a no GST penalty for, taxpayers must complete the appropriate form, typically indicating zero taxable sales and submitting it to the tax authority by the deadline.

What is the purpose of no gst penalty for?

The purpose of no GST penalty for is to inform the tax authority that the taxpayer had no GST liabilities for the reporting period, thus ensuring compliance without incurring penalties.

What information must be reported on no gst penalty for?

Taxpayers must report their GST registration number, the reporting period, and confirm that there were no taxable sales during that period.

Fill out your no gst penalty for online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

No Gst Penalty For is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.