Get the free SMALL BUSINESS FORGIVABLE LOAN AGREEMENT ...

Show details

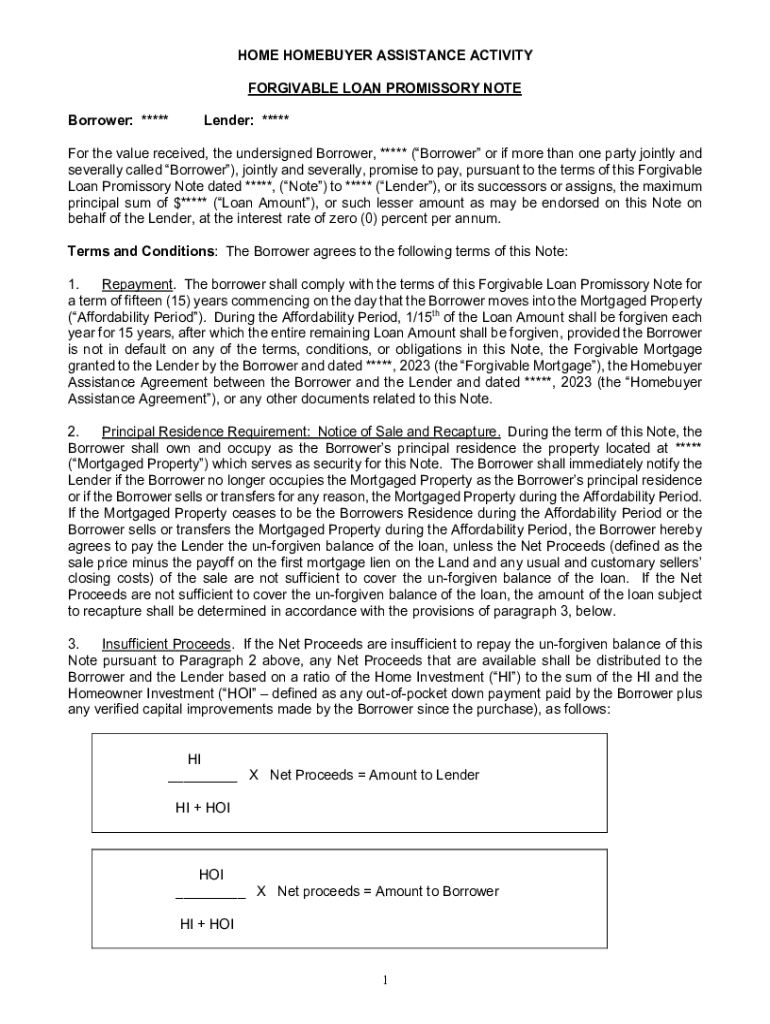

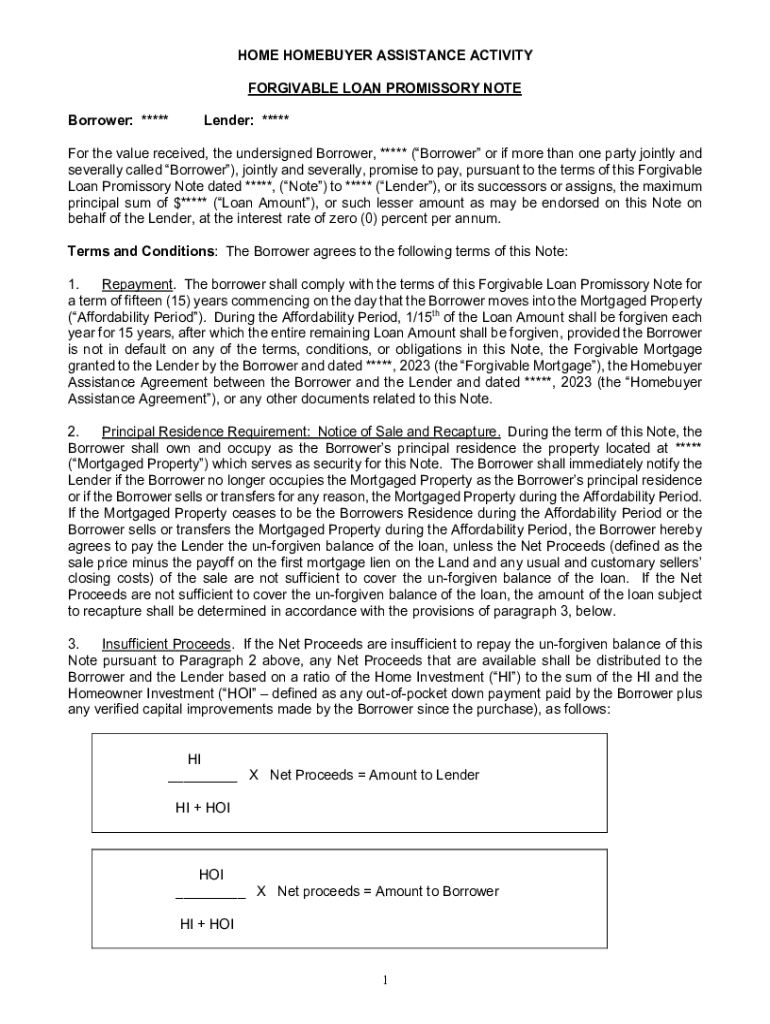

HOME HOMEBUYER ASSISTANCE ACTIVITY FORGIVABLE LOAN PROMISSORY NOTE Borrower: *****Lender: *****For the value received, the undersigned Borrower, ***** (Borrower or if more than one party jointly and

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign small business forgivable loan

Edit your small business forgivable loan form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your small business forgivable loan form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing small business forgivable loan online

To use the services of a skilled PDF editor, follow these steps:

1

Log in to your account. Click on Start Free Trial and register a profile if you don't have one yet.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit small business forgivable loan. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out small business forgivable loan

How to fill out small business forgivable loan

01

Gather necessary documentation such as your business license, tax returns, and payroll records.

02

Determine the loan amount you need based on eligible expenses like payroll, rent, and utilities.

03

Choose an approved lender participating in the forgivable loan program.

04

Complete the loan application form provided by the lender, ensuring all information is accurate.

05

Submit the application along with your supporting documents to the lender.

06

Await approval from the lender, and be prepared to provide any additional information if requested.

07

Once approved, receive the loan funds and use them specifically for qualifying expenses.

08

Keep detailed records of how the funds are used to ensure you meet the forgiveness criteria.

09

After using the funds, apply for loan forgiveness with the lender by providing the required documentation.

Who needs small business forgivable loan?

01

Small business owners who are struggling to cover payroll, rent, and utility costs due to financial hardship.

02

Entrepreneurs who want to retain their employees and maintain operations during economic downturns.

03

Business owners who match the criteria set by the forgivable loan program and seek financial assistance.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my small business forgivable loan directly from Gmail?

It's easy to use pdfFiller's Gmail add-on to make and edit your small business forgivable loan and any other documents you get right in your email. You can also eSign them. Take a look at the Google Workspace Marketplace and get pdfFiller for Gmail. Get rid of the time-consuming steps and easily manage your documents and eSignatures with the help of an app.

How can I send small business forgivable loan to be eSigned by others?

When your small business forgivable loan is finished, send it to recipients securely and gather eSignatures with pdfFiller. You may email, text, fax, mail, or notarize a PDF straight from your account. Create an account today to test it.

How do I edit small business forgivable loan straight from my smartphone?

The easiest way to edit documents on a mobile device is using pdfFiller’s mobile-native apps for iOS and Android. You can download those from the Apple Store and Google Play, respectively. You can learn more about the apps here. Install and log in to the application to start editing small business forgivable loan.

What is small business forgivable loan?

A small business forgivable loan is a type of financial aid designed to provide funds to small businesses, which can be forgiven if certain conditions are met, typically involving the retention of employees and maintaining payroll levels.

Who is required to file small business forgivable loan?

Small businesses that have received forgivable loans, often through government programs such as the PPP (Paycheck Protection Program), are required to file for forgiveness to confirm they met the eligibility criteria.

How to fill out small business forgivable loan?

To fill out a small business forgivable loan application, gather required financial documents, complete the loan forgiveness application form provided by the lender, and submit it with necessary documentation showing how the funds were used.

What is the purpose of small business forgivable loan?

The primary purpose of a small business forgivable loan is to provide financial support to small businesses to cover operating expenses, payroll, and other critical costs to prevent layoffs and business closures.

What information must be reported on small business forgivable loan?

Businesses must report how loan funds were used, including payroll expenses, utility payments, rent, and other allowable costs, as well as employee retention and salary levels.

Fill out your small business forgivable loan online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Small Business Forgivable Loan is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.