Get the free 386 Guideline On Payment of Allowances Special Provisions

Show details

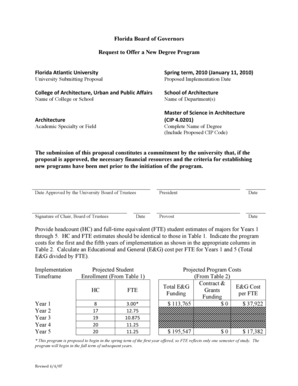

OIL AND NATURAL GAS CORPORATION LIMITED Office of ChiefER Corporate Policy Section II Floor, B. S. Negi Bhavan Tel Bhavan, Dehradun 248003 Last updated: 11.08.2016 TRAVELLING ALLOWANCE REGULATIONS

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 386 guideline on payment

Edit your 386 guideline on payment form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 386 guideline on payment form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit 386 guideline on payment online

Follow the guidelines below to use a professional PDF editor:

1

Log in to account. Start Free Trial and sign up a profile if you don't have one.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit 386 guideline on payment. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 386 guideline on payment

How to fill out 386 guideline on payment

01

Begin by gathering all necessary documentation related to the payment you are filing for.

02

Review the specific guidelines outlined in the 386 document to ensure you understand the requirements.

03

Fill in your personal information at the top of the form, including your name, address, and identification number.

04

Clearly state the purpose of the payment and provide any relevant details that may support your claim.

05

Include the amount you are requesting, ensuring it aligns with the documentation provided.

06

Sign and date the form to verify that the information is accurate and truthful.

07

Submit the completed form along with all supporting documentation to the designated authority.

Who needs 386 guideline on payment?

01

Individuals or organizations seeking reimbursement for services rendered or expenses incurred.

02

Anyone involved in a payment dispute that requires formal documentation for resolution.

03

Entities needing to comply with regulatory requirements related to payment processing.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify 386 guideline on payment without leaving Google Drive?

Using pdfFiller with Google Docs allows you to create, amend, and sign documents straight from your Google Drive. The add-on turns your 386 guideline on payment into a dynamic fillable form that you can manage and eSign from anywhere.

How do I complete 386 guideline on payment online?

pdfFiller has made it simple to fill out and eSign 386 guideline on payment. The application has capabilities that allow you to modify and rearrange PDF content, add fillable fields, and eSign the document. Begin a free trial to discover all of the features of pdfFiller, the best document editing solution.

How do I make edits in 386 guideline on payment without leaving Chrome?

Add pdfFiller Google Chrome Extension to your web browser to start editing 386 guideline on payment and other documents directly from a Google search page. The service allows you to make changes in your documents when viewing them in Chrome. Create fillable documents and edit existing PDFs from any internet-connected device with pdfFiller.

What is 386 guideline on payment?

The 386 guideline on payment refers to a set of regulatory requirements for reporting certain financial transactions to ensure compliance with federal payment standards.

Who is required to file 386 guideline on payment?

Entities that engage in specific transactions covered by the 386 guidelines, including businesses and organizations that receive or make qualifying payments, are required to file.

How to fill out 386 guideline on payment?

To fill out the 386 guideline on payment, you must complete a designated form providing detailed information about the transactions, including amounts, parties involved, and the purpose of the payments, and submit it to the appropriate regulatory authority.

What is the purpose of 386 guideline on payment?

The purpose of the 386 guideline on payment is to promote transparency, prevent fraud, and ensure that payments made or received adhere to federal standards.

What information must be reported on 386 guideline on payment?

Information that must be reported includes the names of the payer and payee, transaction date, payment amounts, and a brief description of the payment purpose.

Fill out your 386 guideline on payment online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

386 Guideline On Payment is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.