Get the free Commercial Umbrella Liability Coverage Form

Show details

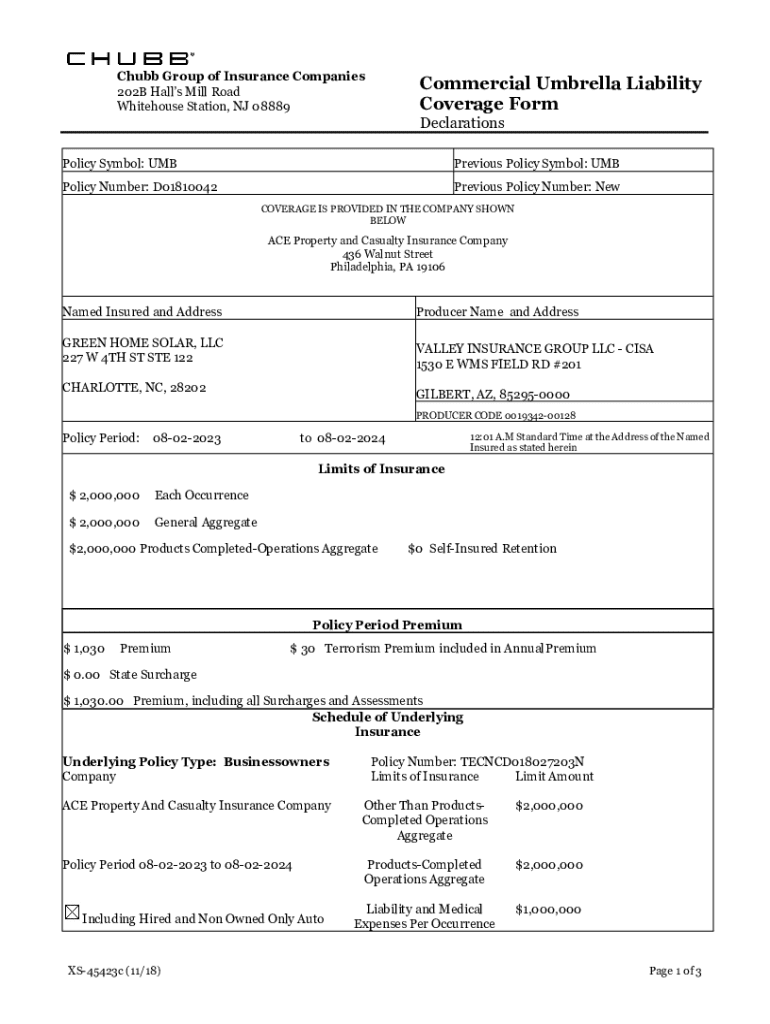

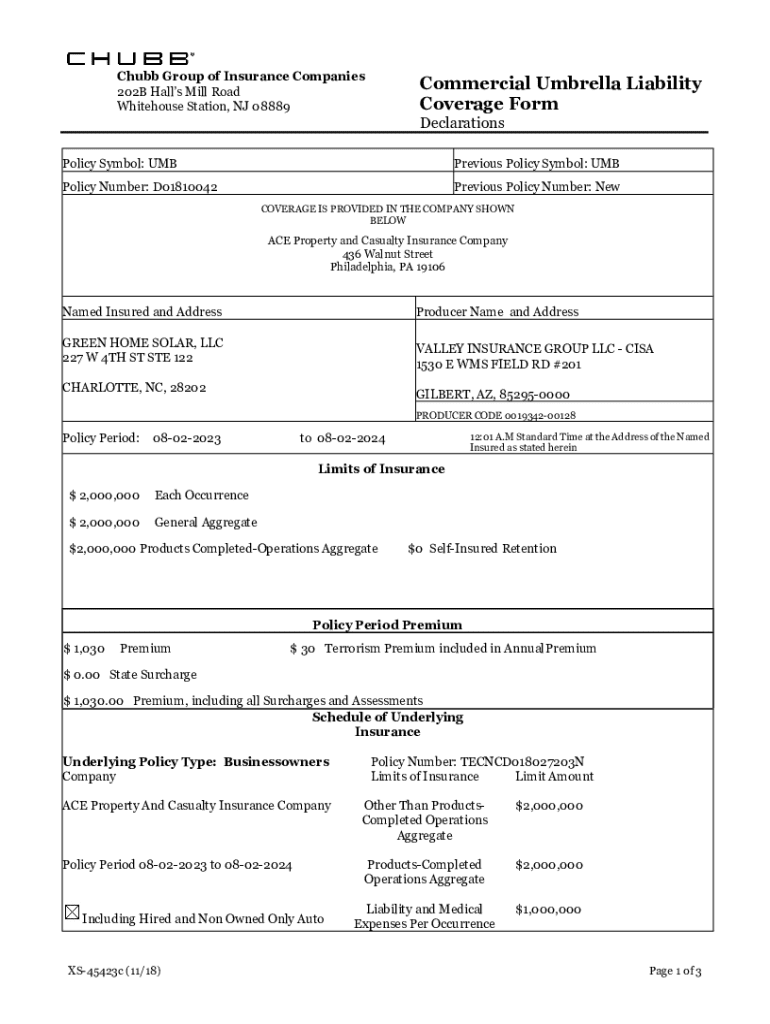

Chubb Group of Insurance Companies 202B Halls Mill Road Whitehouse Station, NJ 08889Commercial Umbrella Liability Coverage Form DeclarationsPolicy Symbol: UMBPrevious Policy Symbol: UMBPolicy Number:

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign commercial umbrella liability coverage

Edit your commercial umbrella liability coverage form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your commercial umbrella liability coverage form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit commercial umbrella liability coverage online

Follow the steps down below to benefit from the PDF editor's expertise:

1

Check your account. In case you're new, it's time to start your free trial.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit commercial umbrella liability coverage. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out commercial umbrella liability coverage

How to fill out commercial umbrella liability coverage

01

Gather your current insurance policies: Review your general liability, auto liability, and any other relevant insurance policies that you currently have.

02

Determine your coverage needs: Assess the risks associated with your business and consider factors such as the size of your business, industry, and potential liabilities.

03

Decide on coverage limits: Determine the amount of additional coverage you need beyond your existing liability policies, commonly ranging from $1 million to $10 million.

04

Contact insurance providers: Reach out to multiple insurance companies to get quotes and compare their offerings.

05

Fill out the application: Provide the necessary information requested by the insurance provider, including details about your business operations, locations, and existing liabilities.

06

Review policy exclusions: Carefully review the policy terms to understand what is covered and what is not, ensuring you are adequately protected.

07

Finalize your purchase: Once you are satisfied with the coverage and terms, complete the purchase of the policy and maintain a copy for your records.

Who needs commercial umbrella liability coverage?

01

Businesses of all sizes: Companies small, medium, or large that carry risks in their operations.

02

Contractors and construction companies: Those engaged in higher-risk industries with potential for significant claims.

03

Nonprofits and charitable organizations: To protect against liability claims that could jeopardize their financial stability.

04

Professional service providers: Businesses such as law firms, accounting firms, and consultants that may face lawsuits related to their services.

05

Businesses with high asset value: Entities that need to protect their assets from substantial liability claims.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my commercial umbrella liability coverage directly from Gmail?

It's easy to use pdfFiller's Gmail add-on to make and edit your commercial umbrella liability coverage and any other documents you get right in your email. You can also eSign them. Take a look at the Google Workspace Marketplace and get pdfFiller for Gmail. Get rid of the time-consuming steps and easily manage your documents and eSignatures with the help of an app.

How do I execute commercial umbrella liability coverage online?

pdfFiller makes it easy to finish and sign commercial umbrella liability coverage online. It lets you make changes to original PDF content, highlight, black out, erase, and write text anywhere on a page, legally eSign your form, and more, all from one place. Create a free account and use the web to keep track of professional documents.

How do I complete commercial umbrella liability coverage on an Android device?

Use the pdfFiller mobile app to complete your commercial umbrella liability coverage on an Android device. The application makes it possible to perform all needed document management manipulations, like adding, editing, and removing text, signing, annotating, and more. All you need is your smartphone and an internet connection.

What is commercial umbrella liability coverage?

Commercial umbrella liability coverage is a type of insurance that provides additional liability protection above and beyond the limits of an insured's existing liability policies, such as general liability, auto liability, and employers' liability insurance. It helps protect businesses from large claims that could exceed their primary coverage limits.

Who is required to file commercial umbrella liability coverage?

Generally, businesses that have significant assets, engage in high-risk activities, or are required by contract to carry additional liability insurance may be required to file for commercial umbrella liability coverage. This can include companies in industries such as construction, healthcare, and manufacturing.

How to fill out commercial umbrella liability coverage?

To fill out a commercial umbrella liability coverage application, businesses typically need to provide information about their existing insurance policies, business operations, revenue, number of employees, and any prior claims history. It is advisable to work with an insurance broker to ensure all necessary information is accurately reported.

What is the purpose of commercial umbrella liability coverage?

The purpose of commercial umbrella liability coverage is to provide an extra layer of financial protection for businesses against unforeseen claims and lawsuits that could result in significant financial losses. It helps protect company assets and ensures continued operational stability in the event of large liability claims.

What information must be reported on commercial umbrella liability coverage?

Typically, the information that must be reported includes details about existing liability policies, the types of business activities, annual revenue, number of employees, location of business operations, and prior claims history. Additionally, specific coverage amounts sought under the umbrella policy may also need to be disclosed.

Fill out your commercial umbrella liability coverage online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Commercial Umbrella Liability Coverage is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.