NH DoR DP-14 2024-2025 free printable template

Show details

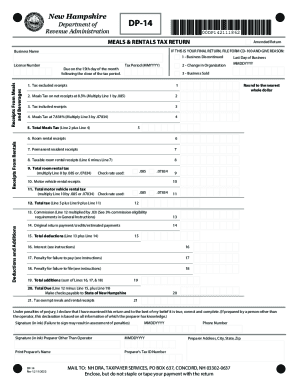

This document serves as the Meals and Rentals Tax Return for businesses in New Hampshire, including provisions for amended returns and final return filing.

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign new hampshire dp 14 form

Edit your nh dor dp 14 meals rentals insturctions printable form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your nh dor dp 14 meals rentals insturctions form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit nh dp 14 meals form online

Follow the steps down below to use a professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit nh dor dp 14 rentals insturctions printable form. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

It's easier to work with documents with pdfFiller than you could have believed. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

NH DoR DP-14 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out nh dp 14 meals fillable form

How to fill out NH DoR DP-14

01

Obtain the NH DoR DP-14 form from the New Hampshire Department of Revenue website or local office.

02

Carefully read the instructions provided with the form to understand the requirements.

03

Fill in your personal information, including your name, address, and contact details.

04

Enter the relevant property information, including the property address and parcel number.

05

Provide details regarding the assessed value of the property.

06

Include any supporting documentation that may be required, such as previous tax bills or assessment notices.

07

Review the completed form for accuracy and completeness.

08

Sign and date the form as required.

09

Submit the form by the deadline to the appropriate local tax office.

Who needs NH DoR DP-14?

01

Property owners in New Hampshire who wish to appeal their property assessment.

02

Individuals who believe their property has been overvalued for tax purposes.

03

Those seeking to correct errors in property assessment records.

Video instructions and help with filling out and completing nh dp 14 form

Instructions and Help about nh dp 14 meals printable

Fill

nh dor dp 14 rentals insturctions download form

: Try Risk Free

People Also Ask about new hampshire dp 14 meals rentals

Can I pay my NH taxes online?

Payment for all DRA tax types should be made through the Department's online portal, GRANITE TAX CONNECT. Click on the link to access your existing account or to create a new account today.

What is the tax form for interest dividends in NH?

New Hampshire uses Form DP-10 for full or part-year residents. The DP-10 only has to be filed if the taxpayer received more than $2400 (single) or $4800 (joint) of interest and/or dividends. TaxAct® supports this form in the New Hampshire program.

Do I need to file NH state tax return?

New Hampshire does not tax individuals' earned income, so you are not required to file an individual New Hampshire tax return. The state only taxes interest and dividends at 5% on residents and fiduciaries whose gross interest and dividends income, from all sources, exceeds $2,400 annually ($4,800 for joint filers).

How do I pay my NH property taxes?

Pay/View Your Property Tax Account You can now pay your property tax bill using an electronic check (ACH), or credit card by touch tone telephone (IVR) or online 24 hours a day, 7 days a week. Dial 1-800-615-9507 or pay/view your property tax bill online by following the instructions.

What is NH Department of revenue Transfer tax?

The tax is imposed on both the buyer and the seller at the rate of $. 75 per $100 of the price or consideration for the sale, granting, or transfer. What types of transactions are taxable? All contractual transfers are subject to tax unless specifically exempt under RSA 78-B:2.

How often are property taxes paid in NH?

The Property Tax Year is April 1st through March 31st. Property tax bills are sent semiannually. The first installment bill is due on July 1st, the second installment due date varies depending on the date the tax rate is set and the date the bills are postmarked, generally no later than December 20th.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send nh dor dp 14 rentals insturctions form for eSignature?

To distribute your nh dor dp 14 rentals insturctions fill, simply send it to others and receive the eSigned document back instantly. Post or email a PDF that you've notarized online. Doing so requires never leaving your account.

How do I edit nh dor dp 14 rentals insturctions print in Chrome?

Download and install the pdfFiller Google Chrome Extension to your browser to edit, fill out, and eSign your nh dor dp 14 rentals insturctions pdf, which you can open in the editor with a single click from a Google search page. Fillable documents may be executed from any internet-connected device without leaving Chrome.

Can I create an electronic signature for the nh dor dp 14 meals rentals insturctions get in Chrome?

Yes. You can use pdfFiller to sign documents and use all of the features of the PDF editor in one place if you add this solution to Chrome. In order to use the extension, you can draw or write an electronic signature. You can also upload a picture of your handwritten signature. There is no need to worry about how long it takes to sign your nh dp 14 meals pdf.

What is NH DoR DP-14?

NH DoR DP-14 is a form used by the New Hampshire Department of Revenue to report various financial information related to businesses and individuals for tax purposes.

Who is required to file NH DoR DP-14?

Businesses and individuals in New Hampshire that have specific tax obligations, such as income or excise tax, are required to file NH DoR DP-14.

How to fill out NH DoR DP-14?

To fill out NH DoR DP-14, gather the necessary financial information, including income details and deductions, then complete the form by providing accurate information in each required section before submitting it to the appropriate tax authority.

What is the purpose of NH DoR DP-14?

The purpose of NH DoR DP-14 is to collect relevant tax information from filers to ensure proper tax assessment and compliance with New Hampshire tax laws.

What information must be reported on NH DoR DP-14?

NH DoR DP-14 requires reporting of various financial details, including gross income, deductions, tax credits, and any other relevant financial data that may impact the tax liability.

Fill out your NH DoR DP-14 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Nh Dor Dp 14 Meals Rentals Insturctions Pdf is not the form you're looking for?Search for another form here.

Keywords relevant to nh dp 14 meals pdffiller

Related to nh dor dp 14 meals rentals insturctions sample

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.