AL Avenue Tobacco Form 2024-2025 free printable template

Show details

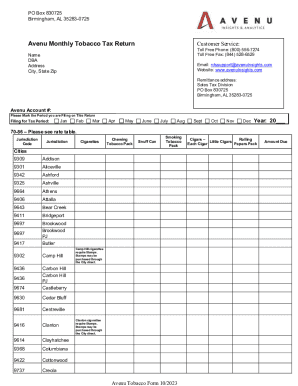

PO Box 830725 Birmingham, AL 35283-0725 Avenu Monthly Tobacco Tax Return Customer Service: Name DBA Address City, State Zip Email: rdssupport@avenuinsights.com Website: www.avenuinsights.com Toll

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign alabama revenue discovery systems monthly tax form

Edit your alabama monthly tobacco tax form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your alabama monthly tax return form download form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit al monthly tobacco tax return online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in to account. Start Free Trial and register a profile if you don't have one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit monthly tobacco tax form. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you can have believed. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

AL Avenue Tobacco Form Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out alabama monthly tobacco return fillable form

How to fill out AL Avenue Tobacco Form

01

Obtain the AL Avenue Tobacco Form from the official website or your local tobacco regulatory office.

02

Ensure you have all necessary personal and business information ready, including your name, address, and Tax ID if applicable.

03

Fill in the required sections accurately, following the instructions provided on the form.

04

Provide details about the types of tobacco products you are dealing with, as well as their quantities.

05

Review the filled form for any errors or omissions.

06

Sign and date the form where indicated.

07

Submit the completed form via the method specified (online, by mail, or in person) along with any required fees.

Who needs AL Avenue Tobacco Form?

01

Business owners involved in the sale or distribution of tobacco products.

02

Individuals applying for a tobacco license.

03

Establishments seeking to comply with local tobacco regulations.

04

Manufacturers and wholesalers of tobacco products.

Fill

al tobacco form

: Try Risk Free

People Also Ask about alabama monthly tax return form

How much is a 10 pack carton of cigarettes?

As we mentioned, the average cost of a pack of cigarettes is seven dollars per pack, depending on the state tax. This cost is based on a pack of 20 cigarettes. You can also get a carton, which costs around $49 and includes 10 packs containing 20 cigarettes each.

How much is tobacco in Alabama?

Cigarette Prices and Taxes by State #StatePack of Cigarettes Cost37Colorado$6.0638Indiana$5.8939Kentucky$5.8840Alabama$5.7847 more rows

Did cigarettes go up in Alabama?

Tax increase impact Alabama's tax on cigarettes is going to increase to 67.5 cents per pack, up from its longtime 42.5-cent levy on smokers. The increase is expected to generate $70 million in new revenue that will go into the General Fund.

Which state has the highest tobacco tax?

The highest combined state-local tax rate is $7.16 in Chicago, IL, with Evanston, IL second at $6.48 per pack. Other high state-local rates include New York City at $5.85 and Juneau, AK at $5.00 per pack.

What is the average cost of a pack of cigarettes in Alabama?

The median price for a pack of cigarettes is $7.93. With 20 cigarettes per pack, the average cigarette costs between $0.31 and $0.60.Download Table Data. StateCigarette PriceTaxAlabama$6.85$0.68Wyoming$6.85$0.60Nebraska$6.84$0.64South Carolina$6.82$0.5747 more rows

What is Alabama's tobacco tax?

State Tobacco Product Tax Rates Tobacco Product TypeTax RateSmoking Tobacco & Cigar Wrappers (1 1/8 oz or less)4¢Smoking Tobacco & Cigar Wrappers (over 1 1/8 oz, not exceeding 2 oz)10¢Smoking Tobacco & Cigar Wrappers (over 2 oz, not exceeding 3 oz)16¢Smoking Tobacco & Cigar Wrappers (over 3 oz, not exceeding 4 oz)21¢14 more rows

How much is a pack of Marlboros in Alabama?

The price of 1 package of Marlboro cigarettes in Birmingham, Alabama is $7.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in alabama monthly tax return form blank without leaving Chrome?

Install the pdfFiller Chrome Extension to modify, fill out, and eSign your alabama tobacco return, which you can access right from a Google search page. Fillable documents without leaving Chrome on any internet-connected device.

How do I edit alabama rds tobacco tax straight from my smartphone?

The pdfFiller mobile applications for iOS and Android are the easiest way to edit documents on the go. You may get them from the Apple Store and Google Play. More info about the applications here. Install and log in to edit alabama monthly tobacco tax.

How can I fill out al revenue discovery systems tobacco online on an iOS device?

Install the pdfFiller iOS app. Log in or create an account to access the solution's editing features. Open your alabama rds monthly tobacco tax printable by uploading it from your device or online storage. After filling in all relevant fields and eSigning if required, you may save or distribute the document.

What is AL Avenue Tobacco Form?

The AL Avenue Tobacco Form is a regulatory document used by businesses in the tobacco industry to report their sales and inventory of tobacco products.

Who is required to file AL Avenue Tobacco Form?

Any business or individual involved in the manufacturing, importing, or distribution of tobacco products in the relevant jurisdiction is required to file the AL Avenue Tobacco Form.

How to fill out AL Avenue Tobacco Form?

To fill out the AL Avenue Tobacco Form, businesses must provide accurate information regarding their tobacco sales, inventory levels, and relevant business details. It typically involves entering information in specified fields and ensuring compliance with regulatory requirements.

What is the purpose of AL Avenue Tobacco Form?

The purpose of the AL Avenue Tobacco Form is to monitor and regulate the tobacco market, ensure compliance with laws, and gather data for taxation and public health initiatives.

What information must be reported on AL Avenue Tobacco Form?

The information that must be reported on the AL Avenue Tobacco Form typically includes details such as the types and quantities of tobacco products sold, inventory levels, business identification information, and any applicable tax information.

Fill out your pdf 2024-2025 form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Rds Tobacco Form Online is not the form you're looking for?Search for another form here.

Keywords relevant to county cigarettes returned

Related to the rds tobacco form

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.