Get the free Tax Appeal Order

Show details

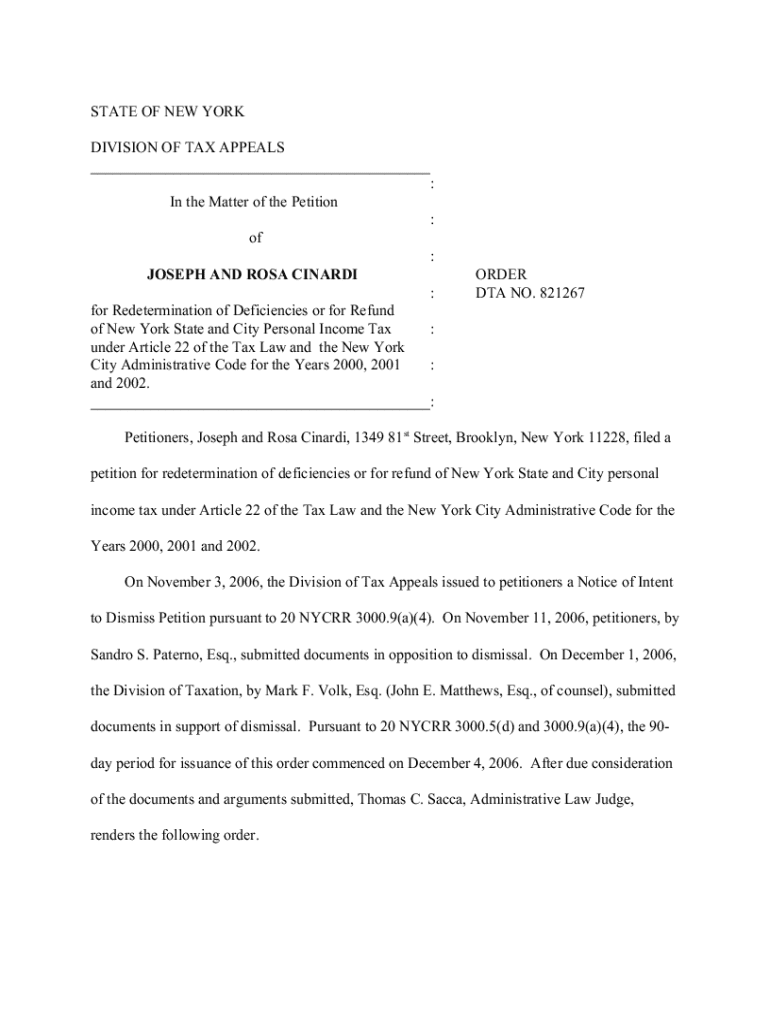

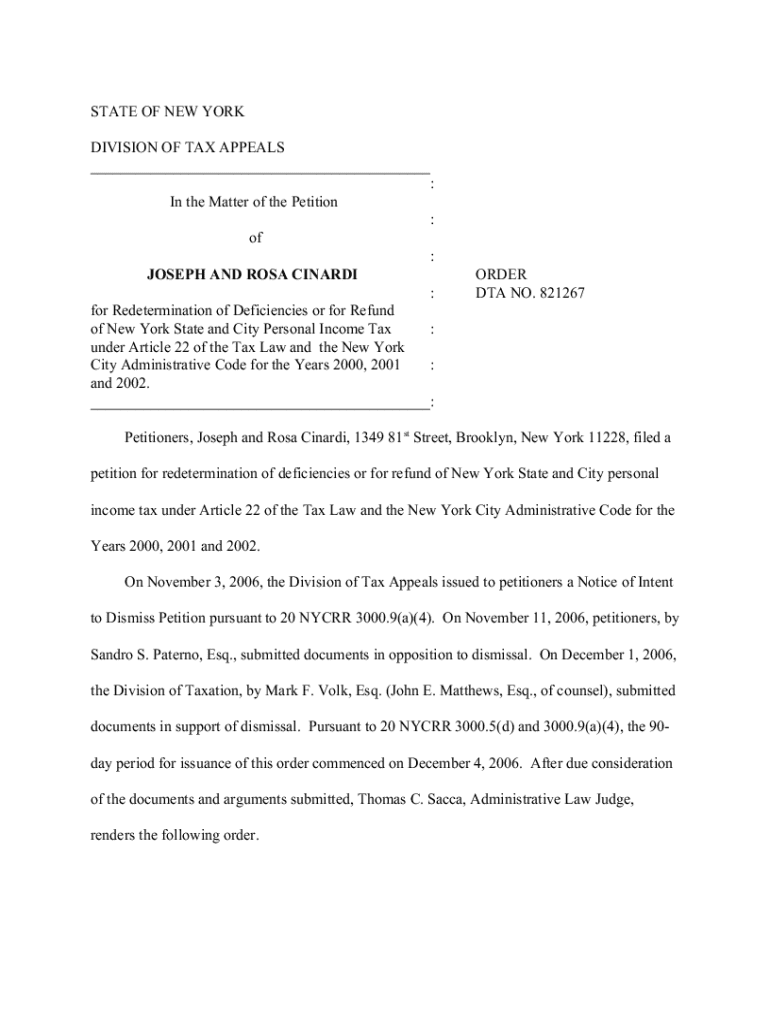

This document is an order from the State of New York Division of Tax Appeals regarding the petition of Joseph and Rosa Cinardi for redetermination of deficiencies or for a refund of New York State and City personal income tax for the years 2000, 2001, and 2002. The petitioners sought an administrative hearing after their request for a conciliation conference was denied. The order concludes that the petition was not filed within the statutory 90-day period, thus dismissing the petition.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign tax appeal order

Edit your tax appeal order form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your tax appeal order form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit tax appeal order online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit tax appeal order. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out tax appeal order

How to fill out tax appeal order

01

Obtain the tax appeal order form from your local tax authority's website or office.

02

Carefully read the instructions provided with the form to understand the requirements.

03

Fill in your personal information, including your name, address, and contact details.

04

Provide the property details that are being appealed, including address and parcel number.

05

Clearly state the reason for the appeal, explaining why you believe the tax assessment is incorrect.

06

Attach any supporting documents or evidence that substantiate your appeal, such as comparative property assessments.

07

Review the completed form for accuracy and completeness.

08

Submit the tax appeal order form by the deadline, either by mail or electronically, according to local guidelines.

Who needs tax appeal order?

01

Property owners who believe their property tax assessment is unfair or incorrect.

02

Individuals seeking a reduction in their property taxes due to discrepancies in property valuation.

03

Real estate investors who want to appeal taxes on investment properties.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find tax appeal order?

It's simple with pdfFiller, a full online document management tool. Access our huge online form collection (over 25M fillable forms are accessible) and find the tax appeal order in seconds. Open it immediately and begin modifying it with powerful editing options.

How do I edit tax appeal order on an Android device?

Yes, you can. With the pdfFiller mobile app for Android, you can edit, sign, and share tax appeal order on your mobile device from any location; only an internet connection is needed. Get the app and start to streamline your document workflow from anywhere.

How do I fill out tax appeal order on an Android device?

On Android, use the pdfFiller mobile app to finish your tax appeal order. Adding, editing, deleting text, signing, annotating, and more are all available with the app. All you need is a smartphone and internet.

What is tax appeal order?

A tax appeal order is a formal request submitted to a tax authority to contest a tax assessment or ruling made by that authority.

Who is required to file tax appeal order?

Any taxpayer who disagrees with a tax assessment or ruling issued by tax authorities is required to file a tax appeal order.

How to fill out tax appeal order?

To fill out a tax appeal order, you typically need to complete the designated form provided by the tax authority, detailing the reasons for the appeal and any supporting documentation.

What is the purpose of tax appeal order?

The purpose of a tax appeal order is to provide taxpayers with a mechanism to challenge and seek a review of tax assessments or decisions they believe to be incorrect.

What information must be reported on tax appeal order?

The information that must be reported includes personal identification details, the tax assessment in question, reasons for the appeal, and any relevant evidence supporting the case.

Fill out your tax appeal order online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Tax Appeal Order is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.