FL Business Tax Receipt - Town of Davie 2024-2025 free printable template

Show details

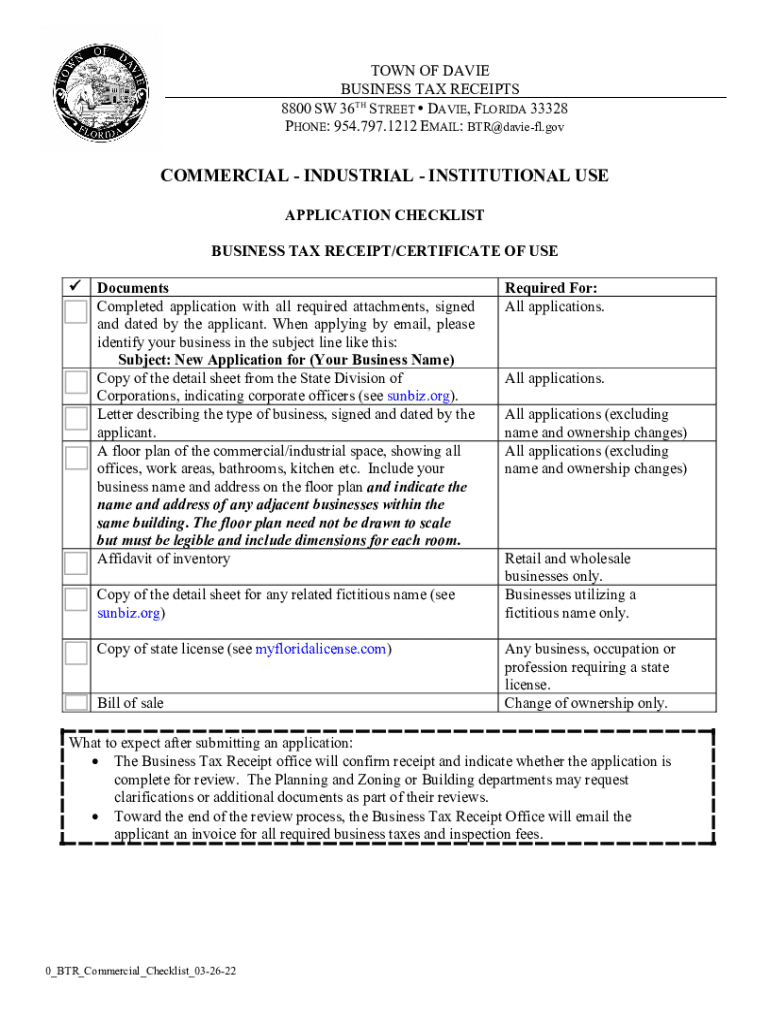

TOWN OF DAVIE

BUSINESS TAX RECEIPTS

8800 SW 36TH STREET DAVIE, FLORIDA 33328

PHONE: 954.797.1212 EMAIL: BTR@daviefl.govCOMMERCIAL INDUSTRIAL INSTITUTIONAL USE

APPLICATION CHECKLIST

BUSINESS TAX

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign 2024 business tax receipt

Edit your 2024 business tax receipt form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 2024 business tax receipt form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit 2024 business tax receipt online

Use the instructions below to start using our professional PDF editor:

1

Log in to your account. Start Free Trial and register a profile if you don't have one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit 2024 business tax receipt. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents. Check it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

FL Business Tax Receipt - Town of Davie Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out 2024 business tax receipt

How to fill out FL Business Tax Receipt - Town of Davie

01

Obtain the FL Business Tax Receipt application form from the Town of Davie website or municipal office.

02

Fill in the necessary business information, including business name, address, and owner details.

03

Specify the type of business and the nature of the services or products offered.

04

Provide any required documentation, such as proof of identity or business registration.

05

Calculate the tax fee based on your business category and submit the payment.

06

Submit your completed application along with payment to the Town of Davie Business Tax Division.

07

Wait for confirmation and receipt issuance from the town.

Who needs FL Business Tax Receipt - Town of Davie?

01

All businesses operating within the Town of Davie, including sole proprietors, partnerships, and corporations, need a FL Business Tax Receipt.

Fill

form

: Try Risk Free

People Also Ask about

What is a local business tax receipt in Florida?

You must pay a tax to operate any business within city limits. A business tax receipt is proof of payment and it is required before a business opens.

Do I need a business tax receipt in Florida?

You must pay a tax to operate any business within city limits. A business tax receipt is proof of payment and it is required before a business opens.

How do I get a business tax receipt in Florida?

New applicants must use the online application system or fill out and print the Local Business Tax receipt application and submit it by mail or in person.

Is a business tax receipt the same as an occupational license in Florida?

A BTR is a tax for the privilege of engaging in or managing a business, profession, or occupation within the town limits. (The Florida Legislature enacted legislation which amended references to Occupational License. On January 1, 2007, the term “Occupational License was amended to read “Business Tax Receipt”.)

How much does a business tax receipt cost in Florida?

The cost of a business tax is $190.30 for each type of business. There are a few exceptions, however.

Is a local business tax receipt the same as a business license?

Note. Business tax receipts can sometimes work as a type of business permit, but not always. Some cities may require business licenses and business permits along with a business tax receipt in order for a business to operate.

How do I get a Florida business tax receipt?

New applicants must use the online application system or fill out and print the Local Business Tax receipt application and submit it by mail or in person.

Is a business tax receipt the same as a business license in Florida?

This general business license is usually called a business tax receipt in Florida and is required for any new business providing merchandise or services to the public, even if the business is a one-person company and operates out of a private residence.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send 2024 business tax receipt to be eSigned by others?

When you're ready to share your 2024 business tax receipt, you can swiftly email it to others and receive the eSigned document back. You may send your PDF through email, fax, text message, or USPS mail, or you can notarize it online. All of this may be done without ever leaving your account.

How do I complete 2024 business tax receipt online?

Easy online 2024 business tax receipt completion using pdfFiller. Also, it allows you to legally eSign your form and change original PDF material. Create a free account and manage documents online.

How do I fill out 2024 business tax receipt using my mobile device?

You can quickly make and fill out legal forms with the help of the pdfFiller app on your phone. Complete and sign 2024 business tax receipt and other documents on your mobile device using the application. If you want to learn more about how the PDF editor works, go to pdfFiller.com.

What is FL Business Tax Receipt - Town of Davie?

The FL Business Tax Receipt is a license issued by the Town of Davie that allows individuals or businesses to operate within its jurisdiction legally.

Who is required to file FL Business Tax Receipt - Town of Davie?

Any individual or business engaging in commercial activities within the Town of Davie must file for a Business Tax Receipt.

How to fill out FL Business Tax Receipt - Town of Davie?

To fill out the FL Business Tax Receipt, applicants must provide relevant business information, including business name, address, type of business, and any other necessary details as required by the town.

What is the purpose of FL Business Tax Receipt - Town of Davie?

The purpose of the FL Business Tax Receipt is to regulate businesses operating within the town, ensure compliance with local laws, and generate revenue for municipal services.

What information must be reported on FL Business Tax Receipt - Town of Davie?

Information that must be reported includes the business name, physical address, owner's name, type of business activity, and any relevant permits or licenses.

Fill out your 2024 business tax receipt online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

2024 Business Tax Receipt is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.