Get the free IRS Tax Return Transcript Request Procedures - udc

Show details

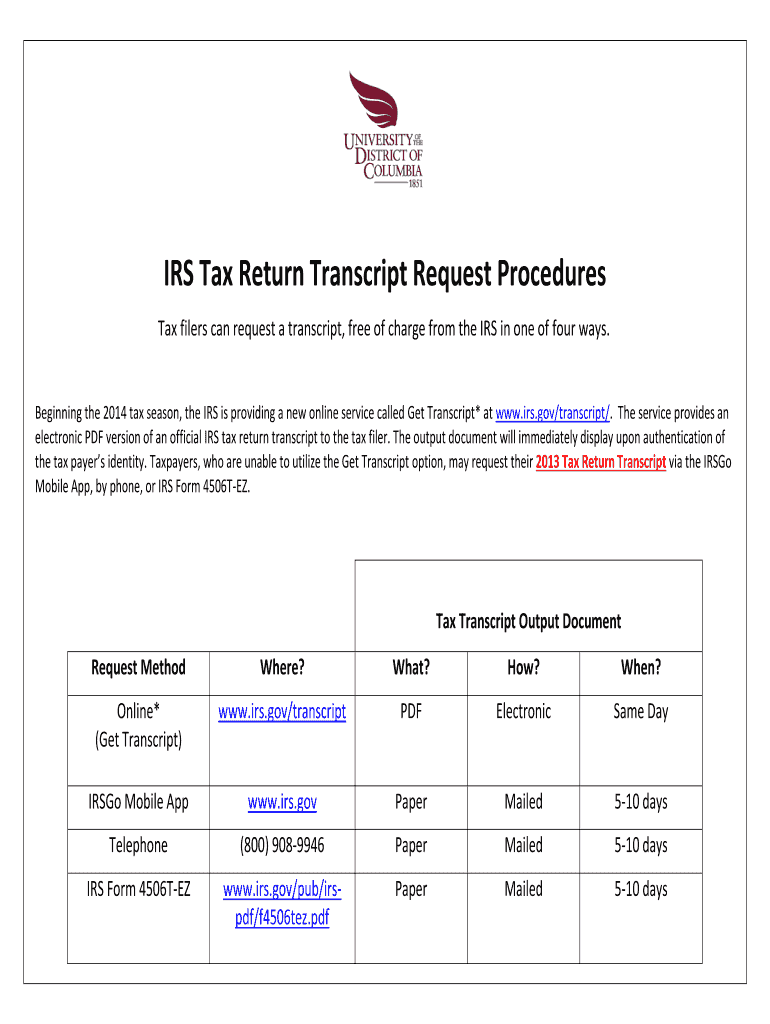

IRS Tax Return Transcript Request Procedures Tax filers can request a transcript, free of charge from the IRS in one of four ways. Beginning the 2014 tax season, the IRS is providing a new online

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign irs tax return transcript

Edit your irs tax return transcript form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your irs tax return transcript form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit irs tax return transcript online

Use the instructions below to start using our professional PDF editor:

1

Log in to account. Click Start Free Trial and sign up a profile if you don't have one yet.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit irs tax return transcript. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

The use of pdfFiller makes dealing with documents straightforward. Now is the time to try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out irs tax return transcript

How to fill out an IRS tax return transcript:

01

Request the transcript: Begin by visiting the IRS website and searching for Form 4506-T, which is the Request for Transcript of Tax Return. Fill in all the required information, including your name, Social Security number, and the tax year(s) you need the transcript for. You can choose to receive the transcript by mail or electronically.

02

Choose the transcript type: There are three different types of tax return transcripts available - tax return transcript, tax account transcript, and record of account transcript. Evaluate your specific needs and select the type that best suits your requirements.

03

Fill in the form accurately: Double-check all the information you have provided on Form 4506-T for accuracy. Ensure that your personal details and the tax year(s) are correct before submitting the form to the IRS.

04

Submit the form: Once you have filled out the form completely and reviewed it for accuracy, submit it to the IRS. If you are submitting it electronically, follow the instructions provided on the IRS website. If you are mailing the form, send it to the address specified on the form or on the IRS website.

Who needs an IRS tax return transcript:

01

Taxpayers applying for student loans: Many colleges, universities, and financial aid programs require applicants to submit their IRS tax return transcript as a proof of income or financial status. This helps determine eligibility for various types of financial aid, grants, or scholarships.

02

Mortgage or loan applicants: When applying for a mortgage or a loan, lenders often request an IRS tax return transcript to verify income and ensure that the borrower can afford the loan. The transcript serves as evidence of your financial stability.

03

Individuals facing identity theft or fraud: If you suspect that you have been a victim of identity theft or tax fraud, obtaining an IRS tax return transcript can help you identify any discrepancies in your tax filing history. It allows you to monitor and verify the accuracy of the information reported to the IRS.

04

Tax preparation and accounting purposes: Tax professionals, accountants, and tax preparers might require IRS tax return transcripts to accurately prepare tax returns and assist individuals or businesses with their financial planning.

05

Legal and financial matters: Attorneys, CPAs, and financial advisors may request tax return transcripts to analyze past tax filings in legal cases, divorce proceedings, or financial planning for their clients.

Overall, anyone who needs to access or verify their past tax return information may require an IRS tax return transcript. It is essential to comply with specific financial, legal, or educational requirements or to resolve any disputes related to tax matters.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is irs tax return transcript?

An IRS tax return transcript is a summary of your tax return that includes important information such as adjusted gross income, filing status, and any changes made to your tax return after it was filed.

Who is required to file irs tax return transcript?

Individuals who need to provide proof of their income and tax filing status, such as when applying for a loan or financial aid, may be required to file an IRS tax return transcript.

How to fill out irs tax return transcript?

To fill out an IRS tax return transcript, you can request a copy online, by phone, or by mail. You can also authorize a third party to request a transcript on your behalf.

What is the purpose of irs tax return transcript?

The purpose of an IRS tax return transcript is to provide a summary of your tax return for verification purposes, especially when applying for financial aid, loans, or mortgages.

What information must be reported on irs tax return transcript?

An IRS tax return transcript typically includes information such as adjusted gross income, filing status, taxable income, and any changes made to your tax return after it was filed.

How can I edit irs tax return transcript from Google Drive?

By combining pdfFiller with Google Docs, you can generate fillable forms directly in Google Drive. No need to leave Google Drive to make edits or sign documents, including irs tax return transcript. Use pdfFiller's features in Google Drive to handle documents on any internet-connected device.

How do I make changes in irs tax return transcript?

pdfFiller not only allows you to edit the content of your files but fully rearrange them by changing the number and sequence of pages. Upload your irs tax return transcript to the editor and make any required adjustments in a couple of clicks. The editor enables you to blackout, type, and erase text in PDFs, add images, sticky notes and text boxes, and much more.

How do I fill out the irs tax return transcript form on my smartphone?

You can easily create and fill out legal forms with the help of the pdfFiller mobile app. Complete and sign irs tax return transcript and other documents on your mobile device using the application. Visit pdfFiller’s webpage to learn more about the functionalities of the PDF editor.

Fill out your irs tax return transcript online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Irs Tax Return Transcript is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.