IRS 8582 2024-2025 free printable template

Show details

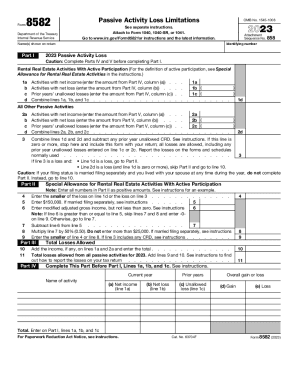

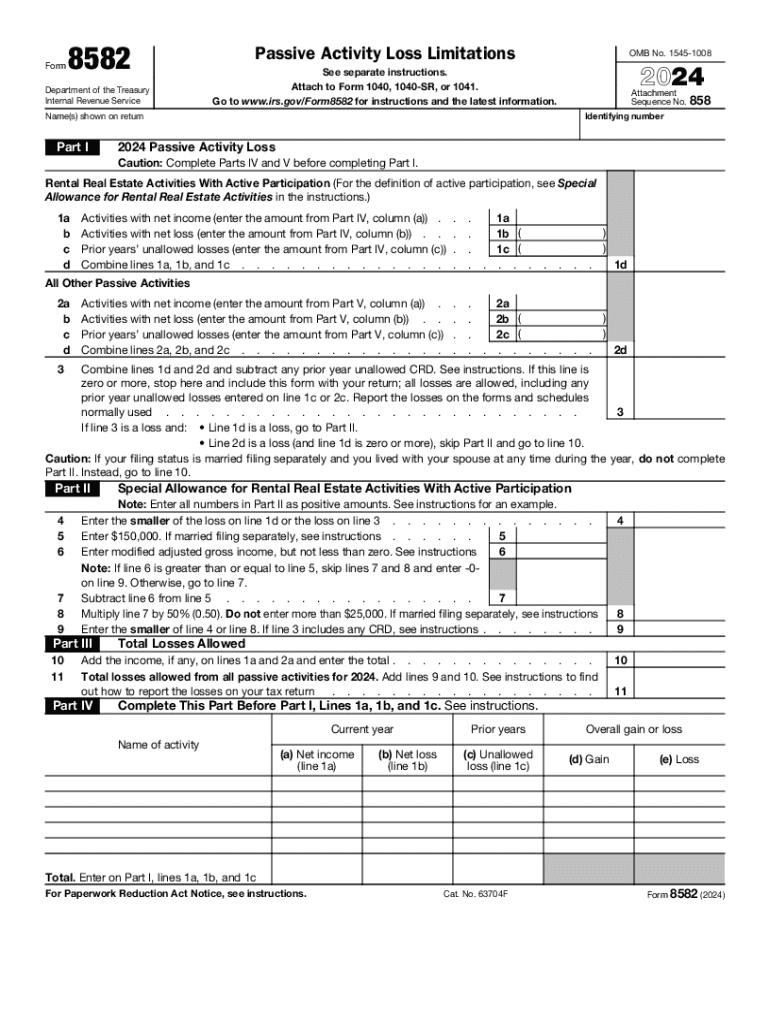

Cat. No. 63704F Form 8582 2024 Page 2 Part V line 2b c Special allowance d Subtract column c from column a. Form Department of the Treasury Internal Revenue Service Passive Activity Loss Limitations OMB No* 1545-1008 See separate instructions. Attach to Form 1040 1040-SR or 1041. Go to www*irs*gov/Form8582 for instructions and the latest information* Attachment Sequence No* 858 Identifying number Name s shown on return Part I 2024 Passive Activity Loss Caution Complete Parts IV and V before...completing Part I. Rental Real Estate Activities With Active Participation For the definition of active participation see Special Allowance for Rental Real Estate Activities in the instructions. 1a b c d Activities with net income enter the amount from Part IV column a. Prior years unallowed losses enter the amount from Part IV column c Combine lines 1a 1b and 1c. 1b 1c. 2a 2b 2c 1d All Other Passive Activities 2d zero or more stop here and include this form with your return all losses are...allowed including any normally used. If line 3 is a loss and Line 1d is a loss go to Part II. Line 2d is a loss and line 1d is zero or more skip Part II and go to line 10. Caution If your filing status is married filing separately and you lived with your spouse at any time during the year do not complete Part II. Instead go to line 10. Note Enter all numbers in Part II as positive amounts. See instructions for an example. Enter the smaller of the loss on line 1d or the loss on line 3. Enter 150...000. If married filing separately see instructions. Enter modified adjusted gross income but not less than zero. See instructions Note If line 6 is greater than or equal to line 5 skip lines 7 and 8 and enter -0on line 9. Otherwise go to line 7. Subtract line 6 from line 5. Multiply line 7 by 50 0. 50. Do not enter more than 25 000. If married filing separately see instructions Special Allowance for Rental Real Estate Activities With Active Participation Total Losses Allowed Add the income if...any on lines 1a and 2a and enter the total. out how to report the losses on your tax return. Complete This Part Before Part I Lines 1a 1b and 1c* See instructions. Current year Name of activity a Net income line 1a b Net loss Prior years c Unallowed loss line 1c Overall gain or loss d Gain e Loss Total* Enter on Part I lines 1a 1b and 1c For Paperwork Reduction Act Notice see instructions. Use This Part if an Amount Is Shown on Part II Line 9. See instructions. Form or schedule and line number...to be reported on see instructions Total Part VIII a Loss b Ratio Allowed Losses. See instructions. Allocation of Unallowed Losses. See instructions. b Unallowed loss c Allowed loss Page 3 a loss e Allowed Net loss plus prior year unallowed loss from form or schedule. b Net income from form or schedule c Subtract line 1b from line 1a* If zero or less enter -0Form or schedule and line number to. Form Department of the Treasury Internal Revenue Service Passive Activity Loss Limitations OMB No*...1545-1008 See separate instructions. Attach to Form 1040 1040-SR or 1041. Go to www*irs*gov/Form8582 for instructions and the latest information* Attachment Sequence No* 858 Identifying number Name s shown on return Part I 2024 Passive Activity Loss Caution Complete Parts IV and V before completing Part I.

pdfFiller is not affiliated with IRS

Instructions and Help about IRS 8582

How to edit IRS 8582

How to fill out IRS 8582

Instructions and Help about IRS 8582

How to edit IRS 8582

To edit IRS Form 8582, ensure you have a completed copy of the form available. If you are using a digital tool like pdfFiller, you can upload the form directly for modifications. Utilize the editing features to fill in or correct specific sections. Once all edits are made, save your document for further processing or submission.

How to fill out IRS 8582

Filling out IRS Form 8582 requires careful attention to detail. Follow these steps:

01

Gather relevant tax information, including income and expenses related to passive activities.

02

Enter your personal identifying information at the top of the form.

03

Complete Part I, calculating any passive activity loss incurred during the year.

04

Move to Part II to summarize any passive activity gains and losses.

05

Verify all information for accuracy before submitting the form.

Latest updates to IRS 8582

Latest updates to IRS 8582

Be aware of recent changes that may affect IRS Form 8582. The IRS periodically revises instructions, forms, and restrictions for reporting passive activities. Always check the IRS website for the latest updates to ensure compliance. Such changes can impact eligibility and required documentation.

All You Need to Know About IRS 8582

What is IRS 8582?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

Due date

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

All You Need to Know About IRS 8582

What is IRS 8582?

IRS Form 8582 is a tax form used to report passive activity losses and credits. It is essential for taxpayers who have investments in real estate or businesses that operate with passive income. The form helps calculate the amount of loss that can be deducted against non-passive income.

What is the purpose of this form?

The main purpose of IRS Form 8582 is to determine how much of your passive losses can be utilized to offset other income. The IRS utilizes this form to ensure that taxpayers are accurately reporting their income and expenses related to passive activities. It ultimately affects tax liability and ensures compliance with tax regulations.

Who needs the form?

Taxpayers who have passive activities such as rental properties or limited partnerships must file IRS Form 8582. If your passive losses exceed your passive income, this form is necessary to calculate how much of those losses can offset your other income. Neglecting to file this form when required can lead to penalties.

When am I exempt from filling out this form?

Taxpayers may be exempt from filling out IRS Form 8582 if they do not have any passive activities or if their losses do not exceed passive income. Additionally, certain real estate professionals may have specific exemptions. Always assess your situation before omitting this form.

Components of the form

IRS Form 8582 is divided into several parts that address passive activity losses and income. Key components include:

01

Part I: Determining the passive activity loss for the year.

02

Part II: Summarizing your passive activities and calculating the allowable losses.

03

Part III: Providing details on credits from passive activities.

Due date

IRS Form 8582 is typically due on the same date as your federal income tax return. For most taxpayers, this is April 15. If filing for an extension, ensure to adhere to the extended due date to avoid penalties.

What are the penalties for not issuing the form?

Failing to file IRS Form 8582 when required may result in penalties. The IRS may disallow passive losses that could have been offset against your income, leading to higher tax liabilities. Additionally, a failure to file penalty may apply, which can increase your overall tax burden.

What information do you need when you file the form?

When filing IRS Form 8582, ensure you have the following information available:

01

Your Social Security number or Employer Identification Number.

02

Details of all passive activities and their respective income and expenses.

03

Supporting documentation reflecting losses from passive activities.

Is the form accompanied by other forms?

IRS Form 8582 may be submitted alongside Form 1040, which is the standard individual income tax return. Depending on your specific situation, you may also need to include other forms related to passive activities, such as Schedule E or Form 1065, if applicable.

Where do I send the form?

Submit IRS Form 8582 to the address specified in the instructions that accompany the form. Depending on whether you are filing electronically or by mail, the submission address may vary. Always verify the correct submission location to ensure timely processing.

See what our users say

Read user feedback and try pdfFiller to explore all its benefits for yourself

I can't believe how easy it is to fax with PDFiller! Awesome!

google drive connection issues, but overall great product

See what our users say