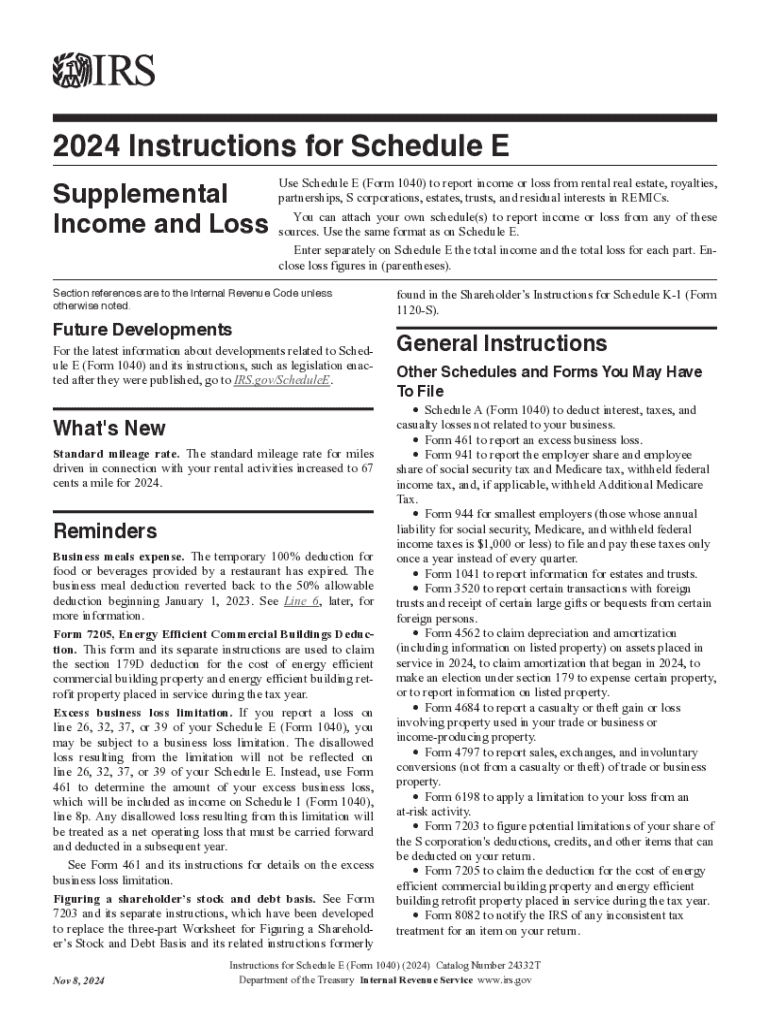

IRS Instruction 1040 - Schedule E 2024-2025 free printable template

Get, Create, Make and Sign instructions schedule e income form

Editing capital loss carryover worksheet online

Uncompromising security for your PDF editing and eSignature needs

IRS Instruction 1040 - Schedule E Form Versions

How to fill out instructions schedule e form

How to fill out IRS Instruction 1040 - Schedule E

Who needs IRS Instruction 1040 - Schedule E?

Video instructions and help with filling out and completing instructions schedule

Instructions and Help about 2024 form 1040 instructions

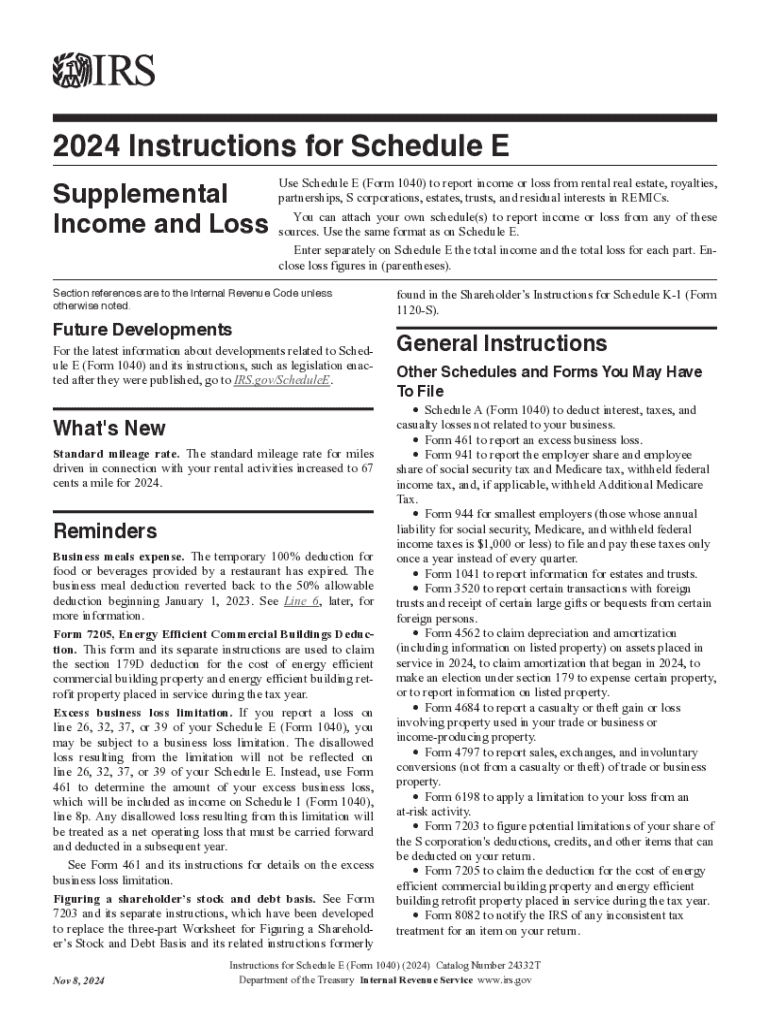

Today we do a quick video on how to fill out a Schedule E so Schedule II is for people who have rental properties there are other uses for it for royalties if you have like oil stakes and oil wells and stuff like that but for today's purpose we're just going to focus on people who have rental properties whether it's just a single-family house you rent out or multi-family house like a duplex or triplex or if you have commercial real estate property it's all going to be recorded here on Schedule E so looking down here you go to the form, so it Schedules E looks like so the first one part one here they're going to ask you did you make any payments in 2012 that required your file forms 1099 so again a 1099 is just if you paid someone over six hundred dollars to do work for you, and they weren't an employer they're just an individual contractor you're going to have to issue them a 1099 so if you did pay one person more than six hundred dollars you're going to click yes here Part B is just if yes did you or will you file required forms and you better click yes here if you click yes above alright so the physical address for each property typically when you're using tax software you'll fill out a separate one for each property, so we're just going to put one here six one North Street we use my home time here Willard Ohio four eight nine zero okay so type of property there's typically there'll be a drop-down menu here when you're filling out in tax software residential commercial or multifamily stuff like that, so we're just going to say this is a residential property favorite rental days how many days did you use this as a rental versus how many days did you use it for personal use if this is a traditional rental property this is going to be 365 you're not going to use it for personal use if you do use it for personal use it is bringing up a whole other set of tax rules there, so we won't get into that today, but that's for people who mostly have vacation properties in they use part of it themselves and then rent it out for other parts of the year so for now we're just going to say 365 there okay so here we get into the good stuff part one is income rents received now this is a lot of people try and give me this number they take the rents they receive so let's say they get a thousand a month that's twelve thousand a year, and they subtract their mortgage payment from that that is not what you do here this is just exactly what you received in rent so if the rent that your tenant pays you is a thousand a month, and they were there all year you paid twelve thousand rents for the year royalties will ignore that for now again that's for people who have steaks and like oil wells and stuff like that okay part of our mine five here we'll get into expenses advertising expenses this is typically if you had to put it in a newspaper or spend money on the internet to advertise it, so it's usually not huge money for rental properties, but it could be depending on how...

People Also Ask about instructions 1040 schedule income

How do I download a document from the IRS?

Where do you put royalties on tax return?

How do I submit IRS forms?

How do I save a 1040 as a PDF?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send unrecaptured section 1250 gain worksheet for eSignature?

How do I edit capital loss carryover worksheet straight from my smartphone?

How do I edit irs capital loss carryover worksheet on an iOS device?

What is IRS Instruction 1040 - Schedule E?

Who is required to file IRS Instruction 1040 - Schedule E?

How to fill out IRS Instruction 1040 - Schedule E?

What is the purpose of IRS Instruction 1040 - Schedule E?

What information must be reported on IRS Instruction 1040 - Schedule E?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.