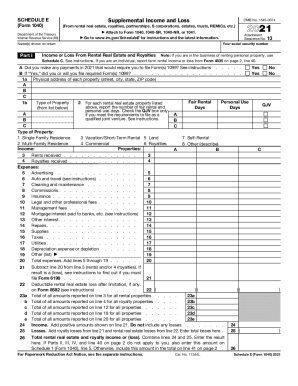

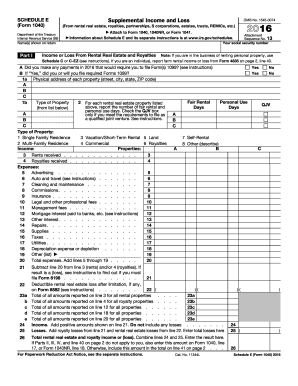

IRS Instruction 1040 - Schedule E free printable template

Show details

You generally use Form 1099-MISC Miscel- Future Developments For the latest information about developments related to Schedule E Form 1040 and its instructions such as legislation enacted after they were published go to www.irs.gov/form1040. Except as otherwise provided in the Internal Revenue Code gross income includes all income from whatever source derived. Gross income however does not include extraterritorial income that is qualifying foreign trade income under certain circumstances. Use...

pdfFiller is not affiliated with IRS

Get, Create, Make and Sign

Edit your schedule e 2011 form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your schedule e 2011 form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing schedule e 2011 form online

To use our professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit schedule e 2011 form. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

Dealing with documents is always simple with pdfFiller.

IRS Instruction 1040 - Schedule E Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out schedule e 2011 form

How to fill out schedule e 2011 form?

01

Gather all necessary documents and information related to rental income and expenses.

02

Enter the information about your rental property, such as its address and the type of property it is.

03

Report the total rental income received from all rental properties you own during the year.

04

Deduct the expenses associated with your rental properties, such as property management fees, repairs, and mortgage interest paid.

05

Determine if you had any losses or gains from the rental properties and report them accordingly.

06

Calculate the net income or loss from rental activities and transfer that figure to the appropriate section on your tax return.

Who needs schedule e 2011 form?

01

Individuals who own rental properties and receive rental income.

02

Landlords who have expenses related to the rental properties that they wish to deduct from their taxes.

03

Taxpayers who had any rental income or losses during the tax year 2011 and need to report them to the IRS.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is schedule e form?

Schedule E is a tax form used by taxpayers to report income and losses from rental real estate, royalties, partnerships, S corporations, estates, trusts, and residual interests in REMICs.

Who is required to file schedule e form?

Individuals and entities who have rental real estate income, royalty income, partnership income, S corporation income, estate and trust income, and residual interest income in REMICs are required to file Schedule E form.

How to fill out schedule e form?

To fill out Schedule E form, you need to provide information about your rental real estate income, royalty income, partnership income, S corporation income, estate and trust income, and residual interest income. You will also need to provide details about any expenses and losses associated with these sources of income.

What is the purpose of schedule e form?

The purpose of Schedule E form is to report income and losses from rental real estate, royalties, partnerships, S corporations, estates, trusts, and residual interests in REMICs. It helps taxpayers accurately report their income and determine the tax liability associated with these sources of income.

What information must be reported on schedule e form?

On Schedule E form, you must report your rental real estate income, royalty income, partnership income, S corporation income, estate and trust income, and residual interest income. You must also report any expenses, losses, and deductions associated with these sources of income.

When is the deadline to file schedule e form in 2023?

The deadline to file Schedule E form in 2023 is April 17, 2024.

What is the penalty for the late filing of schedule e form?

The penalty for late filing of Schedule E form is generally 5% of the unpaid tax amount for each month or part of a month the form is late, up to a maximum of 25% of the unpaid tax amount.

How can I edit schedule e 2011 form from Google Drive?

Using pdfFiller with Google Docs allows you to create, amend, and sign documents straight from your Google Drive. The add-on turns your schedule e 2011 form into a dynamic fillable form that you can manage and eSign from anywhere.

How can I get schedule e 2011 form?

It's simple with pdfFiller, a full online document management tool. Access our huge online form collection (over 25M fillable forms are accessible) and find the schedule e 2011 form in seconds. Open it immediately and begin modifying it with powerful editing options.

How do I complete schedule e 2011 form on an Android device?

On Android, use the pdfFiller mobile app to finish your schedule e 2011 form. Adding, editing, deleting text, signing, annotating, and more are all available with the app. All you need is a smartphone and internet.

Fill out your schedule e 2011 form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.