IRS Instruction 1040 - Schedule E 2024 free printable template

Show details

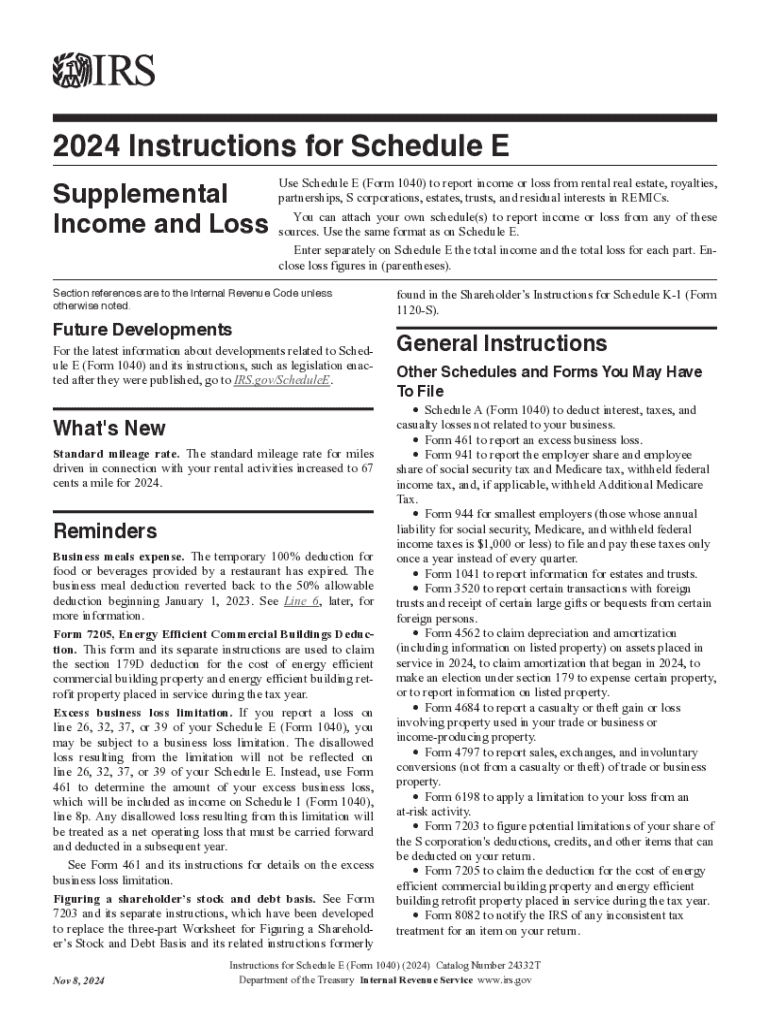

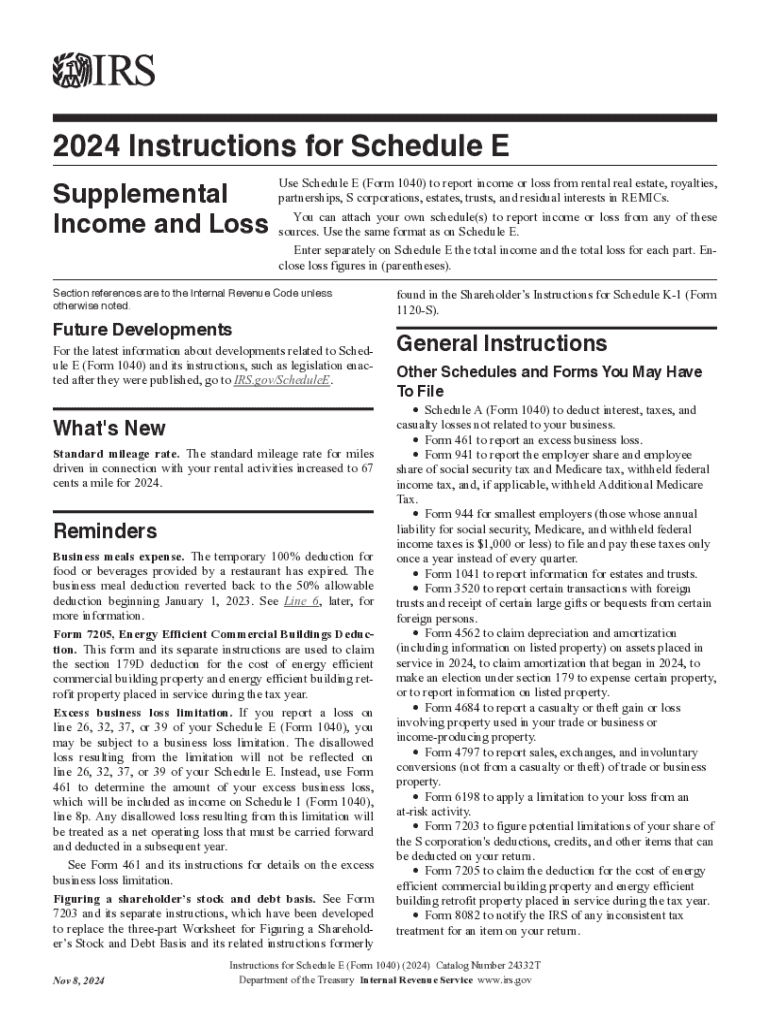

2024 Instructions for Schedule E Supplemental Income and LossUse Schedule E (Form 1040) to report income or loss from rental real estate, royalties, partnerships, S corporations, estates, trusts,

pdfFiller is not affiliated with IRS

Get, Create, Make and Sign IRS Instruction 1040 - Schedule E

Edit your IRS Instruction 1040 - Schedule E form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your IRS Instruction 1040 - Schedule E form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing IRS Instruction 1040 - Schedule E online

Use the instructions below to start using our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit IRS Instruction 1040 - Schedule E. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

IRS Instruction 1040 - Schedule E Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out IRS Instruction 1040 - Schedule E

How to fill out IRS Instruction 1040 - Schedule E

01

Gather your income documents related to rental properties, partnerships, S corporations, estates, trusts, and royalties.

02

Obtain a copy of IRS Form 1040 and Schedule E.

03

Begin with Part I to report your rental income and expenses. Fill in the property address, income from rents, and various expense categories.

04

Proceed to Part II to report income or loss from partnerships and S corporations. List each entity and corresponding amounts.

05

Use Part III for estates and trusts, reporting income or loss from these sources.

06

Complete Part IV for royalties by detailing the income received.

07

Make sure to total each part and carry the totals to the appropriate line on Form 1040.

08

Review the completed Schedule E for accuracy before submission.

Who needs IRS Instruction 1040 - Schedule E?

01

Individuals who own rental properties and need to report rental income and expenses.

02

Partners in partnerships who must report their share of income or loss.

03

Shareholders of S corporations who need to report their income from these entities.

04

Beneficiaries of estates and trusts who receive income from these sources.

05

Individuals receiving royalty income from literary, artistic, or natural resource rights.

Fill

form

: Try Risk Free

People Also Ask about

How do I download a document from the IRS?

Right click on the title link. Select "Save Target As" (Internet Explorer) or "Save Link As" (Microsoft Edge, Google Chrome, Mozilla Firefox, and Apple Safari) when presented with a menu (if your mouse is configured for left-handed operation use the left mouse button).

Where do you put royalties on tax return?

You generally report royalties in Part I of Schedule E (Form 1040 or Form 1040-SR), Supplemental Income and Loss. However, if you hold an operating oil, gas, or mineral interest or are in business as a self-employed writer, inventor, artist, etc., report your income and expenses on Schedule C.

How do I submit IRS forms?

Submit Forms via Fax or Mail If you can't submit your forms online, you can fax or mail your forms directly to the IRS. For information, see Instructions for Form 2848 or Instructions Form 8821.

How do I save a 1040 as a PDF?

Click the Your Federal or Your State Return. This will open the document in a PDF format. Right click the document and click "Save as" or "Save target As" (depending on your browser). If this option is not available, open the PDF and choose to "Save As" directly from the PDF viewer.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send IRS Instruction 1040 - Schedule E for eSignature?

To distribute your IRS Instruction 1040 - Schedule E, simply send it to others and receive the eSigned document back instantly. Post or email a PDF that you've notarized online. Doing so requires never leaving your account.

How do I edit IRS Instruction 1040 - Schedule E straight from my smartphone?

The easiest way to edit documents on a mobile device is using pdfFiller’s mobile-native apps for iOS and Android. You can download those from the Apple Store and Google Play, respectively. You can learn more about the apps here. Install and log in to the application to start editing IRS Instruction 1040 - Schedule E.

How do I edit IRS Instruction 1040 - Schedule E on an iOS device?

No, you can't. With the pdfFiller app for iOS, you can edit, share, and sign IRS Instruction 1040 - Schedule E right away. At the Apple Store, you can buy and install it in a matter of seconds. The app is free, but you will need to set up an account if you want to buy a subscription or start a free trial.

What is IRS Instruction 1040 - Schedule E?

IRS Instruction 1040 - Schedule E is a form used by taxpayers to report income and losses from rental real estate, royalties, partnerships, S corporations, estates, trusts, and more. It is part of the federal income tax return.

Who is required to file IRS Instruction 1040 - Schedule E?

Taxpayers who receive income from rental properties, royalties, partnerships, S corporations, estates, or trusts have to file Schedule E to report that income and any associated expenses.

How to fill out IRS Instruction 1040 - Schedule E?

To fill out Schedule E, taxpayers must provide detailed information about the rental income, allowable expenses, and any other relevant financial data from the entities they are connected with. This includes filling out specific lines and sections for each income source.

What is the purpose of IRS Instruction 1040 - Schedule E?

The purpose of Schedule E is to enable taxpayers to report various types of income and losses that arise outside of traditional employment, ensuring that the IRS has accurate information about their income sources.

What information must be reported on IRS Instruction 1040 - Schedule E?

Taxpayers must report the type of property, income received, expenses incurred, and details related to partnerships, S corporations, estates, or trusts, including their share of income or losses.

Fill out your IRS Instruction 1040 - Schedule E online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

IRS Instruction 1040 - Schedule E is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.