MO Form 4854 2024-2025 free printable template

Show details

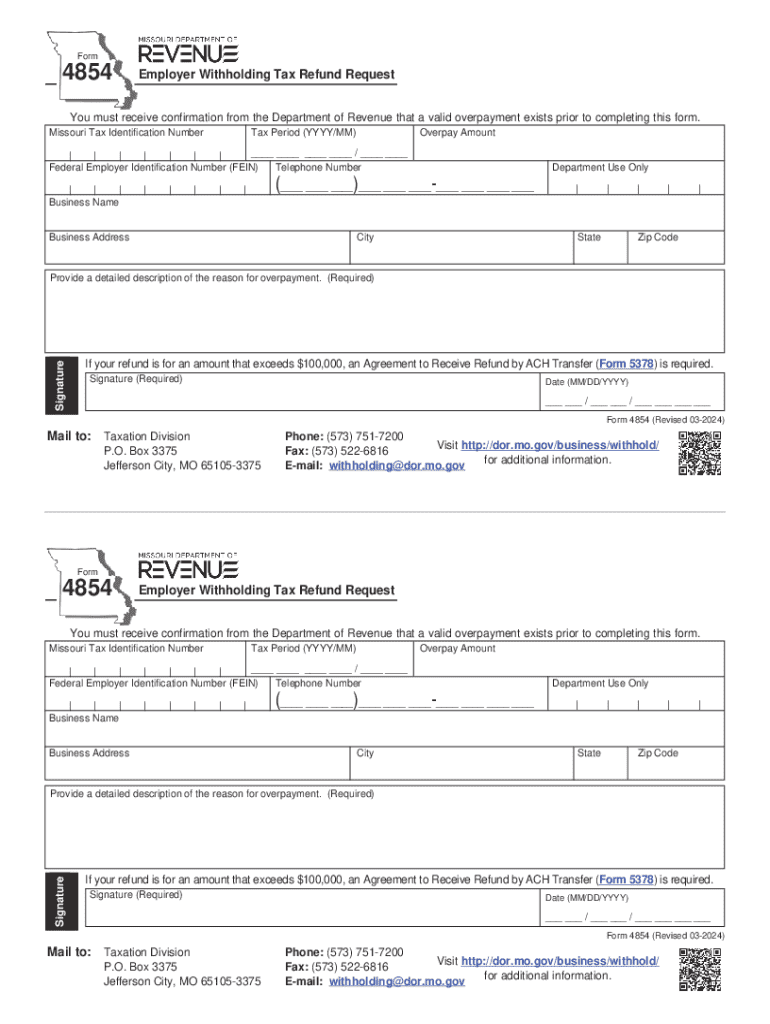

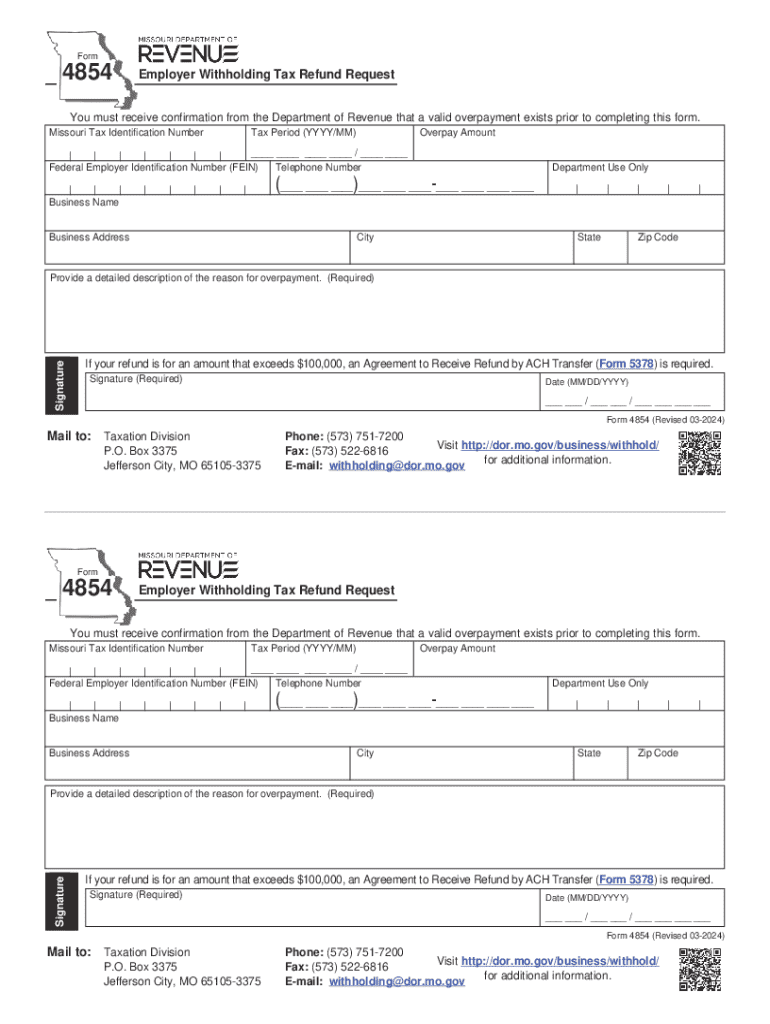

Reset FormPrint FormForm4854Employer Withholding Tax Refund RequestYou must receive confirmation from the Department of Revenue that a valid overpayment exists prior to completing this form.

Missouri

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign mo form 4854 2024-2025

Edit your mo form 4854 2024-2025 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your mo form 4854 2024-2025 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing mo form 4854 2024-2025 online

To use the services of a skilled PDF editor, follow these steps below:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit mo form 4854 2024-2025. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

MO Form 4854 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out mo form 4854 2024-2025

How to fill out MO Form 4854

01

Obtain the MO Form 4854 from the official Missouri Department of Revenue website or your local office.

02

Read the instructions carefully to understand the purpose of the form.

03

Fill out your personal information including your name, address, and Social Security number.

04

Indicate the tax year that the form applies to.

05

Provide details about your income and any deductions or credits you are claiming.

06

Complete the sections that apply to your specific tax situation.

07

Review the form for accuracy and completeness.

08

Sign and date the form where required.

09

Submit the form according to the instructions, either electronically or by mail.

Who needs MO Form 4854?

01

Individuals who are residents of Missouri and need to report income for a specific tax year.

02

Taxpayers who have received a 1099 form or other income reporting documents.

03

Individuals claiming deductions or credits that require additional information.

Fill

form

: Try Risk Free

People Also Ask about

How often do I have to file MO 941?

If you do not have a pre-printed voucher booklet, obtain a blank Form MO-941. Withholding tax returns may be filed on a quarter-monthly (weekly), monthly, quarterly or annual basis. Your filing frequency is determined by the amount of income tax that is withheld from the wages you pay.

How much is Missouri state tax withholding?

Withholding Formula (Effective Pay Period 06, 2022) If the Amount of Taxable Income Is:The Amount of Tax Withholding Should Be:Over $0 but not over $1,1211.5%Over $1,121 but not over $2,242$16.82 plus 2.0% of excess over $1,121Over $2,242 but not over $3,363$39.24 plus 2.5% of excess over $2,2426 more rows • Mar 30, 2022

What is the Missouri discount tax?

When an employer's state withholding exceeds certain thresholds, the Missouri Discount rate is reduced. The discount is 2% from $0.00 to $5,000, 1% from $5,001-$10,000 and 0.5% for withholding is in excess of $10,000.

How do I get my Missouri tax PIN number?

Your PIN is a 4 digit number located on the cover of your voucher booklet or return. If you have entered an invalid Missouri Tax Identification Number, you will receive the following message: The Missouri Tax Identification Number you entered is an invalid number.

Do I have to pay Missouri state income tax?

If you or your spouse earned Missouri source income of $600 or more (other than military pay), you must file a Missouri income tax return by completing Form MO-1040 and Form MO-NRI. Be sure to include a copy of your federal return.

Does Missouri withhold state taxes?

Yes, an employer is required to withhold Missouri tax from all wages paid to an employee in exchange for services the employee performs for the employer in Missouri.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get mo form 4854 2024-2025?

The premium version of pdfFiller gives you access to a huge library of fillable forms (more than 25 million fillable templates). You can download, fill out, print, and sign them all. State-specific mo form 4854 2024-2025 and other forms will be easy to find in the library. Find the template you need and use advanced editing tools to make it your own.

How do I make edits in mo form 4854 2024-2025 without leaving Chrome?

mo form 4854 2024-2025 can be edited, filled out, and signed with the pdfFiller Google Chrome Extension. You can open the editor right from a Google search page with just one click. Fillable documents can be done on any web-connected device without leaving Chrome.

Can I create an eSignature for the mo form 4854 2024-2025 in Gmail?

You can easily create your eSignature with pdfFiller and then eSign your mo form 4854 2024-2025 directly from your inbox with the help of pdfFiller’s add-on for Gmail. Please note that you must register for an account in order to save your signatures and signed documents.

What is MO Form 4854?

MO Form 4854 is a tax form used in Missouri for reporting certain information related to income tax liabilities and credits.

Who is required to file MO Form 4854?

Individuals and entities who are subject to Missouri income tax and have specific tax credits or liabilities that need to be reported must file MO Form 4854.

How to fill out MO Form 4854?

To fill out MO Form 4854, gather your income and tax credit information, complete the form sections by entering the necessary details, and ensure all required signatures are obtained before submission.

What is the purpose of MO Form 4854?

The purpose of MO Form 4854 is to provide the Missouri Department of Revenue with relevant information about tax credits, liabilities, and other pertinent financial details to ensure proper tax calculation and compliance.

What information must be reported on MO Form 4854?

Information that must be reported on MO Form 4854 includes personal identification details, income data, types of tax credits being claimed, and any other relevant financial information applicable to the tax year.

Fill out your mo form 4854 2024-2025 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Mo Form 4854 2024-2025 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.