Get the free 500 and over

Show details

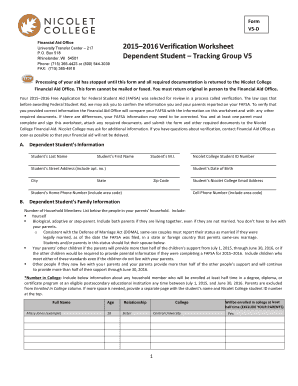

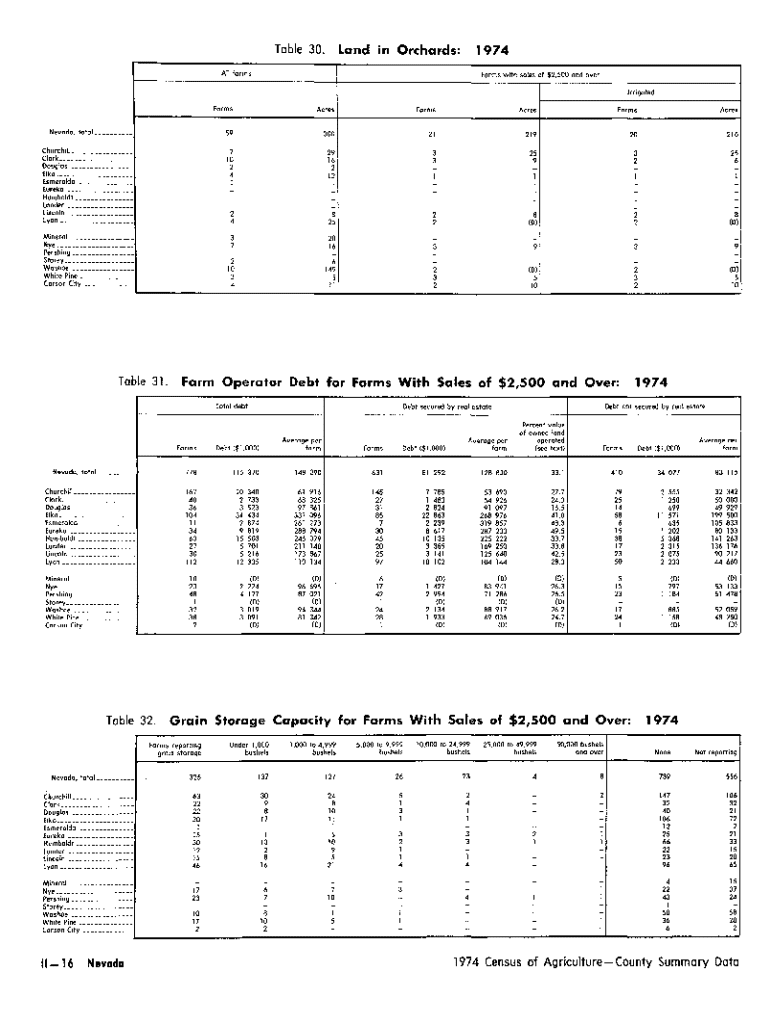

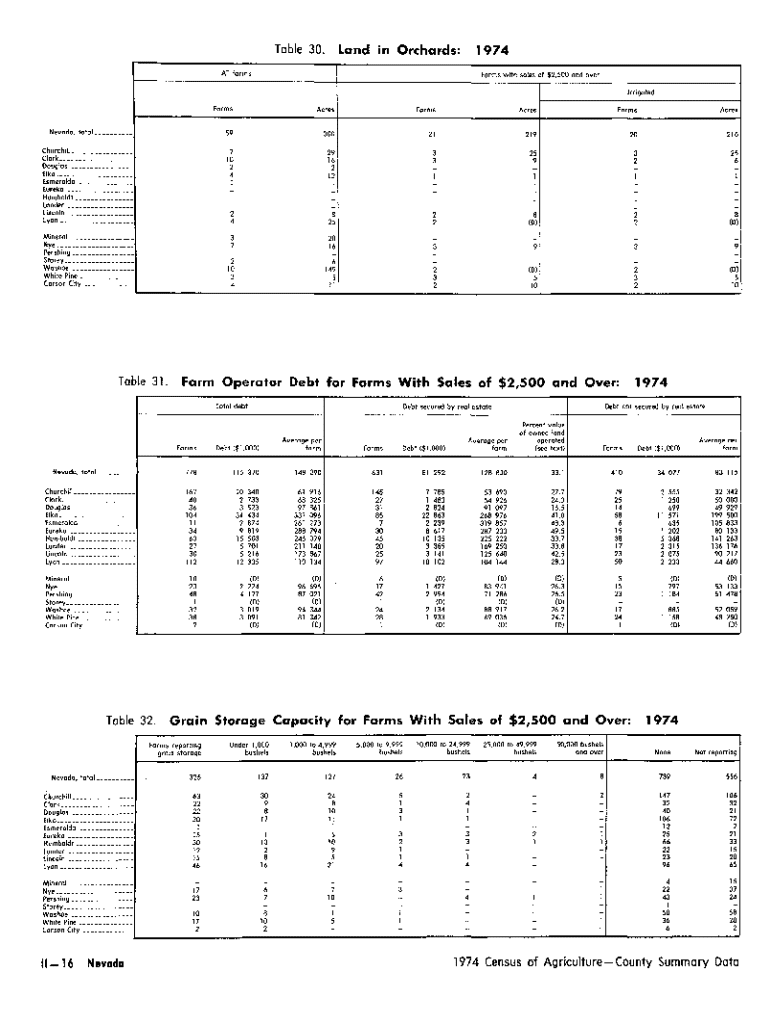

Table 30.1974Land in Orchards:All formsForms with soles of $2.500 and overIrrigatedNevada, toto\' ___ _Churchill ___ _ ClorL ___ _Douglas ___ _Elko ___ _Esmeralda ___ _ Eureka ___ _FarmsAcresFormsAcresFormsAcres5930021219202167

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 500 and over

Edit your 500 and over form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 500 and over form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing 500 and over online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit 500 and over. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

Dealing with documents is simple using pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

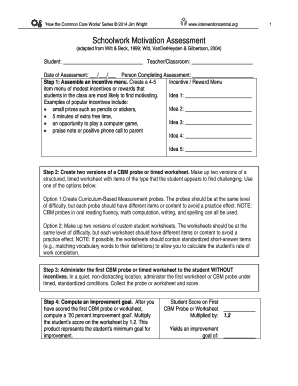

How to fill out 500 and over

How to fill out 500 and over

01

Gather all necessary financial documents, including income statements, tax returns, and bank statements.

02

Review your current financial situation and calculate your total income and expenses.

03

Identify the specific form or application that requires filling out the '500 and over' section.

04

Carefully read the instructions provided for the section, ensuring you understand what information is required.

05

Fill out each field accurately, providing detailed information where necessary.

06

Double-check all entries for errors or omissions before submitting the form.

07

Keep a copy of the filled-out form for your records.

Who needs 500 and over?

01

Individuals or businesses applying for loans or credit that require income verification over $500.

02

Taxpayers filing specific tax forms that include income thresholds over $500.

03

People seeking grants or government assistance programs that have financial eligibility criteria based on income levels.

04

Businesses providing detailed financial reports or projections to stakeholders or investors.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my 500 and over in Gmail?

The pdfFiller Gmail add-on lets you create, modify, fill out, and sign 500 and over and other documents directly in your email. Click here to get pdfFiller for Gmail. Eliminate tedious procedures and handle papers and eSignatures easily.

How can I send 500 and over to be eSigned by others?

Once your 500 and over is complete, you can securely share it with recipients and gather eSignatures with pdfFiller in just a few clicks. You may transmit a PDF by email, text message, fax, USPS mail, or online notarization directly from your account. Make an account right now and give it a go.

How do I edit 500 and over online?

The editing procedure is simple with pdfFiller. Open your 500 and over in the editor, which is quite user-friendly. You may use it to blackout, redact, write, and erase text, add photos, draw arrows and lines, set sticky notes and text boxes, and much more.

What is 500 and over?

500 and over refers to a specific tax filing requirement for individuals or entities that have a certain threshold of income or transactions, usually indicating that they must report their earnings or financial activities.

Who is required to file 500 and over?

Individuals or entities with gross income, transactions, or payments exceeding the threshold of $500 are generally required to file a report or form associated with this requirement.

How to fill out 500 and over?

To fill out 500 and over, one must gather the required financial information, complete the necessary forms by providing accurate income and transaction details, and ensure all submissions meet the guidelines set by the tax authorities.

What is the purpose of 500 and over?

The purpose of 500 and over is to ensure compliance with tax regulations by monitoring income and transactions that exceed a specified amount, helping to prevent tax evasion and ensure accurate tax reporting.

What information must be reported on 500 and over?

Information required on 500 and over typically includes the total amount of income, types of transactions, party names involved, and other relevant financial details that contribute to the overall taxable amount.

Fill out your 500 and over online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

500 And Over is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.