Get the free Forms with expenses of$110 $499

Show details

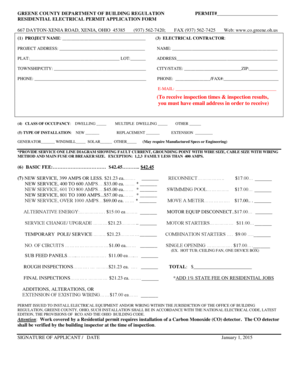

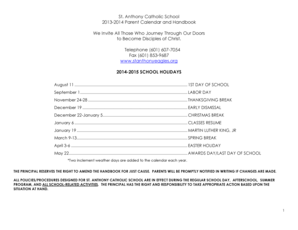

Table 6.Selected Farm Production Expenses:1978, 1974, and 1969[1978 dolo are based on a sample of forms; see lexl] 1978All Farms1978All FarmsExpenses Farms($1.000)19741969955 27475998 21 580233 120

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign forms with expenses of110

Edit your forms with expenses of110 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your forms with expenses of110 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing forms with expenses of110 online

Use the instructions below to start using our professional PDF editor:

1

Check your account. In case you're new, it's time to start your free trial.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit forms with expenses of110. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out forms with expenses of110

How to fill out forms with expenses of110

01

Gather all receipts and documents related to expenses of 110.

02

Identify the specific form you need to fill out for expense reporting.

03

Start by entering the date of each expense in the respective column.

04

Fill in the description of each expense clearly.

05

Specify the amount of each expense, ensuring accuracy.

06

Attach any required supporting documents or receipts as evidence.

07

Review the completed form for any errors or missing information.

08

Submit the form to the appropriate department or individual for approval.

Who needs forms with expenses of110?

01

Employees who incur expenses related to work activities.

02

Freelancers or contractors seeking reimbursement for work-related expenses.

03

Small business owners documenting expenses for accounting purposes.

04

Individuals preparing financial reports or tax filings that include expenses.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my forms with expenses of110 in Gmail?

Using pdfFiller's Gmail add-on, you can edit, fill out, and sign your forms with expenses of110 and other papers directly in your email. You may get it through Google Workspace Marketplace. Make better use of your time by handling your papers and eSignatures.

How can I get forms with expenses of110?

The premium subscription for pdfFiller provides you with access to an extensive library of fillable forms (over 25M fillable templates) that you can download, fill out, print, and sign. You won’t have any trouble finding state-specific forms with expenses of110 and other forms in the library. Find the template you need and customize it using advanced editing functionalities.

How can I edit forms with expenses of110 on a smartphone?

The best way to make changes to documents on a mobile device is to use pdfFiller's apps for iOS and Android. You may get them from the Apple Store and Google Play. Learn more about the apps here. To start editing forms with expenses of110, you need to install and log in to the app.

What is forms with expenses of 110?

Forms with expenses of 110 refer to specific tax forms that must be filed to report certain types of business expenses, typically related to a particular tax regulation or requirement.

Who is required to file forms with expenses of 110?

Businesses, individuals, or entities that incur expenses that meet the criteria established by the taxation authority and exceed $110 are generally required to file forms with expenses of 110.

How to fill out forms with expenses of 110?

To fill out forms with expenses of 110, you must gather all relevant expense receipts, enter the required information in the appropriate sections of the form, and ensure that all calculations are accurate before submitting it.

What is the purpose of forms with expenses of 110?

The purpose of forms with expenses of 110 is to report specific expenses incurred by a taxpayer for the purpose of determining taxable income and ensuring compliance with tax obligations.

What information must be reported on forms with expenses of 110?

The information that must be reported includes the types of expenses, amounts spent, dates of expenditure, and any relevant identification or categorization required by the tax authority.

Fill out your forms with expenses of110 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Forms With Expenses of110 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.