IN State Form 46402 2024-2025 free printable template

Show details

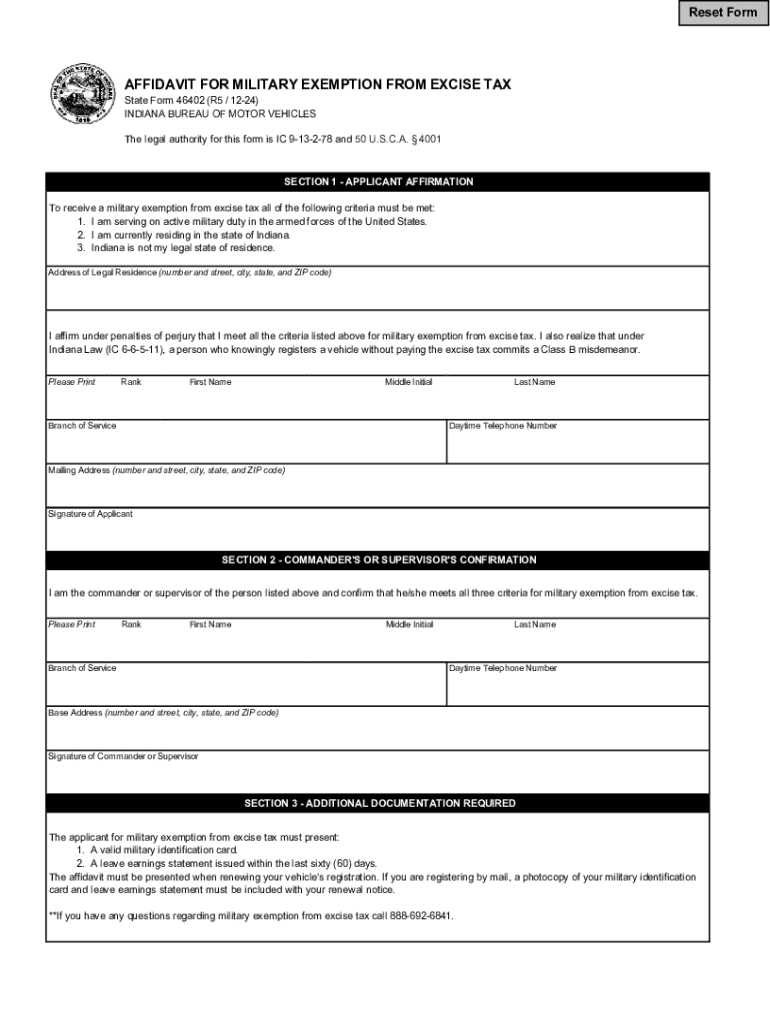

Reset FormAFFIDAVIT FOR MILITARY EXEMPTION FROM EXCISE TAXState Form 46402 (R5 / 1224)

INDIANA BUREAU OF MOTOR VEHICLESThe legal authority for this form is IC 913278 and 50 U.S.C.A. 4001SECTION 1

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign state form 46402

Edit your state form 46402 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your state form 46402 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit state form 46402 online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit state form 46402. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to work with documents. Check it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

IN State Form 46402 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out state form 46402

How to fill out IN State Form 46402

01

Obtain IN State Form 46402 from the Indiana Department of Revenue website or your local office.

02

Fill out the taxpayer identification section with your name, address, and Social Security number or tax identification number.

03

Indicate the type of form you are filing (individual, business, etc.).

04

Complete the financial information section accurately, providing necessary income and deduction details.

05

Review and sign the form to confirm all information is accurate.

06

Submit the completed form either electronically or by mailing it to the appropriate address provided on the form.

Who needs IN State Form 46402?

01

Individuals or businesses filing income tax returns in Indiana.

02

Taxpayers seeking to claim deductions, credits, or special tax considerations.

03

People needing to report specific financial information to the state of Indiana.

Fill

form

: Try Risk Free

People Also Ask about

What is the difference between a w9 and tax exemption certificate?

Purchasers submit resale certificates to vendors, who typically initiate the request. The person or company making the payment, rather than the person receiving the payment, typically requests the Form W-9. The W-9 relates to federal income tax, while resale certificates relate to state sales tax.

How do I get a tax exempt form in Texas?

How do we apply for an exemption? To apply for franchise and sales tax exemptions, complete and submit Form AP-204, Texas Application for Exemption – Federal and All Others (PDF) to the Comptroller's office. Include a copy of the IRS-issued exemption determination letter with any addenda.

How to fill out a tax exempt form in WI?

A fully completed certificate must include (1) the complete name and address of the purchaser, (2) general description of the purchaser's business (type of business), (3) reason for exemption, and (4) signature of purchaser unless the certificate is received electronically.

How do you qualify for tax exemption in Texas?

To qualify for the general residence homestead exemption an individual must have an ownership interest in the property and use the property as the individual's principal residence. An applicant is required to state that he or she does not claim an exemption on another residence homestead in or outside of Texas.

How do I get a US sales tax exemption certificate?

To apply for an initial or renewal tax exemption card, eligible missions and their members should submit an application on the Department's E-Government (E-Gov) system. Applications are generally processed within five business days.

Does Texas have a tax exemption certificate?

Description: This form is used to claim an exemption from payment of sales and use taxes (for the purchase of taxable items).

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute state form 46402 online?

pdfFiller makes it easy to finish and sign state form 46402 online. It lets you make changes to original PDF content, highlight, black out, erase, and write text anywhere on a page, legally eSign your form, and more, all from one place. Create a free account and use the web to keep track of professional documents.

How do I fill out the state form 46402 form on my smartphone?

On your mobile device, use the pdfFiller mobile app to complete and sign state form 46402. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to discover more about our mobile applications, the features you'll have access to, and how to get started.

How do I fill out state form 46402 on an Android device?

Use the pdfFiller Android app to finish your state form 46402 and other documents on your Android phone. The app has all the features you need to manage your documents, like editing content, eSigning, annotating, sharing files, and more. At any time, as long as there is an internet connection.

What is IN State Form 46402?

IN State Form 46402 is a document used by individuals and entities in Indiana to report certain tax information to the state.

Who is required to file IN State Form 46402?

Individuals and businesses that have specific tax obligations or transactions in Indiana are required to file IN State Form 46402.

How to fill out IN State Form 46402?

To fill out IN State Form 46402, you must provide your personal or business information, complete the required sections accurately, and ensure all calculations are correct.

What is the purpose of IN State Form 46402?

The purpose of IN State Form 46402 is to ensure compliance with state tax laws by reporting necessary information about income, deductions, and credits.

What information must be reported on IN State Form 46402?

The information that must be reported on IN State Form 46402 includes taxpayer identification details, income earned, deductions claimed, and any tax credits applicable.

Fill out your state form 46402 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

State Form 46402 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.