IN DLGF 12662 - Vermillion County 2024-2025 free printable template

Show details

Reset Form

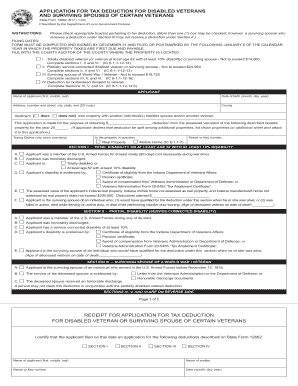

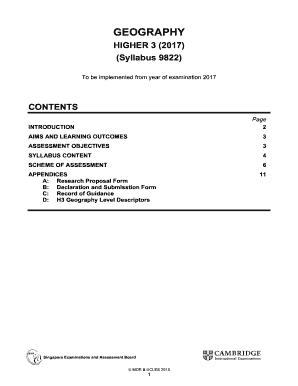

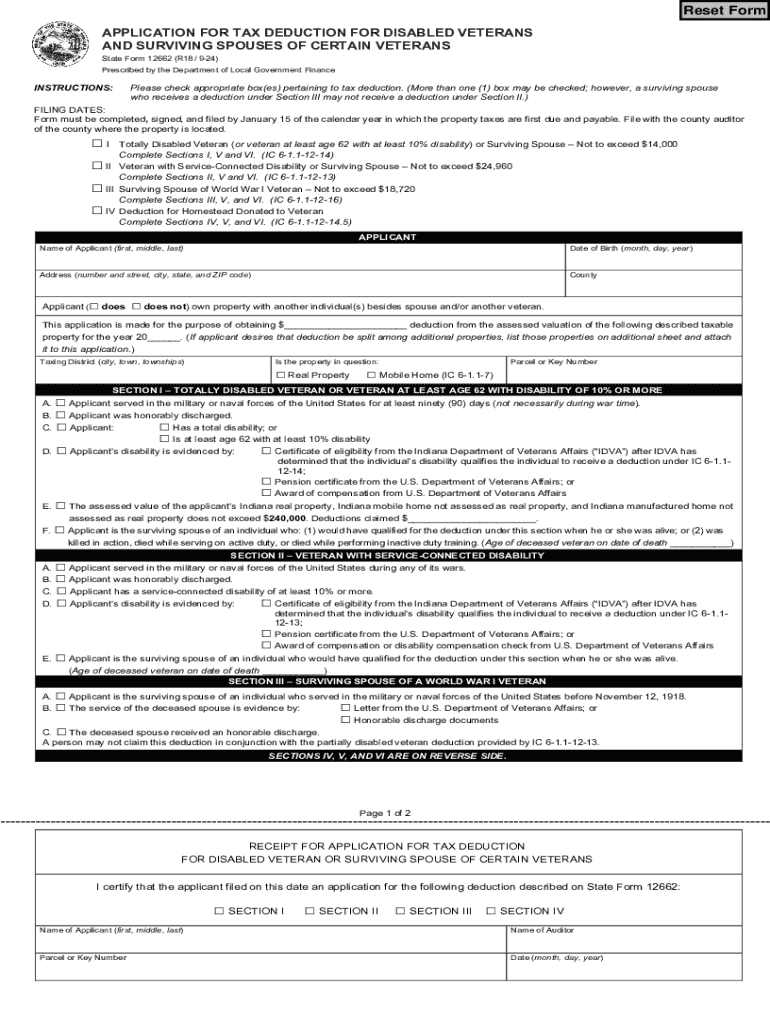

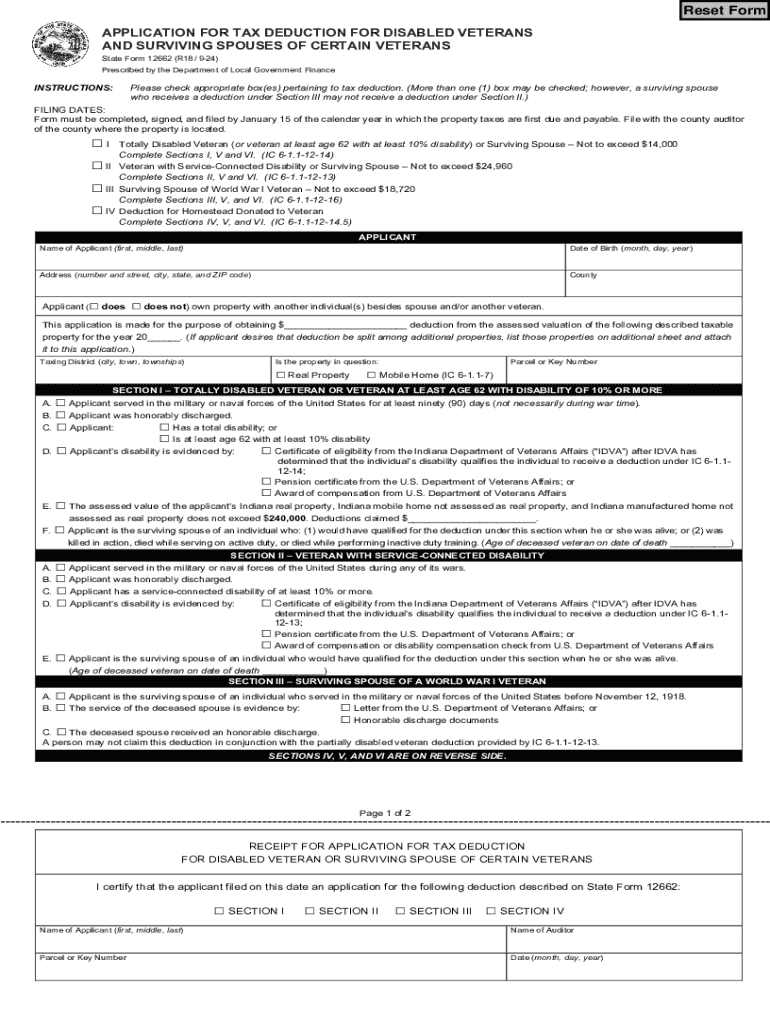

APPLICATION FOR TAX DEDUCTION FOR DISABLED VETERANS

AND SURVIVING SPOUSES OF CERTAIN VETERANS

State Form 12662 (R18 / 924)Prescribed by the Department of Local Government FinanceINSTRUCTIONS:Please

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign IN DLGF 12662 - Vermillion County

Edit your IN DLGF 12662 - Vermillion County form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your IN DLGF 12662 - Vermillion County form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit IN DLGF 12662 - Vermillion County online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit IN DLGF 12662 - Vermillion County. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

IN DLGF 12662 - Vermillion County Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out IN DLGF 12662 - Vermillion County

How to fill out IN DLGF 12662 - Vermillion County

01

Obtain the IN DLGF 12662 form from the Vermillion County website or local government office.

02

Read all instructions provided with the form to ensure proper completion.

03

Fill in your personal information including name, address, and contact details.

04

Complete all sections relevant to your property or situation, ensuring to provide accurate data.

05

Review the completed form for any errors or omissions.

06

Sign and date the form as required.

07

Submit the completed form to the appropriate Vermillion County office by the specified deadline.

Who needs IN DLGF 12662 - Vermillion County?

01

Property owners in Vermillion County looking to apply for certain tax benefits or exemptions.

02

Individuals or entities appealing property assessments in Vermillion County.

03

Anyone seeking information or clarification on property tax assessments in Vermillion County.

Fill

form

: Try Risk Free

People Also Ask about

What is the deadline for filing mortgage exemption in Indiana?

Applications completed by December 31 will be effective for the current year and will reflect on the following years tax bill.

Do 100% disabled veterans pay property tax in Indiana?

The amount of the deduction is equal to the service connected disability of the individual deducted from the assessed value of the property. Example: If the individual is totally disabled 100% of the assessed value is deducted.

How does the Indiana homestead exemption work?

The standard homestead deduction is either 60% of your property's assessed value or a maximum of $45,000, whichever is less. The supplemental homestead deduction is based on the assessed value of your property and equals: 35% of the assessed value of a property that is less than $600,000.

How do I file a mortgage exemption in Indiana?

You may file in person, via mail or online (depending on the county in which your property is located). To file in person, you should take the packet you received at closing to your county auditor's office. Tell them you need to file your mortgage exemption.

Is Indiana doing away with mortgage exemption?

As of January 1, 2023, the Mortgage deduction has been repealed. This means that property owners are no longer able to apply for/receive this deduction as of the January 1, 2023 assessment date payable in 2024 property tax cycle.

What is the over 65 property tax exemption in Indiana?

If you receive the over 65 or surviving spouse deduction, you will receive a reduction in your home's assessed value of $14,000 or half the assessed value, whichever is less. The lower the assessed value of your home, the smaller your property tax bill.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my IN DLGF 12662 - Vermillion County directly from Gmail?

The pdfFiller Gmail add-on lets you create, modify, fill out, and sign IN DLGF 12662 - Vermillion County and other documents directly in your email. Click here to get pdfFiller for Gmail. Eliminate tedious procedures and handle papers and eSignatures easily.

How can I modify IN DLGF 12662 - Vermillion County without leaving Google Drive?

People who need to keep track of documents and fill out forms quickly can connect PDF Filler to their Google Docs account. This means that they can make, edit, and sign documents right from their Google Drive. Make your IN DLGF 12662 - Vermillion County into a fillable form that you can manage and sign from any internet-connected device with this add-on.

How do I complete IN DLGF 12662 - Vermillion County on an Android device?

Use the pdfFiller mobile app and complete your IN DLGF 12662 - Vermillion County and other documents on your Android device. The app provides you with all essential document management features, such as editing content, eSigning, annotating, sharing files, etc. You will have access to your documents at any time, as long as there is an internet connection.

What is IN DLGF 12662 - Vermillion County?

IN DLGF 12662 is a form used by Vermillion County for reporting data related to property tax assessments and related financial information as required by the Indiana Department of Local Government Finance.

Who is required to file IN DLGF 12662 - Vermillion County?

Entities involved in the assessment and collection of property taxes in Vermillion County, such as local government units and taxing districts, are required to file IN DLGF 12662.

How to fill out IN DLGF 12662 - Vermillion County?

To fill out IN DLGF 12662, individuals must complete the form by providing accurate data on property valuations, tax rates, and other financial information as specified in the instructions included with the form.

What is the purpose of IN DLGF 12662 - Vermillion County?

The purpose of IN DLGF 12662 is to ensure transparency and accountability in property tax assessments and to provide data necessary for the preparation of local government budgets and tax levies.

What information must be reported on IN DLGF 12662 - Vermillion County?

The information that must be reported on IN DLGF 12662 includes property values, tax levies, expenditure estimates, and additional financial data relevant to local government operations.

Fill out your IN DLGF 12662 - Vermillion County online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

IN DLGF 12662 - Vermillion County is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.