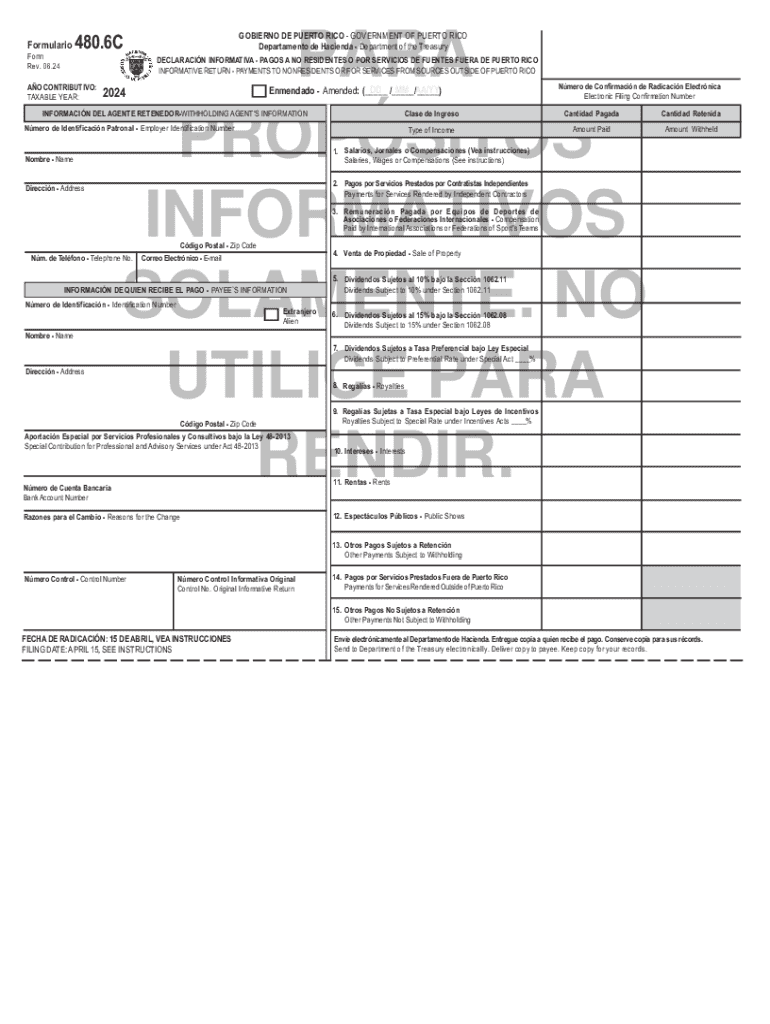

PR 480.6C 2024-2025 free printable template

Show details

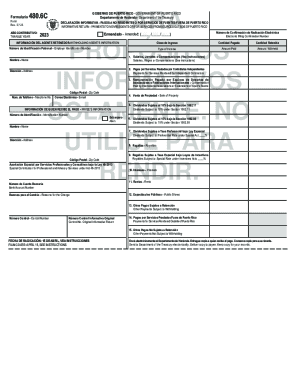

Formulario

FormPARA

PROPSITOS

INFORMATIVOS

SOLAMENTE. NO

UTILICE PARA

RENDIR.480.6CGOBIERNO DE PUERTO RICO GOVERNMENT OF PUERTO RICO

Departamento de Hacienda Department of the TreasuryDECLARACIN

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign form 480 6c

Edit your 480 6c puerto rico form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your puerto rico form 480 6 b form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing PR 4806C online

Use the instructions below to start using our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit PR 4806C. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

PR 480.6C Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out PR 4806C

How to fill out PR 480.6C

01

Begin by obtaining the PR 480.6C form from the appropriate source.

02

Carefully read the instructions provided with the form to understand the requirements.

03

Fill in your personal information accurately in the designated fields, including name, address, and contact details.

04

Provide any necessary identification numbers, such as Social Security Number or Tax ID, where required.

05

Complete each section of the form based on the specifics of your case or request.

06

Review the filled-out form for any errors or omissions before proceeding.

07

Sign and date the form at the bottom where indicated.

08

Submit the completed PR 480.6C form according to the instructions provided, either electronically or by mail.

Who needs PR 480.6C?

01

Individuals or entities seeking certification or permissions related to specific regulatory requirements.

02

Businesses that need to comply with governmental processes and secure approvals.

Fill

form

: Try Risk Free

People Also Ask about

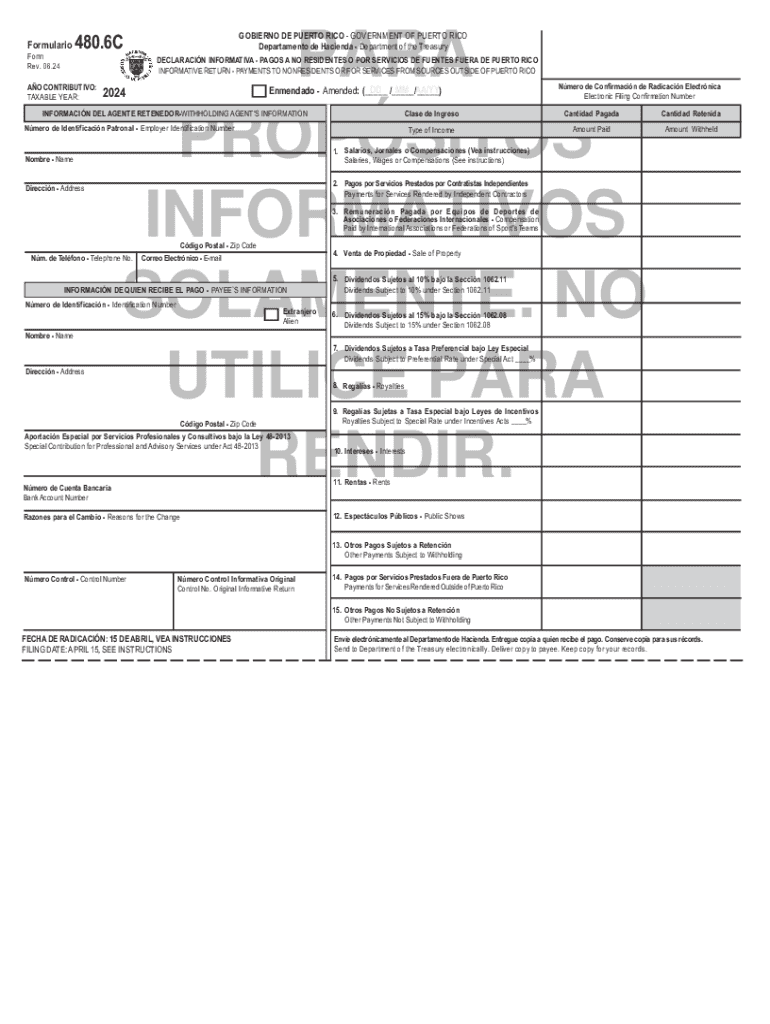

What is the form 480.6 C withholding?

480.6C - Form 480.6C is intended for non-residents of Puerto Rico. It covers investment income that has been subject to Puerto Rico source withholding. 480.6D - Form 480.6D is intended for residents of Puerto Rico. It covers exempt income and income subject to the Puerto Rico Alternate Basic Tax (ABT).

What is form 480 6C?

It covers investment income that has been subject to Puerto Rico source withholding. This form is for information only. You should only enter form 1099-DIV in your tax return.

What is 480.6 a gross proceeds?

What is tax Form 480.6A? Form 480.6A reports any taxable dividends and/or gross proceeds from realized capital gains or losses in your taxable investment account. This form will also report any interest paid out in your cash account.

What is 480.6 C in IRA?

480.6C—Reporting for non-residents of Puerto Rico who hold Puerto Rico-based securities in their account(s) for which taxes were withheld on gross income.

How do I report 480.6 C?

Yes, you will need to report this Puerto Rican Bank interest as income on your income tax returns. You can include this PR interest under the 1099-INT section as if you received a 1099-INT. Just make sure that you include this amount in USD.

What is 480.6 C on 1040?

480.6C - Form 480.6C is intended for non-residents of Puerto Rico. It covers investment income that has been subject to Puerto Rico source withholding.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute PR 4806C online?

pdfFiller makes it easy to finish and sign PR 4806C online. It lets you make changes to original PDF content, highlight, black out, erase, and write text anywhere on a page, legally eSign your form, and more, all from one place. Create a free account and use the web to keep track of professional documents.

How do I fill out PR 4806C using my mobile device?

You can easily create and fill out legal forms with the help of the pdfFiller mobile app. Complete and sign PR 4806C and other documents on your mobile device using the application. Visit pdfFiller’s webpage to learn more about the functionalities of the PDF editor.

Can I edit PR 4806C on an iOS device?

Use the pdfFiller mobile app to create, edit, and share PR 4806C from your iOS device. Install it from the Apple Store in seconds. You can benefit from a free trial and choose a subscription that suits your needs.

What is PR 480.6C?

PR 480.6C is a specific tax form used by individuals or entities to report certain types of income or transactions to tax authorities.

Who is required to file PR 480.6C?

Individuals or entities that meet specific income thresholds or engage in particular transactions as defined by tax regulations are required to file PR 480.6C.

How to fill out PR 480.6C?

To fill out PR 480.6C, taxpayers need to complete each section of the form accurately by entering the required information such as personal identification details, income types, and calculations as prescribed by the filing guidelines.

What is the purpose of PR 480.6C?

The purpose of PR 480.6C is to enable tax authorities to assess and verify income reported by individuals or entities, ensuring compliance with tax laws.

What information must be reported on PR 480.6C?

Reported information on PR 480.6C typically includes personal identification information, details of income generated, deductions claimed, and any relevant transactional data.

Fill out your PR 4806C online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

PR 4806c is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.