Get the free Meal Deduction Authorization

Show details

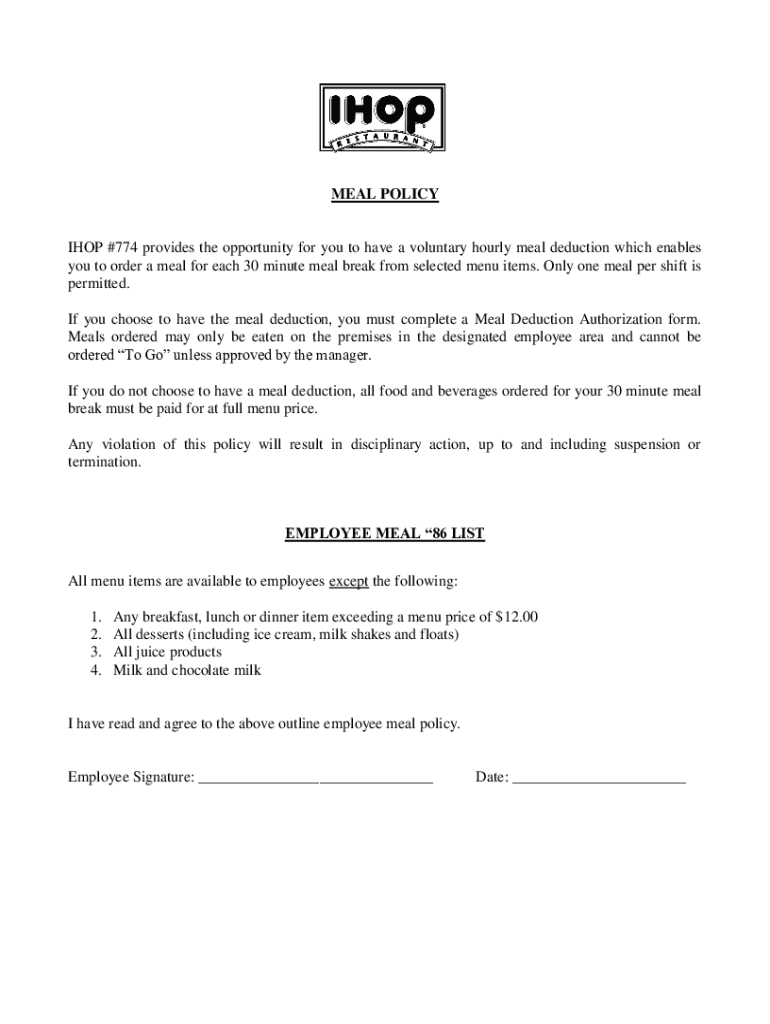

This policy outlines the guidelines for employees at IHOP #774 regarding meal deductions during work shifts. It details the allowance of one meal per shift from select menu items, the requirement to complete the Meal Deduction Authorization form if opting in, rules regarding on-premises dining, and consequences for policy violations.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign meal deduction authorization

Edit your meal deduction authorization form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your meal deduction authorization form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing meal deduction authorization online

Follow the guidelines below to benefit from a competent PDF editor:

1

Sign into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit meal deduction authorization. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out meal deduction authorization

How to fill out meal deduction authorization

01

Obtain the meal deduction authorization form from your employer or relevant authority.

02

Fill in your personal information at the top, including your name, position, and employee ID.

03

Specify the dates for which the meal deductions will apply.

04

Indicate the type of meals that are eligible for deduction (e.g., breakfast, lunch, dinner).

05

Provide a brief explanation of why the meal deduction is necessary (e.g., travel for work).

06

Review the terms and conditions of the meal deduction to ensure compliance.

07

Sign and date the form to confirm your agreement.

08

Submit the completed form to your supervisor or HR department for approval.

Who needs meal deduction authorization?

01

Employees who travel for work or are required to attend meetings outside their regular work location.

02

Team members attending business events or conferences that provide meals.

03

Workers on assignment who need to incur meal expenses while on the job.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get meal deduction authorization?

The premium version of pdfFiller gives you access to a huge library of fillable forms (more than 25 million fillable templates). You can download, fill out, print, and sign them all. State-specific meal deduction authorization and other forms will be easy to find in the library. Find the template you need and use advanced editing tools to make it your own.

How do I make changes in meal deduction authorization?

With pdfFiller, the editing process is straightforward. Open your meal deduction authorization in the editor, which is highly intuitive and easy to use. There, you’ll be able to blackout, redact, type, and erase text, add images, draw arrows and lines, place sticky notes and text boxes, and much more.

Can I sign the meal deduction authorization electronically in Chrome?

You certainly can. You get not just a feature-rich PDF editor and fillable form builder with pdfFiller, but also a robust e-signature solution that you can add right to your Chrome browser. You may use our addon to produce a legally enforceable eSignature by typing, sketching, or photographing your signature with your webcam. Choose your preferred method and eSign your meal deduction authorization in minutes.

What is meal deduction authorization?

Meal deduction authorization is a formal permission granted to employees or organizations allowing them to deduct certain meal expenses for tax purposes.

Who is required to file meal deduction authorization?

Employees who wish to deduct meal expenses as part of their business expenses must file for meal deduction authorization.

How to fill out meal deduction authorization?

To fill out meal deduction authorization, individuals must complete a specific form provided by their tax authority, detailing their meal expenses, purpose of the meal, and relevant receipts.

What is the purpose of meal deduction authorization?

The purpose of meal deduction authorization is to provide a legal framework for deducting meal expenses incurred while conducting business activities, thereby reducing taxable income.

What information must be reported on meal deduction authorization?

The meal deduction authorization must report the date of the meal, the amount spent, the business purpose of the meal, the names of participants, and any relevant receipts.

Fill out your meal deduction authorization online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Meal Deduction Authorization is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.