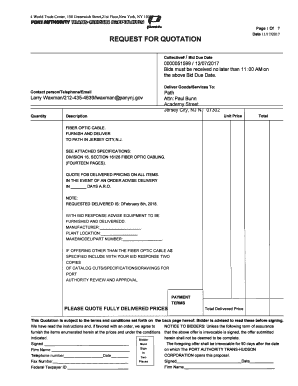

Get the free Protection Gift Trusts - Flexible Trust Deed

Show details

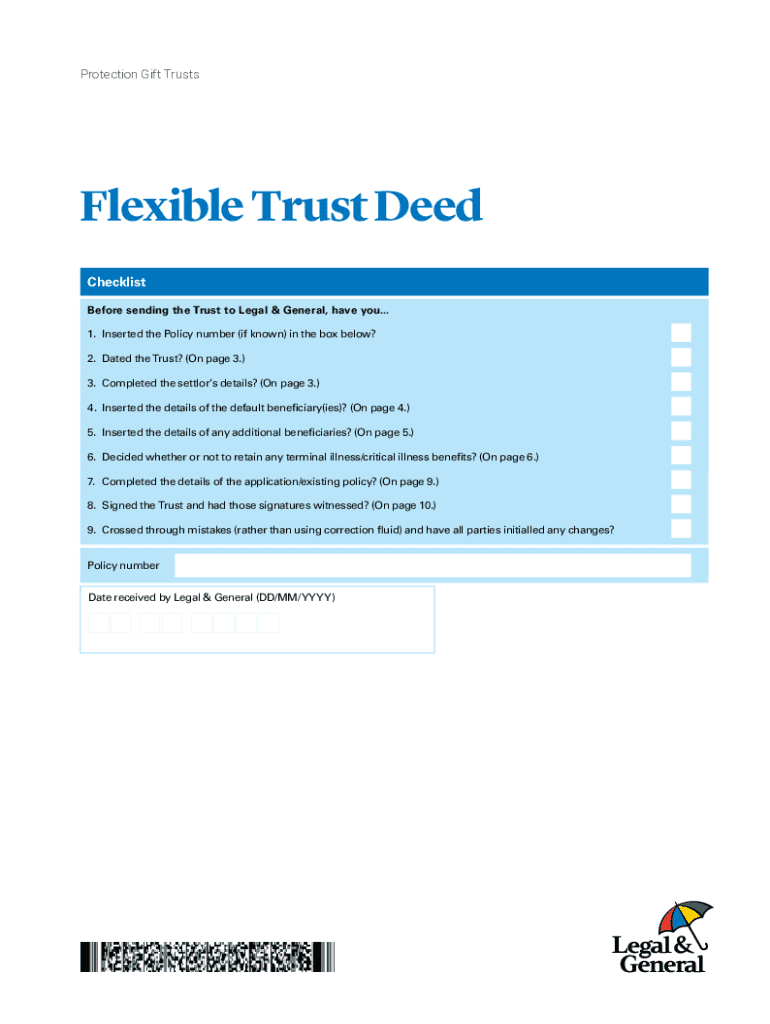

This document outlines the procedures and requirements for creating a Flexible Trust with Legal & General, specifically designed for protection life insurance policies aimed at family protection and inheritance tax planning. It provides a checklist for settlors and trustees to ensure all necessary details are completed accurately before submission.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign protection gift trusts

Edit your protection gift trusts form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your protection gift trusts form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit protection gift trusts online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit protection gift trusts. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, dealing with documents is always straightforward. Now is the time to try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out protection gift trusts

How to fill out protection gift trusts

01

Identify the beneficiaries who will receive the gifts from the trust.

02

Choose a trustworthy and competent trustee to manage the trust.

03

Determine the specific assets or gifts to be placed in the trust.

04

Prepare the trust document outlining the terms and conditions.

05

Consult with an attorney to ensure compliance with legal requirements.

06

Fund the trust by transferring the identified assets to it.

07

Communicate with beneficiaries about the trust and its purpose.

08

Review and update the trust as necessary to reflect changes in circumstances.

Who needs protection gift trusts?

01

Individuals with substantial assets wanting to protect their gifts from creditors.

02

Parents wishing to manage gifts for their children's future security.

03

People wanting to ensure their assets are used according to their wishes after their passing.

04

Those concerned about potential legal issues or disputes regarding their gifts.

05

Individuals planning for long-term care and seeking to preserve wealth for heirs.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send protection gift trusts for eSignature?

protection gift trusts is ready when you're ready to send it out. With pdfFiller, you can send it out securely and get signatures in just a few clicks. PDFs can be sent to you by email, text message, fax, USPS mail, or notarized on your account. You can do this right from your account. Become a member right now and try it out for yourself!

Where do I find protection gift trusts?

The premium version of pdfFiller gives you access to a huge library of fillable forms (more than 25 million fillable templates). You can download, fill out, print, and sign them all. State-specific protection gift trusts and other forms will be easy to find in the library. Find the template you need and use advanced editing tools to make it your own.

How do I edit protection gift trusts in Chrome?

Get and add pdfFiller Google Chrome Extension to your browser to edit, fill out and eSign your protection gift trusts, which you can open in the editor directly from a Google search page in just one click. Execute your fillable documents from any internet-connected device without leaving Chrome.

What is protection gift trusts?

Protection gift trusts are legal arrangements designed to safeguard assets given as gifts, ensuring that they are protected from creditors and other claims.

Who is required to file protection gift trusts?

Individuals who establish protection gift trusts, typically the grantors or beneficiaries, are required to file them with the appropriate tax authorities.

How to fill out protection gift trusts?

Filling out protection gift trusts involves completing specific forms that include information about the grantor, beneficiaries, assets being transferred, and the terms of the trust.

What is the purpose of protection gift trusts?

The purpose of protection gift trusts is to provide a mechanism for individuals to transfer assets to beneficiaries while protecting those assets from legal claims and potential creditors.

What information must be reported on protection gift trusts?

Information that must be reported typically includes details about the trust's grantor, beneficiaries, assets involved, and the trust's terms and conditions.

Fill out your protection gift trusts online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Protection Gift Trusts is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.