Get the free Business Debt Schedule

Show details

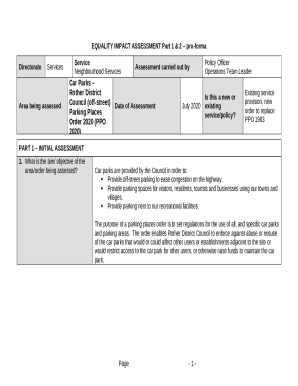

Debt Schedule As of*: For: ORIGINAL PAYABLE TO ORIGINAL PRESENT RATE OF MATURITY MONTHLY AMOUNT DATE BALANCE INTEREST DATE PAYMENT ACCT #: ACCT #: ACCT #: ACCT #: ACCT #: ACCT #: ACCT #: ACCT #: ACCT

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign business debt schedule

Edit your business debt schedule form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your business debt schedule form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit business debt schedule online

Follow the steps down below to benefit from the PDF editor's expertise:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit business debt schedule. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out business debt schedule

Question:

Write point by point how to fill out business debt schedule. Who needs business debt schedule?

How to fill out a business debt schedule:

01

Gather all necessary information: Start by collecting all relevant financial documents and statements related to your business debts. This may include loan agreements, credit card statements, or any other debts your business owes.

02

List all outstanding debts: Create a comprehensive list of all the debts your business currently has. Include the name of the creditor, the type of debt, the outstanding balance, the interest rate, and the payment terms. Be sure to include any secured debts, unsecured debts, and revolving credit.

03

Organize the debts: Sort the list of debts in a logical manner, such as by creditor name or debt type. This will make it easier to analyze and manage the debt schedule.

04

Calculate total outstanding balance: Determine the total amount owing by summing up all the outstanding balances from step 2. This will give you a clear understanding of your business's overall debt liability.

05

Determine interest rates and payment terms: Review each debt to identify the interest rates and payment terms associated with them. This information is crucial for creating a repayment plan and understanding the financial impact of the debts on your business.

06

Prioritize debts: Assess the importance of each debt and their respective interest rates. Generally, it is advisable to prioritize high-interest debts for early repayment to minimize interest expenses. However, every business is unique, so consider factors such as cash flow, any associated collateral, and the overall financial health of your business.

07

Create a repayment plan: Based on your business's financial capabilities and priorities, develop a realistic repayment plan for your debts. Consider factors such as monthly cash flow, profitability, and any potential changes in the business environment.

08

Update the schedule regularly: As new debts are incurred or existing debts are paid off, make sure to update your business debt schedule accordingly. This will ensure that you have an accurate record of your business's debt obligations at all times.

Who needs a business debt schedule:

01

Small business owners: Small business owners often have multiple debts, and a debt schedule can help them keep track of their liabilities and make informed financial decisions.

02

Entrepreneurs seeking financing: If you're looking to secure financing for your business, lenders may require a detailed breakdown of your existing debts. A business debt schedule can provide this information and demonstrate your ability to manage your financial obligations.

03

Financial professionals and advisors: Accountants, financial consultants, and other professionals who assist businesses with their financial management can benefit from a business debt schedule. It can provide a comprehensive overview of the business's debt situation, allowing them to offer informed advice and support in debt management strategies.

04

Risk managers: Businesses that want to assess their risk exposure or evaluate their overall financial health can use a debt schedule to analyze their liabilities. This can help them identify potential issues and take proactive measures to mitigate risks.

Remember, managing and monitoring your business's debts is essential for maintaining healthy financial stability. A business debt schedule serves as a valuable tool in understanding your debt obligations and making informed decisions to improve your business's financial position.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send business debt schedule for eSignature?

When you're ready to share your business debt schedule, you can swiftly email it to others and receive the eSigned document back. You may send your PDF through email, fax, text message, or USPS mail, or you can notarize it online. All of this may be done without ever leaving your account.

Can I sign the business debt schedule electronically in Chrome?

You can. With pdfFiller, you get a strong e-signature solution built right into your Chrome browser. Using our addon, you may produce a legally enforceable eSignature by typing, sketching, or photographing it. Choose your preferred method and eSign in minutes.

How do I edit business debt schedule on an iOS device?

Yes, you can. With the pdfFiller mobile app, you can instantly edit, share, and sign business debt schedule on your iOS device. Get it at the Apple Store and install it in seconds. The application is free, but you will have to create an account to purchase a subscription or activate a free trial.

What is business debt schedule?

Business debt schedule is a document detailing all the debts owed by a business, including the amount owed, interest rates, and payment terms.

Who is required to file business debt schedule?

Businesses that have outstanding debts and are preparing financial statements for reporting purposes are required to file a business debt schedule.

How to fill out business debt schedule?

To fill out a business debt schedule, gather all the necessary information about the debts owed by the business, including amounts, interest rates, and payment schedules. Organize the information in a clear and concise manner on the schedule.

What is the purpose of business debt schedule?

The purpose of a business debt schedule is to provide a comprehensive overview of the debts owed by a business, helping stakeholders understand the financial obligations of the business.

What information must be reported on business debt schedule?

Information that must be reported on a business debt schedule includes the name of the creditor, amount owed, interest rate, payment terms, and any collateral pledged.

Fill out your business debt schedule online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Business Debt Schedule is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.