Who needs the 1040 ES (NR)?

Non-resident aliens must fill out Form 1040-ES (NR) annually to report their financial activity on the U.S. territory to the Internal Revenue Service. Farmers, fishers, certain household employers, and certain higher-income taxpayers should check 1040 ES NR Instructions on the IRS website.

What is Form 1040-ES-(NR)?

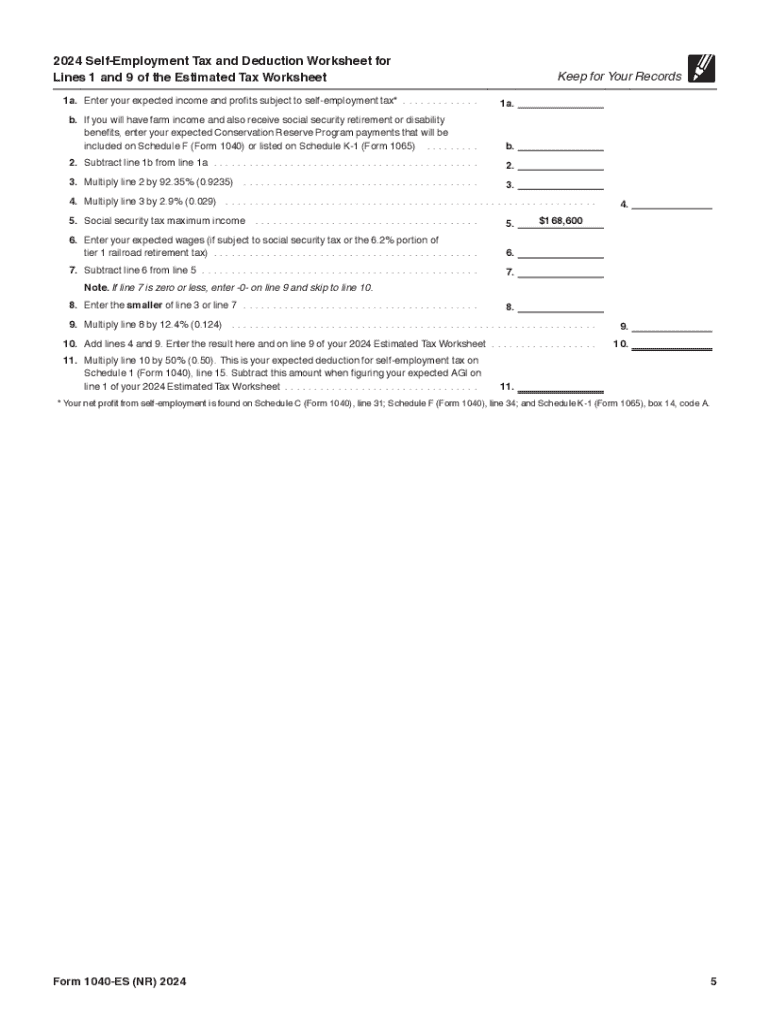

This form is also called Estimated Tax for Nonresident Alien Individuals. As stated in the Instruction to this form, estimated tax is used to pay tax for income that is not subject to withholding. This could include income derived from self-employment, pension/annuity income, prize winnings, capital gains, interest income, dividend income, lottery, horse racing proceeds, rental income, etc.

Do other documents accompany the 1040 ES NR Form?

Nonresidents are also required to file forms 1040 NR, U.S. Nonresident Income Tax Return, or 1040 NR-EZ, U.S. Income Tax Return for Certain Nonresident Aliens with No Dependents.

When is 1040-ES (NR) due?

Due dates for fiscal year taxpayers are the 15th day of the 4th (if applicable), the 6th and 9th months of your current fiscal year, and the 1st month of the following fiscal year (or the next business day if the due date falls on a weekend or holiday). Please note you are on a fiscal year if your 12-month tax period ends on any day except December 31.

How do I fill out Form 1040 ES (NR)?

Scroll to the top of this page and open our fillable 1040-ES(NR) template in your browser. The template contains detailed instructions and tax rate schedules. Before filling out the template, learn the amounts of the increased personal exemption, limitations on itemized deductions, the new standard mileage rate, and view the social security page. Use blank pages to make your calculations, if necessary.

Where to File Addresses for Taxpayers and Tax Professionals Filing Form 1040-ES(NR)?

Send your report to the IRS. Please check the address on the official IRS website.