Get the free Taxpayers' Bill of Rights Public Hearing Scheduled for ...

Show details

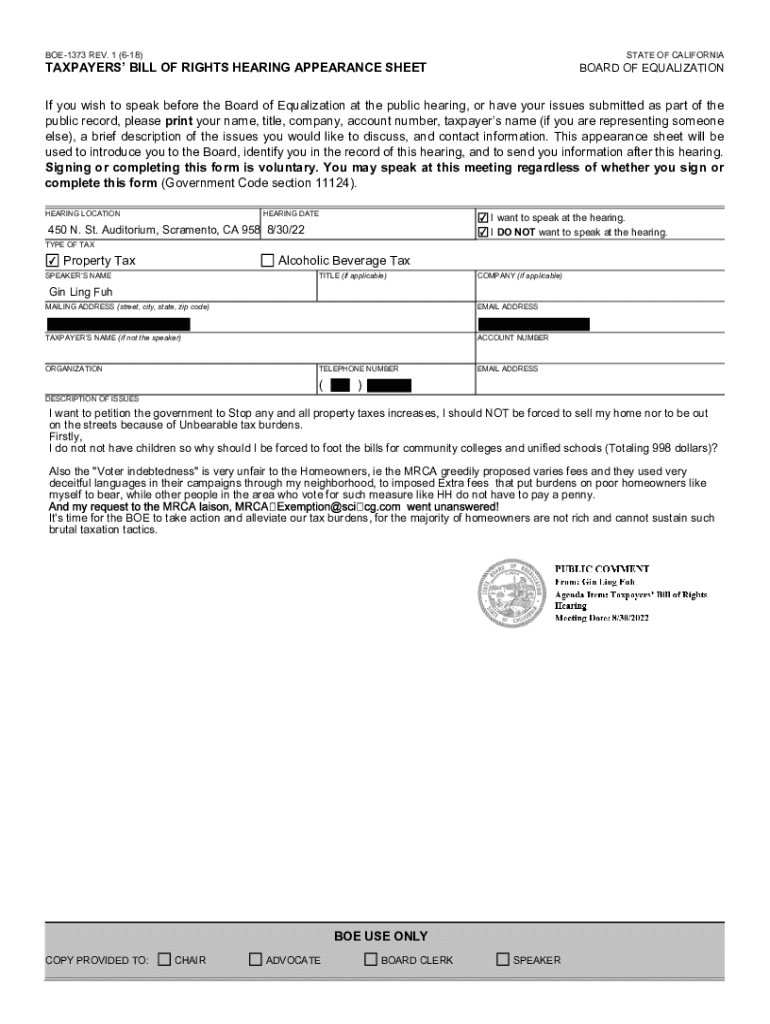

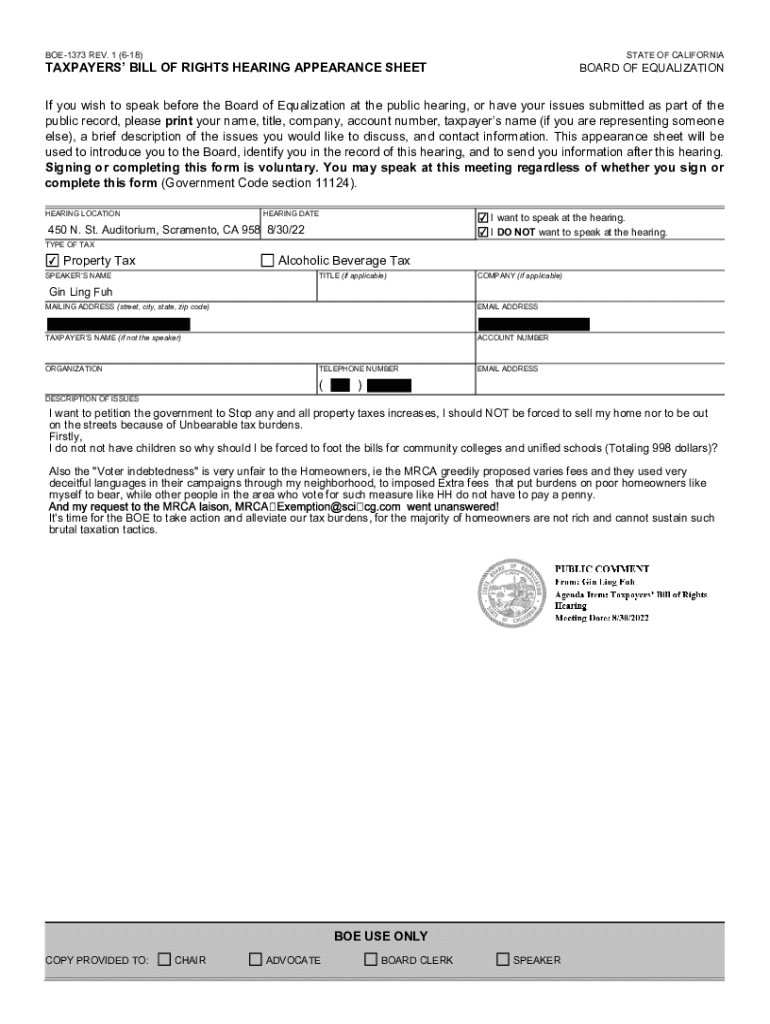

BOE1373 REV. 1 (618)STATE OF CALIFORNIATAXPAYERS BILL OF RIGHTS HEARING APPEARANCE SHEETBOARD OF EQUALIZATIONIf you wish to speak before the Board of Equalization at the public hearing, or have your

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign taxpayers bill of rights

Edit your taxpayers bill of rights form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your taxpayers bill of rights form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing taxpayers bill of rights online

Follow the steps down below to benefit from a competent PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit taxpayers bill of rights. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out taxpayers bill of rights

How to fill out taxpayers bill of rights

01

Obtain a copy of the Taxpayers' Bill of Rights from your local tax authority or official website.

02

Read through the document to understand your rights as a taxpayer.

03

Fill in your personal information at the top of the form, if required.

04

Review each section carefully to understand what protections and rights are outlined.

05

If applicable, sign and date the form to acknowledge your understanding of your rights.

06

Submit the completed form to the appropriate tax authority if required.

Who needs taxpayers bill of rights?

01

Every taxpayer may benefit from knowing their rights.

02

Individuals facing tax disputes or issues.

03

Tax professionals who advise clients on tax matters.

04

Advocacy groups working on tax policy and taxpayer rights.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in taxpayers bill of rights?

With pdfFiller, the editing process is straightforward. Open your taxpayers bill of rights in the editor, which is highly intuitive and easy to use. There, you’ll be able to blackout, redact, type, and erase text, add images, draw arrows and lines, place sticky notes and text boxes, and much more.

Can I create an eSignature for the taxpayers bill of rights in Gmail?

Use pdfFiller's Gmail add-on to upload, type, or draw a signature. Your taxpayers bill of rights and other papers may be signed using pdfFiller. Register for a free account to preserve signed papers and signatures.

How do I fill out taxpayers bill of rights on an Android device?

Use the pdfFiller mobile app to complete your taxpayers bill of rights on an Android device. The application makes it possible to perform all needed document management manipulations, like adding, editing, and removing text, signing, annotating, and more. All you need is your smartphone and an internet connection.

What is taxpayers bill of rights?

The Taxpayers Bill of Rights is a set of laws designed to ensure that taxpayers are treated fairly and have certain rights when dealing with the tax authorities. It outlines the rights of taxpayers to receive clear information, protection from unfair practices, and the ability to appeal decisions made by the tax authorities.

Who is required to file taxpayers bill of rights?

Typically, the Taxpayers Bill of Rights does not require a specific filing; instead, it exists to inform taxpayers of their rights. However, individuals or entities facing issues with tax authorities may reference the bill when necessary.

How to fill out taxpayers bill of rights?

Since the Taxpayers Bill of Rights is not a document that is filled out like a tax return, there is no specific filling out procedure. Taxpayers should familiarize themselves with their rights under this legislation and refer to it if they encounter any issues with tax authorities.

What is the purpose of taxpayers bill of rights?

The purpose of the Taxpayers Bill of Rights is to protect taxpayers from unfair practices by the government and to ensure they are treated fairly. It aims to provide transparency, promote accountability, and enhance the communication between taxpayers and tax authorities.

What information must be reported on taxpayers bill of rights?

While there is no specific information to be reported, taxpayers should understand the rights listed in the Taxpayers Bill of Rights, such as the right to be informed, the right to appeal, and the right to privacy.

Fill out your taxpayers bill of rights online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Taxpayers Bill Of Rights is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.