TX 50-115 2023-2025 free printable template

Show details

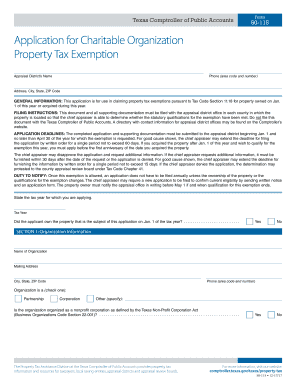

Application for Charitable Organization

Property Tax ExemptionForm 50115___

Tax Year______Appraisal Districts NameAppraisal District Account Number (if known)GENERAL INFORMATION: Use this form to

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign texas property tax exemption form

Edit your form 50 114 online form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your tx property tax exemption form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing texas 50 115 online

To use the services of a skilled PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit 50 115 form. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

TX 50-115 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out tx property tax exemption form

How to fill out TX 50-115

01

Obtain the TX 50-115 form from the Texas Comptroller's website or local office.

02

Fill in your personal information including name, address, and contact details at the top of the form.

03

Indicate the type of application you are submitting in the designated section.

04

Provide information about the specific revenue or tax type you are inquiring about.

05

Complete any additional sections required for your specific situation as indicated in the instructions.

06

Review the form for accuracy and completeness.

07

Sign and date the form at the bottom.

08

Submit the completed form to the appropriate Texas agency, either by mail or electronically, as instructed.

Who needs TX 50-115?

01

Individuals or businesses in Texas who need to report or confirm their tax status.

02

Taxpayers seeking specific information regarding their tax responsibilities or inquiries.

03

Those applying for certain state tax exemptions or credits.

Fill

50 115 form

: Try Risk Free

People Also Ask about

What is the homestead exemption in San Antonio Bexar?

Effective for tax year 2022, persons with a residence homestead are entitled to an exemption of up to 10% of the assessed valuation of their home. The Over 65 exemption is for property owners who are 65 years of age or older and claim their residence as their homestead.

Can I apply for homestead exemption online in Bexar county?

The Online Services Portal is available to ALL owners that would like to conduct business with the Appraisal District electronically. This service includes filing an exemption on your residential homestead property, submitting a Notice of Protest, and receiving important notices and other information online.

Can I apply for Texas homestead exemption online?

If you do not have a deed in your name or other recorded instrument documenting your ownership, you can still qualify for an exemption by completing a simple affidavit in the homestead exemption application form, which is available in Form 50-114-A on the Texas Comptroller's website.

How much is homestead exemption in Texas?

For the $40,000 general residence homestead exemption, you may submit an Application for Residential Homestead Exemption (PDF) and supporting documentation, with the appraisal district where the property is located.

How much is a homestead exemption in Bexar county?

Persons with a residence homestead are entitled to a $5,000 exemption of the assessed valuation of their home.

How to apply for homestead exemption in Bexar county?

To apply for an exemption, call the Bexar Appraisal District at 210-224-2432. You may also contact their agency directly by email or visit their website to obtain the necessary forms. The exemption will be forwarded to the tax office as soon as the Appraisal District updates their records.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify texas property tax exemption without leaving Google Drive?

By integrating pdfFiller with Google Docs, you can streamline your document workflows and produce fillable forms that can be stored directly in Google Drive. Using the connection, you will be able to create, change, and eSign documents, including texas property tax exemption, all without having to leave Google Drive. Add pdfFiller's features to Google Drive and you'll be able to handle your documents more effectively from any device with an internet connection.

Can I create an eSignature for the texas property tax exemption in Gmail?

With pdfFiller's add-on, you may upload, type, or draw a signature in Gmail. You can eSign your texas property tax exemption and other papers directly in your mailbox with pdfFiller. To preserve signed papers and your personal signatures, create an account.

How do I edit texas property tax exemption on an iOS device?

Use the pdfFiller app for iOS to make, edit, and share texas property tax exemption from your phone. Apple's store will have it up and running in no time. It's possible to get a free trial and choose a subscription plan that fits your needs.

What is TX 50-115?

TX 50-115 is a form used in Texas for reporting certain financial and tax information, often related to franchise taxes.

Who is required to file TX 50-115?

Entities that are subject to franchise tax in Texas, including corporations and limited liability companies (LLCs), are required to file TX 50-115.

How to fill out TX 50-115?

To fill out TX 50-115, entities must provide their legal name, identification number, gross receipts, and any applicable deductions or exemptions related to their revenue.

What is the purpose of TX 50-115?

The purpose of TX 50-115 is to provide the Texas Comptroller's office with the necessary information to assess franchise tax obligations.

What information must be reported on TX 50-115?

The information that must be reported on TX 50-115 includes entity identification details, revenue figures, deduction claims, and other relevant financial information.

Fill out your texas property tax exemption online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Texas Property Tax Exemption is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.