Get the free Form 2678

Show details

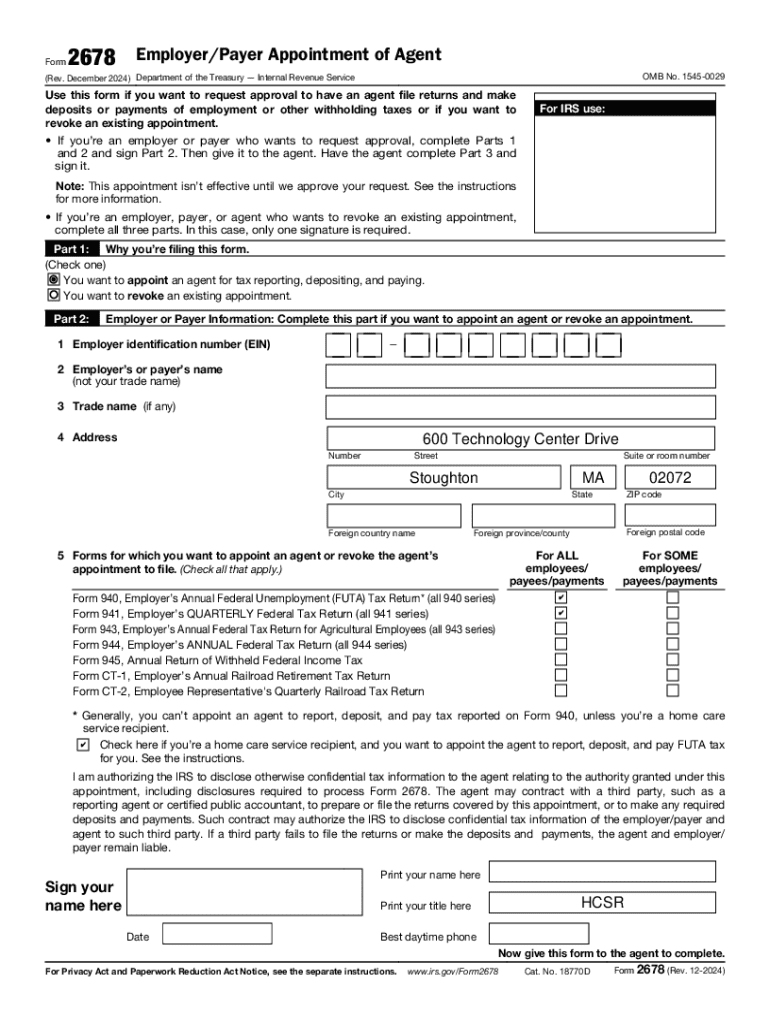

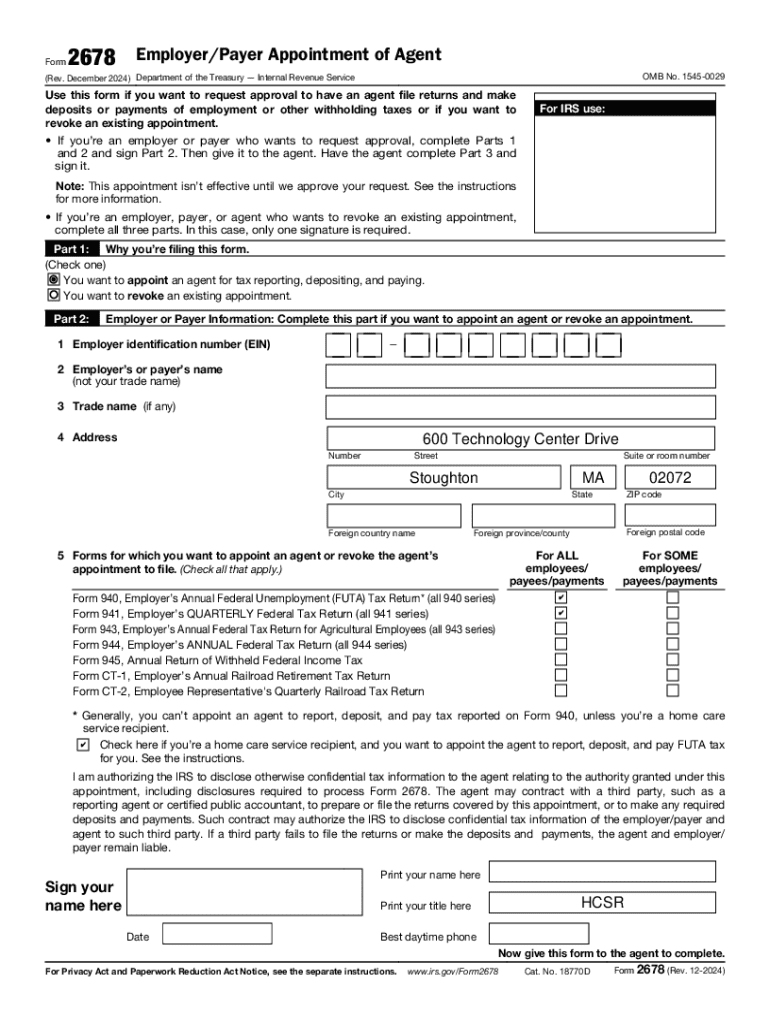

Use this form to request approval for an agent to file returns and make deposits or payments of employment or other withholding taxes, or to revoke an existing appointment. It includes sections for employer or payer information, the reason for filing, and agent information.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign form 2678

Edit your form 2678 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form 2678 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit form 2678 online

Use the instructions below to start using our professional PDF editor:

1

Check your account. It's time to start your free trial.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit form 2678. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out form 2678

How to fill out form 2678

01

Obtain Form 2678 from the IRS website or your local IRS office.

02

Fill in your name, address, and Employer Identification Number (EIN).

03

Select the type of entity you are filing for (e.g., partnership, corporation).

04

Provide the information about the entity, including the names and addresses of the partners or shareholders.

05

Indicate the tax years for which you are making the election.

06

Sign and date the form.

07

Submit the completed form to the appropriate IRS address listed in the instructions.

Who needs form 2678?

01

Partnerships or corporations that want to elect to be taxed as an S corporation.

02

Entities that wish to revoke a previous S corporation election.

03

Taxpayers considering a change in the tax treatment of their business.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get form 2678?

The premium subscription for pdfFiller provides you with access to an extensive library of fillable forms (over 25M fillable templates) that you can download, fill out, print, and sign. You won’t have any trouble finding state-specific form 2678 and other forms in the library. Find the template you need and customize it using advanced editing functionalities.

How do I make changes in form 2678?

pdfFiller allows you to edit not only the content of your files, but also the quantity and sequence of the pages. Upload your form 2678 to the editor and make adjustments in a matter of seconds. Text in PDFs may be blacked out, typed in, and erased using the editor. You may also include photos, sticky notes, and text boxes, among other things.

How do I edit form 2678 in Chrome?

Get and add pdfFiller Google Chrome Extension to your browser to edit, fill out and eSign your form 2678, which you can open in the editor directly from a Google search page in just one click. Execute your fillable documents from any internet-connected device without leaving Chrome.

What is form 2678?

Form 2678 is a regulatory document used to request the Internal Revenue Service (IRS) to recognize the appointment of a third party to act as an authorized representative for tax-related matters.

Who is required to file form 2678?

Form 2678 is typically required to be filed by businesses, partnerships, or individuals who wish to appoint a third-party tax representative to make certain tax-related decisions on their behalf.

How to fill out form 2678?

To fill out Form 2678, the applicant needs to provide information such as the name, address, and taxpayer identification number of both the taxpayer and the representative, along with the specific tax matters for which the authority is granted.

What is the purpose of form 2678?

The purpose of Form 2678 is to allow taxpayers to formally designate another individual or entity as their representative for federal tax matters, facilitating correspondence and various tax administrative tasks.

What information must be reported on form 2678?

The information that must be reported on Form 2678 includes the name, address, taxpayer identification number of the principal taxpayer, and details about the appointed representative, including their contact information and the scope of representation.

Fill out your form 2678 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form 2678 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.