Get the free An Overview of Taxes Imposed and Past Payroll Tax Relief

Show details

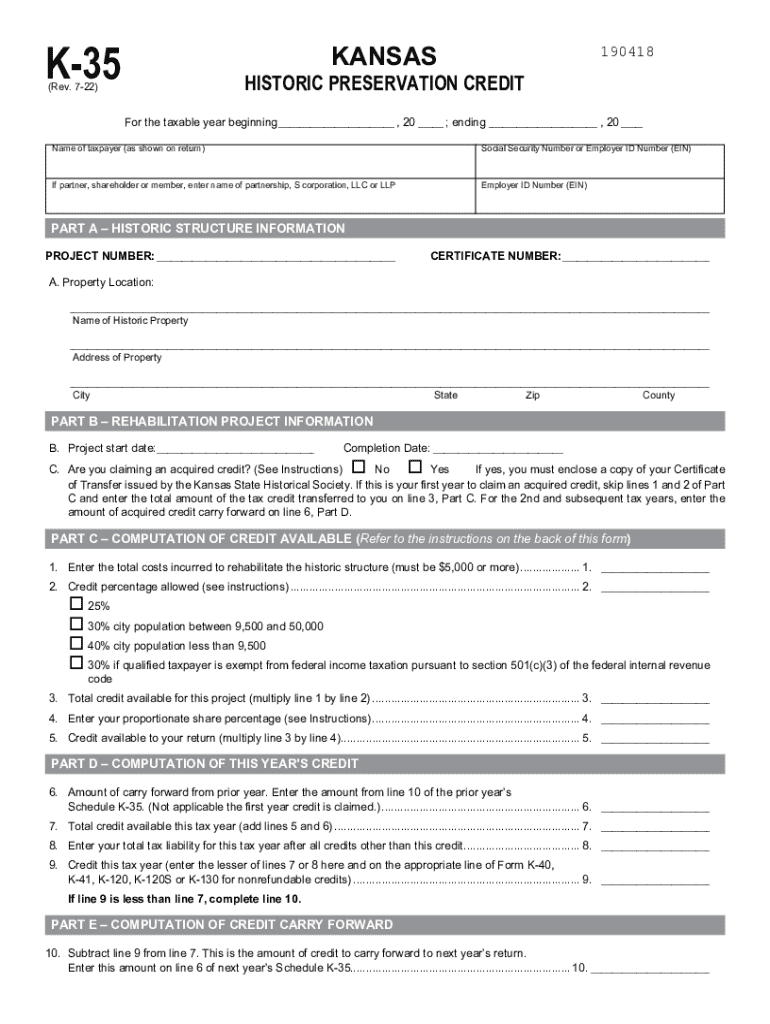

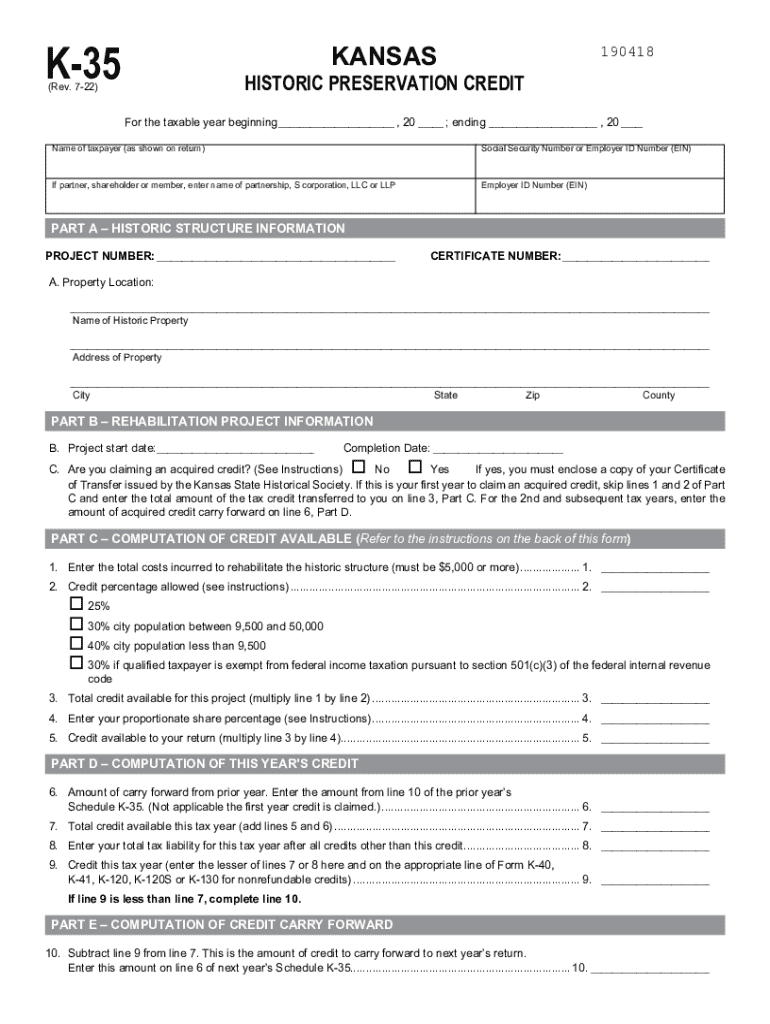

K35KANSAS190418HISTORIC PRESERVATION CREDIT(Rev. 722)For the taxable year beginning ___ , 20 ___ ; ending ___ , 20 ___ Name of taxpayer (as shown on return)Social Security Number or Employer ID Number

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign an overview of taxes

Edit your an overview of taxes form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your an overview of taxes form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit an overview of taxes online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit an overview of taxes. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you can have believed. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out an overview of taxes

How to fill out an overview of taxes

01

Gather all relevant tax documents including income statements, deductions, and credits.

02

Choose the appropriate tax form for your needs (e.g., 1040, 1040A, 1040EZ).

03

Fill out personal information such as name, address, and Social Security number.

04

Report your total income, including wages, dividends, and interest.

05

List any adjustments to income, such as educator expenses or student loan interest.

06

Calculate your adjusted gross income (AGI).

07

Detail your deductions, either standard or itemized.

08

Calculate your taxable income by subtracting deductions from AGI.

09

Determine your tax liability using tax tables or tax software.

10

Account for any tax credits you qualify for.

11

Complete the tax calculation for total tax owed or refund due.

12

Review all entries for accuracy before submitting.

Who needs an overview of taxes?

01

Individuals preparing to file income taxes.

02

Freelancers and self-employed persons who need to understand their tax obligations.

03

Small business owners who need to maintain accurate financial records.

04

Non-profit organizations that must comply with tax regulations.

05

Students or scholars seeking to understand their tax status for scholarships or grants.

06

Anyone seeking to plan for future tax liabilities or refunds.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit an overview of taxes online?

The editing procedure is simple with pdfFiller. Open your an overview of taxes in the editor. You may also add photos, draw arrows and lines, insert sticky notes and text boxes, and more.

Can I edit an overview of taxes on an iOS device?

You certainly can. You can quickly edit, distribute, and sign an overview of taxes on your iOS device with the pdfFiller mobile app. Purchase it from the Apple Store and install it in seconds. The program is free, but in order to purchase a subscription or activate a free trial, you must first establish an account.

Can I edit an overview of taxes on an Android device?

You can. With the pdfFiller Android app, you can edit, sign, and distribute an overview of taxes from anywhere with an internet connection. Take use of the app's mobile capabilities.

What is an overview of taxes?

An overview of taxes is a summary of the various types of taxes that an individual or business may be liable for, including income tax, sales tax, property tax, and others. It outlines the tax structure, rates, and regulations in a specific jurisdiction.

Who is required to file an overview of taxes?

Individuals and businesses that have income, own property, or engage in transactions subject to taxation are generally required to file an overview of taxes. Specific requirements vary based on jurisdiction and the amount of income.

How to fill out an overview of taxes?

To fill out an overview of taxes, gather all necessary financial documents, including income statements and receipts for deductions. Use the appropriate tax forms provided by the tax authority, entering requested information accurately and completely.

What is the purpose of an overview of taxes?

The purpose of an overview of taxes is to calculate and report the taxes owed to the government, ensuring compliance with tax laws, and providing a basis for tax revenue that funds public services and infrastructure.

What information must be reported on an overview of taxes?

An overview of taxes typically requires reporting of total income, deductions, credits, and other relevant financial information that affects tax liability, including any taxes already paid.

Fill out your an overview of taxes online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

An Overview Of Taxes is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.