Get the free Business Subsidy/revolving Loan Fund Application

Show details

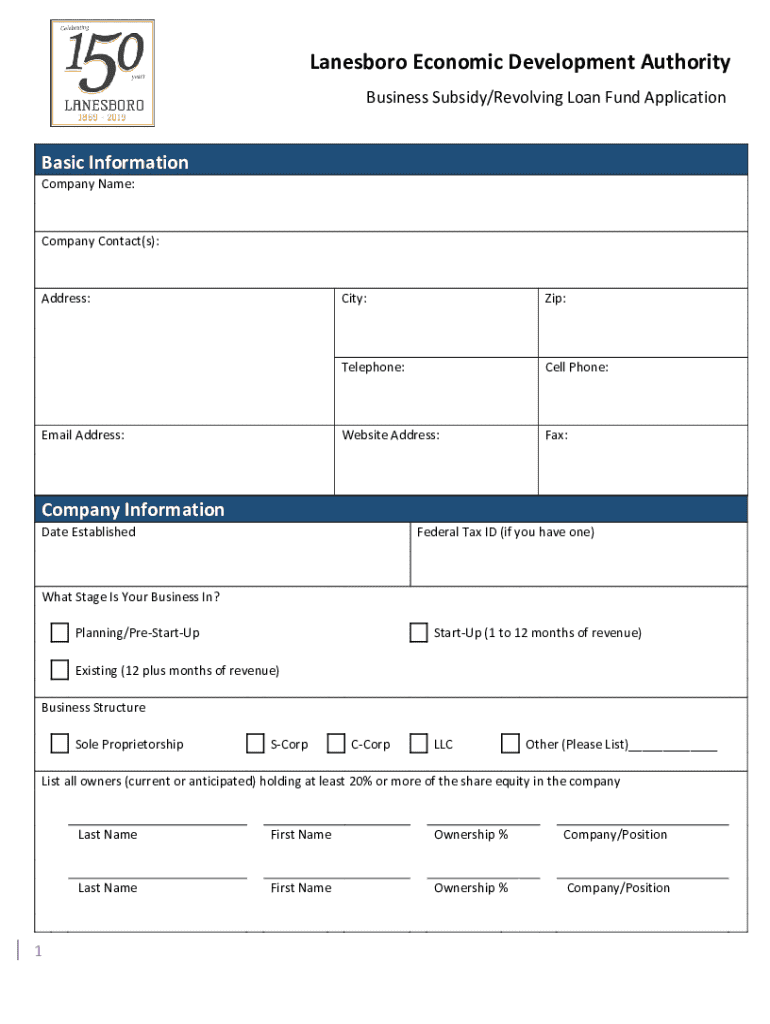

This document is an application form for the Lanesboro Economic Development Authority\'s Business Subsidy and Revolving Loan Fund, aimed at collecting essential information about the applicant\'s business, funding needs, and the economic impact of the proposed project on the community.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign business subsidyrevolving loan fund

Edit your business subsidyrevolving loan fund form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your business subsidyrevolving loan fund form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing business subsidyrevolving loan fund online

To use the professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit business subsidyrevolving loan fund. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

Dealing with documents is always simple with pdfFiller. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out business subsidyrevolving loan fund

How to fill out business subsidyrevolving loan fund

01

Gather necessary documents such as business plan, financial statements, and tax returns.

02

Review the eligibility criteria for the business subsidy revolving loan fund.

03

Complete the loan application form, providing accurate and clear information.

04

Prepare and attach any additional required documents, such as proof of business ownership.

05

Submit the application to the appropriate funding agency or administrator.

06

Follow up with the agency for any updates or additional information needed.

07

Await approval, and if approved, adhere to the loan terms and conditions.

Who needs business subsidyrevolving loan fund?

01

Small businesses seeking financial assistance to grow or sustain operations.

02

Startups looking for initial funding to launch their business.

03

Businesses experiencing temporary cash flow issues.

04

Companies aiming to expand their workforce or invest in new equipment.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find business subsidyrevolving loan fund?

It's simple with pdfFiller, a full online document management tool. Access our huge online form collection (over 25M fillable forms are accessible) and find the business subsidyrevolving loan fund in seconds. Open it immediately and begin modifying it with powerful editing options.

Can I create an electronic signature for signing my business subsidyrevolving loan fund in Gmail?

Use pdfFiller's Gmail add-on to upload, type, or draw a signature. Your business subsidyrevolving loan fund and other papers may be signed using pdfFiller. Register for a free account to preserve signed papers and signatures.

Can I edit business subsidyrevolving loan fund on an iOS device?

Use the pdfFiller mobile app to create, edit, and share business subsidyrevolving loan fund from your iOS device. Install it from the Apple Store in seconds. You can benefit from a free trial and choose a subscription that suits your needs.

What is business subsidyrevolving loan fund?

A business subsidyrevolving loan fund is a financial resource provided to small businesses, enabling them to access loans at favorable terms. The fund typically aims to support economic development and facilitate business growth.

Who is required to file business subsidyrevolving loan fund?

Businesses that have received financing from the business subsidyrevolving loan fund are generally required to file. This includes both new applicants seeking assistance and existing recipients reporting on the use of their funds.

How to fill out business subsidyrevolving loan fund?

Filling out the business subsidyrevolving loan fund typically involves completing an application form that requests detailed information about the business, the purpose of the loan, financial statements, and any other required documentation. Ensure to follow the specific instructions provided by the funding agency.

What is the purpose of business subsidyrevolving loan fund?

The purpose of the business subsidyrevolving loan fund is to provide financial assistance to small businesses, promoting job creation, sustainable development, and economic growth within the community.

What information must be reported on business subsidyrevolving loan fund?

Businesses must report information such as the amount of loan received, how the funds were utilized, current financial status, job creation or retention figures, and compliance with any terms and conditions set forth by the lending agency.

Fill out your business subsidyrevolving loan fund online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Business Subsidyrevolving Loan Fund is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.