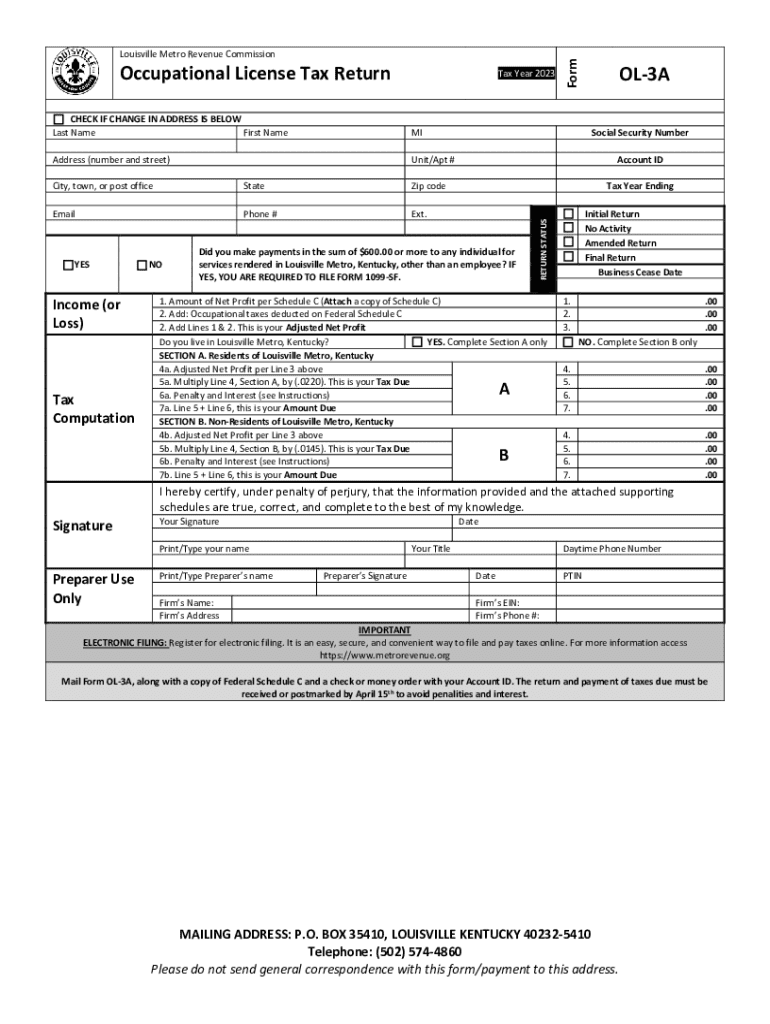

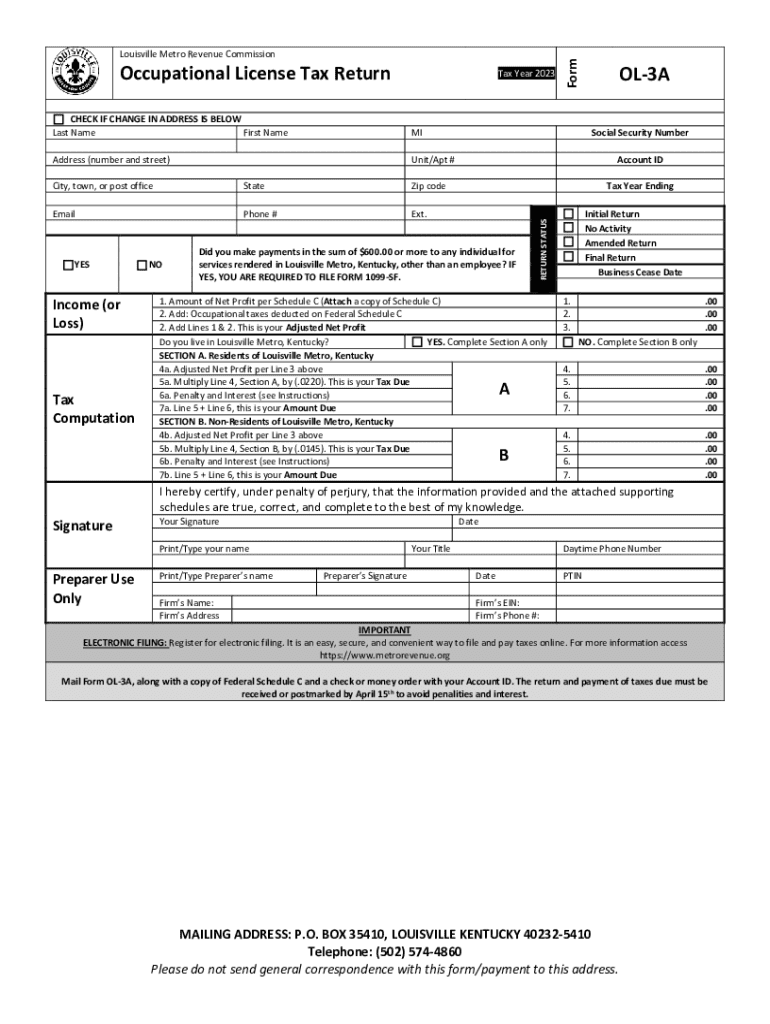

KY OL-3A - Louisville 2023 free printable template

Get, Create, Make and Sign KY OL-3A - Louisville

How to edit KY OL-3A - Louisville online

Uncompromising security for your PDF editing and eSignature needs

KY OL-3A - Louisville Form Versions

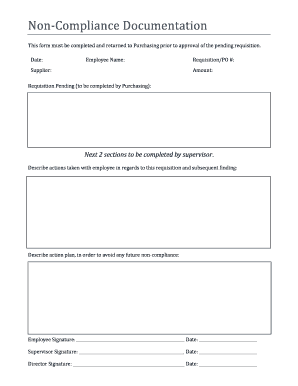

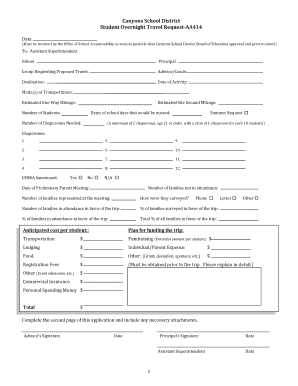

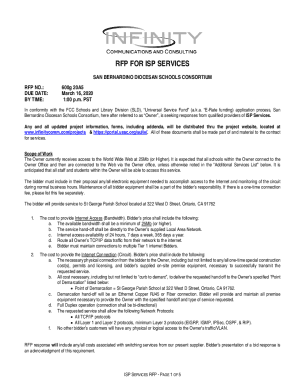

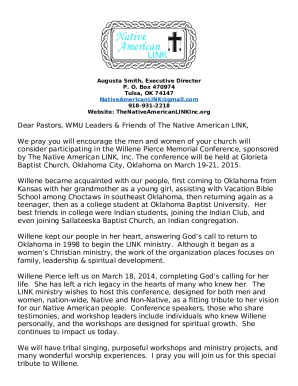

How to fill out KY OL-3A - Louisville

How to fill out KY OL-3A - Louisville

Who needs KY OL-3A - Louisville?

Instructions and Help about KY OL-3A - Louisville

Hirschman is located about 12 miles east of downtown Louisville and is at the Shelbyville Road Hirsch for an intersection we are about 12 minutes from the airport 15 minutes from downtown everything that you possibly need is within just minutes of Hirsch born in Hirsch born now we have over 4000 residents and about twelve hundred and fifty homes very traditional and style sort of a Southern Living type atmosphere back here we have fine dining as well as some top chains are located right here and right around the corner you can hit one of your best neighborhood bars and grills at one of the entrances to hers for, and you'll see what's called our soldiers retreat and that is where Colonel Anderson's grave site has been preserved along with several of the outbuildings from the late 1700s Hirschman Country Club offers some best dining right here you also have great tennis you have a 27-hole Championship golf course it's a very community atmosphere hirschberg does their own fourth of July fireworks, so we don't have to go downtown to see a 30-45 minute light show we can see it right here from our city if you're looking for a traditional family friendly environment with that Southern Living Flair then I think Hirschman is your neighborhood you

People Also Ask about

What is occupational tax in KY?

How do I extend my single member LLC in Kentucky?

Who pays Louisville Metro taxes?

What is the Louisville Metro Revenue Commission Form OL-3 extension?

What is a OL-3 form?

Our user reviews speak for themselves

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify KY OL-3A - Louisville without leaving Google Drive?

How can I send KY OL-3A - Louisville for eSignature?

Can I create an electronic signature for signing my KY OL-3A - Louisville in Gmail?

What is KY OL-3A - Louisville?

Who is required to file KY OL-3A - Louisville?

How to fill out KY OL-3A - Louisville?

What is the purpose of KY OL-3A - Louisville?

What information must be reported on KY OL-3A - Louisville?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.