Get the free Wolfsberg Group Correspondent Banking Due Diligence Questionnaire (cbddq) V1.4

Show details

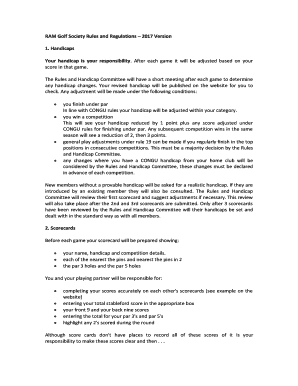

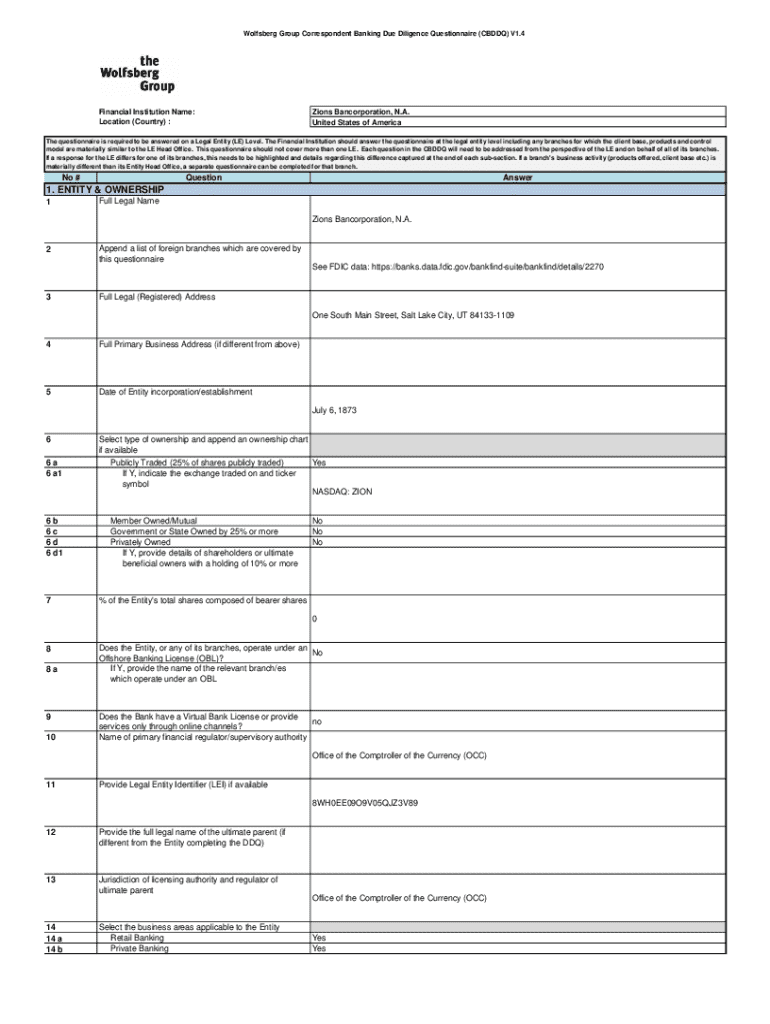

The Wolfsberg Group CBDDQ is a comprehensive questionnaire designed for financial institutions to assess their correspondent banking relationships, focusing on due diligence requirements, anti-money laundering (AML), counter-terrorism financing (CTF), and compliance with sanctions policies. It requires detailed information at the legal entity level regarding ownership, products, services, and risk management practices in order to combat financial crime effectively.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign wolfsberg group correspondent banking

Edit your wolfsberg group correspondent banking form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your wolfsberg group correspondent banking form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing wolfsberg group correspondent banking online

To use the services of a skilled PDF editor, follow these steps:

1

Check your account. It's time to start your free trial.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit wolfsberg group correspondent banking. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out wolfsberg group correspondent banking

How to fill out wolfsberg group correspondent banking

01

Gather all necessary documentation related to the correspondent banking relationship.

02

Complete the basic information section, including names, addresses, and contact details of the banks involved.

03

Provide details on the nature of the business relationship, including services offered and transaction types.

04

Assess and document the risk profile of the correspondent relationship, including geographical risks, customer base, and regulatory issues.

05

Fill out the compliance and regulatory section, ensuring all relevant laws and guidelines are followed.

06

Attach all supporting documents and ensure all sections are thoroughly reviewed.

07

Submit the completed form to the relevant authorities or compliance team for further assessment.

Who needs wolfsberg group correspondent banking?

01

Banks that engage in international correspondent banking relationships.

02

Financial institutions required to assess and document the risks associated with cross-border transactions.

03

Regulatory bodies overseeing compliance in the banking sector.

04

Businesses requiring access to global financial services through correspondent banks.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my wolfsberg group correspondent banking directly from Gmail?

wolfsberg group correspondent banking and other documents can be changed, filled out, and signed right in your Gmail inbox. You can use pdfFiller's add-on to do this, as well as other things. When you go to Google Workspace, you can find pdfFiller for Gmail. You should use the time you spend dealing with your documents and eSignatures for more important things, like going to the gym or going to the dentist.

Can I create an electronic signature for signing my wolfsberg group correspondent banking in Gmail?

Upload, type, or draw a signature in Gmail with the help of pdfFiller’s add-on. pdfFiller enables you to eSign your wolfsberg group correspondent banking and other documents right in your inbox. Register your account in order to save signed documents and your personal signatures.

How can I fill out wolfsberg group correspondent banking on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. Create an account or log in if you already have one. After registering, upload your wolfsberg group correspondent banking. You may now use pdfFiller's advanced features like adding fillable fields and eSigning documents from any device, anywhere.

What is wolfsberg group correspondent banking?

The Wolfsberg Group Correspondent Banking Principles are a set of guidelines established to promote effective risk management and controls in the area of correspondent banking. They aim to enhance the quality of customer due diligence and mitigate risks associated with money laundering and terrorist financing.

Who is required to file wolfsberg group correspondent banking?

Financial institutions engaged in correspondent banking activities are required to adhere to the Wolfsberg Group Correspondent Banking Principles as part of their compliance and risk management practices.

How to fill out wolfsberg group correspondent banking?

Filling out the Wolfsberg Group Correspondent Banking assessment involves completing a questionnaire that assesses the risks of conducting business with a correspondent bank and includes information about the bank's ownership, regulatory status, and anti-money laundering measures.

What is the purpose of wolfsberg group correspondent banking?

The purpose of the Wolfsberg Group Correspondent Banking Principles is to provide a framework for banks to manage risks associated with correspondent banking relationships and ensure compliance with relevant legal, regulatory, and ethical standards.

What information must be reported on wolfsberg group correspondent banking?

Information that must be reported includes the correspondent bank's name, location, ownership structure, regulatory status, and the effectiveness of its AML/CFT (Anti-Money Laundering/Counter Financing of Terrorism) controls.

Fill out your wolfsberg group correspondent banking online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Wolfsberg Group Correspondent Banking is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.