AR AR2210 2024-2025 free printable template

Show details

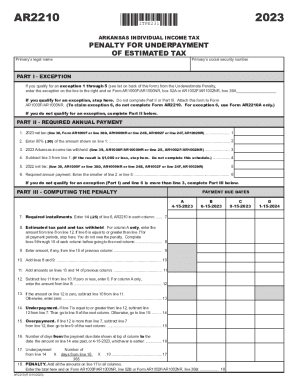

PRINT FORMAR2210CLEAR FORM2024ITPE241 ARKANSAS INDIVIDUAL INCOME TAXPENALTY FOR UNDERPAYMENT OF ESTIMATED TAXPrimarys legal namePrimarys social security numberPART I EXCEPTION If you qualify for an exception 1 through 5 (see list on back of this form) from the Underestimate Penalty, enter the exception on the line to the right and on Form AR1000F/AR1000NR, box 52A or AR1002F/AR1002NR, box 38A ___ If you qualify for an exception, stop here. Do not complete Part II or Part III

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign 2024 arkansas ar2210 form

Edit your arkansas ar2210 printable form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 2024 tax ar2210 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing arkansas ar2210 print online

To use the services of a skilled PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit arkansas income ar2210 form. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

AR AR2210 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out arkansas tax underpayment form

How to fill out AR AR2210

01

Gather all necessary financial documents including income statements, deductions, and tax-related information.

02

Access the AR AR2210 form, which can typically be found on your state tax authority's website.

03

Begin with Section A by entering your personal information, including your name, address, and Social Security number.

04

Proceed to Section B to determine if you are required to file AR AR2210 based on your estimated tax payments.

05

Fill out Section C, where you will calculate the amount of tax you owe and any penalties for underpayment.

06

Review the instructions carefully for each section to ensure all computations are accurate.

07

Sign and date the form at the bottom, and keep a copy for your records.

08

Submit the completed form to the appropriate tax authority by the specified deadline.

Who needs AR AR2210?

01

Individuals or businesses in Arkansas who underpaid their estimated tax payments throughout the year.

02

Taxpayers who receive a notice from the Arkansas Revenue Division indicating they may owe penalties for underpayment.

03

Anyone who wishes to request a waiver for penalties due to reasonable cause.

Fill

2024 arkansas underpayment

: Try Risk Free

People Also Ask about tax ar2210 printable

How do you find prior year tax liability?

Your federal tax liability amount is found on Form 1040 (line 24).

Do you want file it 2210 for 2021 tax year?

Use Form 2210 to see if you owe a penalty for underpaying your estimated tax. The IRS will generally figure your penalty for you and you should not file Form 2210. You can, however, use Form 2210 to figure your penalty if you wish and include the penalty on your return.

How can I avoid IRS underpayment penalty?

Generally, taxpayers should make estimated tax payments in four equal amounts to avoid a penalty. However, if you receive income unevenly during the year, you may be able to vary the amounts of the payments to avoid or lower the penalty by using the annualized installment method.

Why do I need a 2210 form?

Use Form 2210 to see if you owe a penalty for underpaying your estimated tax and, if you do, to figure the amount of the penalty.

What is a 2210?

Use Form 2210 to see if you owe a penalty for underpaying your estimated tax and, if you do, to figure the amount of the penalty.

What is ar2210 on tax form?

ARKANSAS INDIVIDUAL INCOME TAX. ANNUALIZED PENALTY FOR UNDERPAYMENT. OF ESTIMATED INCOME TAX. 2021. Taxpayers with varied income may use this form to compute.

What is an ar2210 form?

ARKANSAS INDIVIDUAL INCOME TAX. ANNUALIZED PENALTY FOR UNDERPAYMENT. OF ESTIMATED INCOME TAX. 2021. Taxpayers with varied income may use this form to compute.

What is the required annual payment?

The required annual payment for most individuals is the lower of 90% of the tax shown on the current year's return or 100% of the tax shown on the return for the previous year.

Do I have to file 2210?

For most filers, if your federal tax withholdings and timely payments are not equal to 90% of your current year tax, or 100% of the total tax from the prior year (whichever is less), then you may need to complete Form 2210 to determine if you are required to pay an underpayment penalty.

How to avoid 2210 penalty?

The IRS will waive your underpayment penalty if you: Didn't pay because of a casualty, disaster, or other unusual circumstance that would be unfair to impose the penalty, or. You retired (after reaching age 62) or became disabled in the current or prior tax year and: You had a reasonable cause for not making the payment.

How do you avoid penalty 2210?

Complete Form 2210 to request a waiver when you file To request a waiver when you file, complete IRS Form 2210 and submit it with your tax return. With the form, attach an explanation for why you didn't pay estimated taxes in the specific time period that you're requesting a waiver for.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send arkansas ar2210 sample to be eSigned by others?

Once you are ready to share your arkansas ar2210 pdf, you can easily send it to others and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail, or notarize it online. You can do all of this without ever leaving your account.

How can I get 2024 arkansas penalty?

With pdfFiller, an all-in-one online tool for professional document management, it's easy to fill out documents. Over 25 million fillable forms are available on our website, and you can find the 2024 ar2210 in a matter of seconds. Open it right away and start making it your own with help from advanced editing tools.

How do I complete ar underpayment estimated online?

Filling out and eSigning 2024 income ar2210 is now simple. The solution allows you to change and reorganize PDF text, add fillable fields, and eSign the document. Start a free trial of pdfFiller, the best document editing solution.

What is AR AR2210?

AR AR2210 is a form used in Arkansas for reporting underpayment of estimated tax by individuals or corporations.

Who is required to file AR AR2210?

Taxpayers who have underpaid their estimated taxes for the year and are subject to penalties for underpayment are required to file AR AR2210.

How to fill out AR AR2210?

To fill out AR AR2210, taxpayers need to provide their identifying information, report their income, calculate the estimated tax payments made, and determine any amount owed due to underpayment.

What is the purpose of AR AR2210?

The purpose of AR AR2210 is to calculate and report any penalties incurred due to underpayment of estimated state income tax.

What information must be reported on AR AR2210?

The information that must be reported on AR AR2210 includes the taxpayer’s income, estimated tax payments made, and any calculations related to underpayment penalties.

Fill out your arkansas tax ar2210 2024-2025 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Ar ar2210 is not the form you're looking for?Search for another form here.

Keywords relevant to tax ar2210 pdf

Related to arkansas ar2210 template

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.